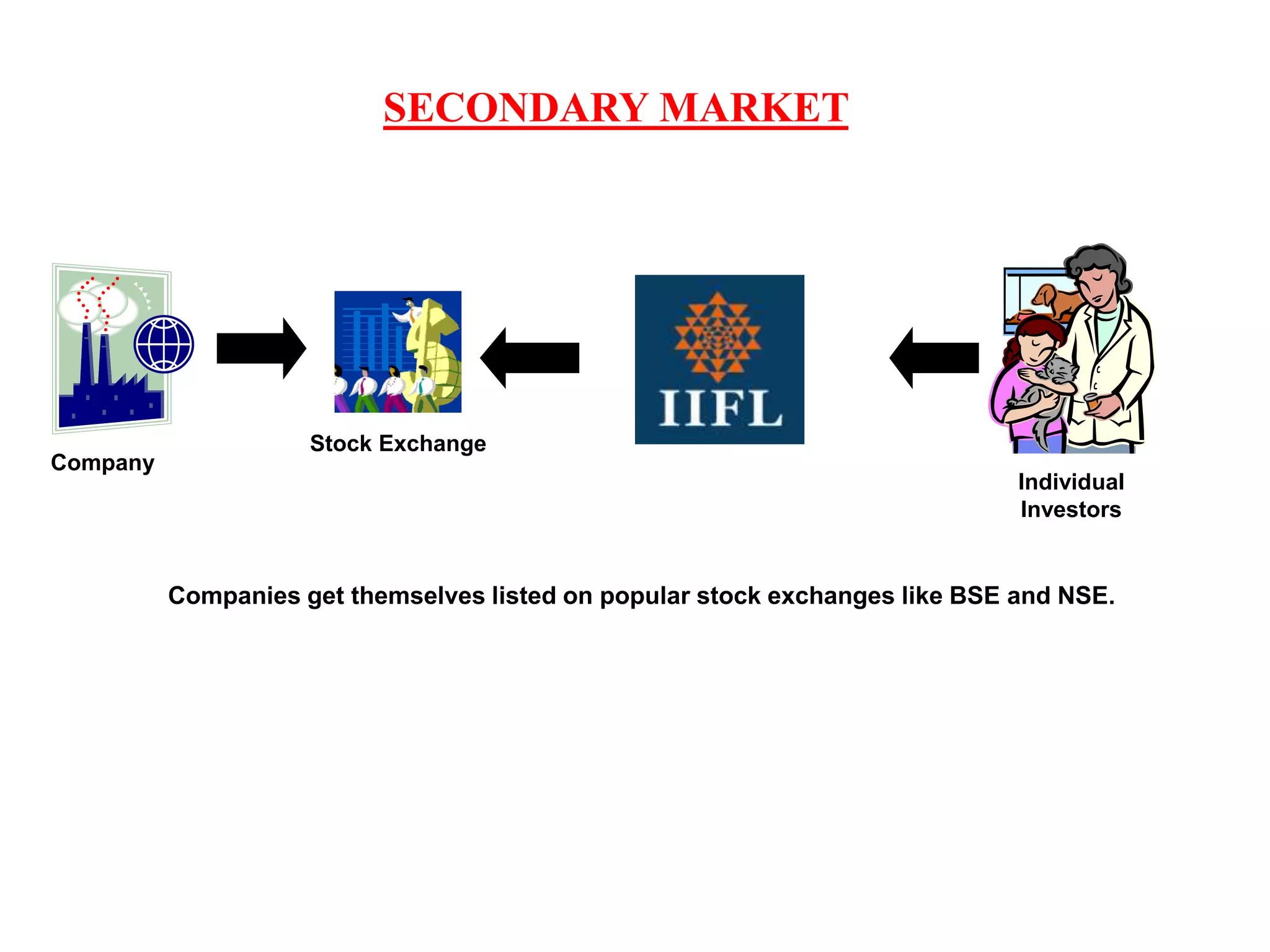

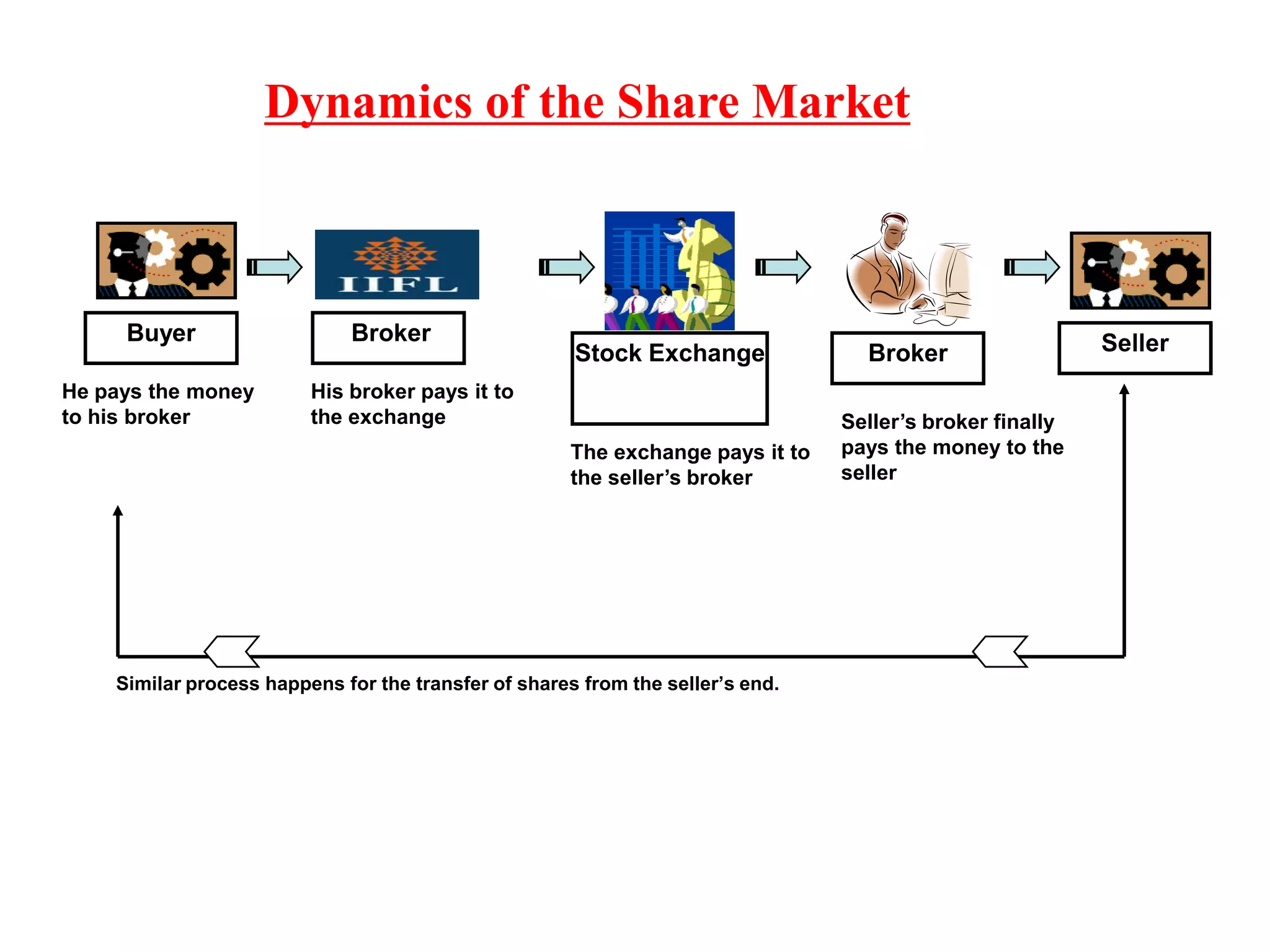

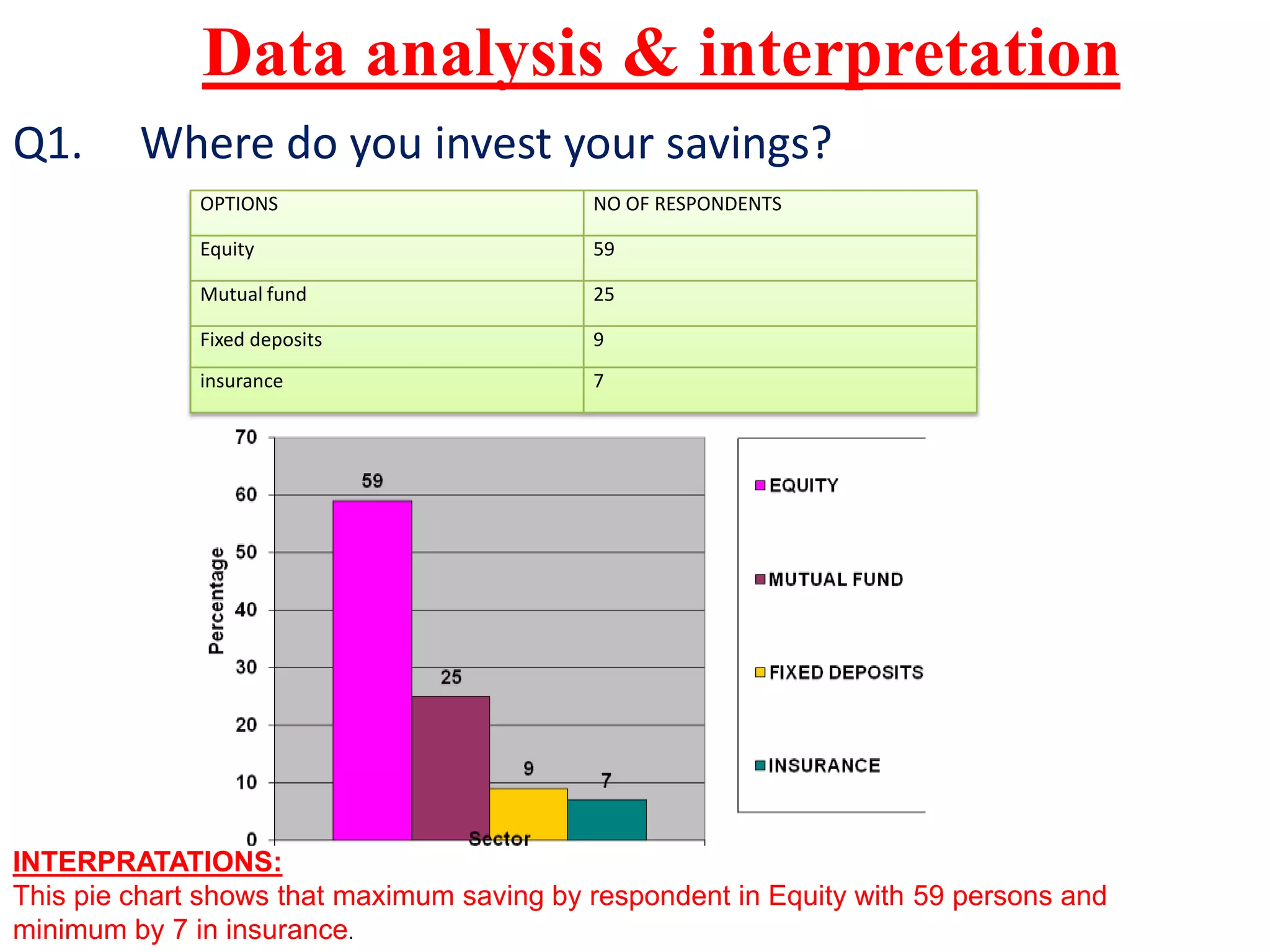

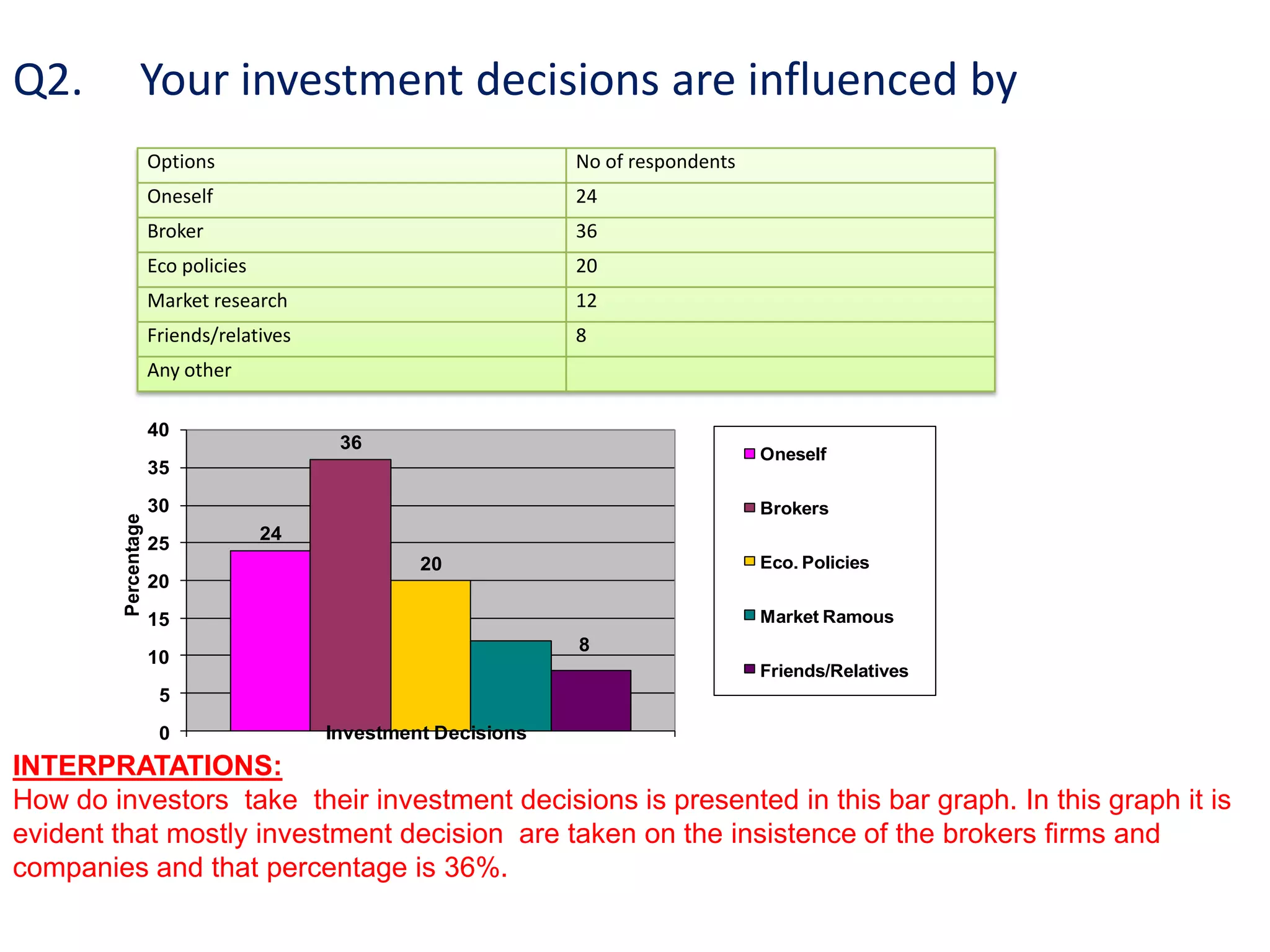

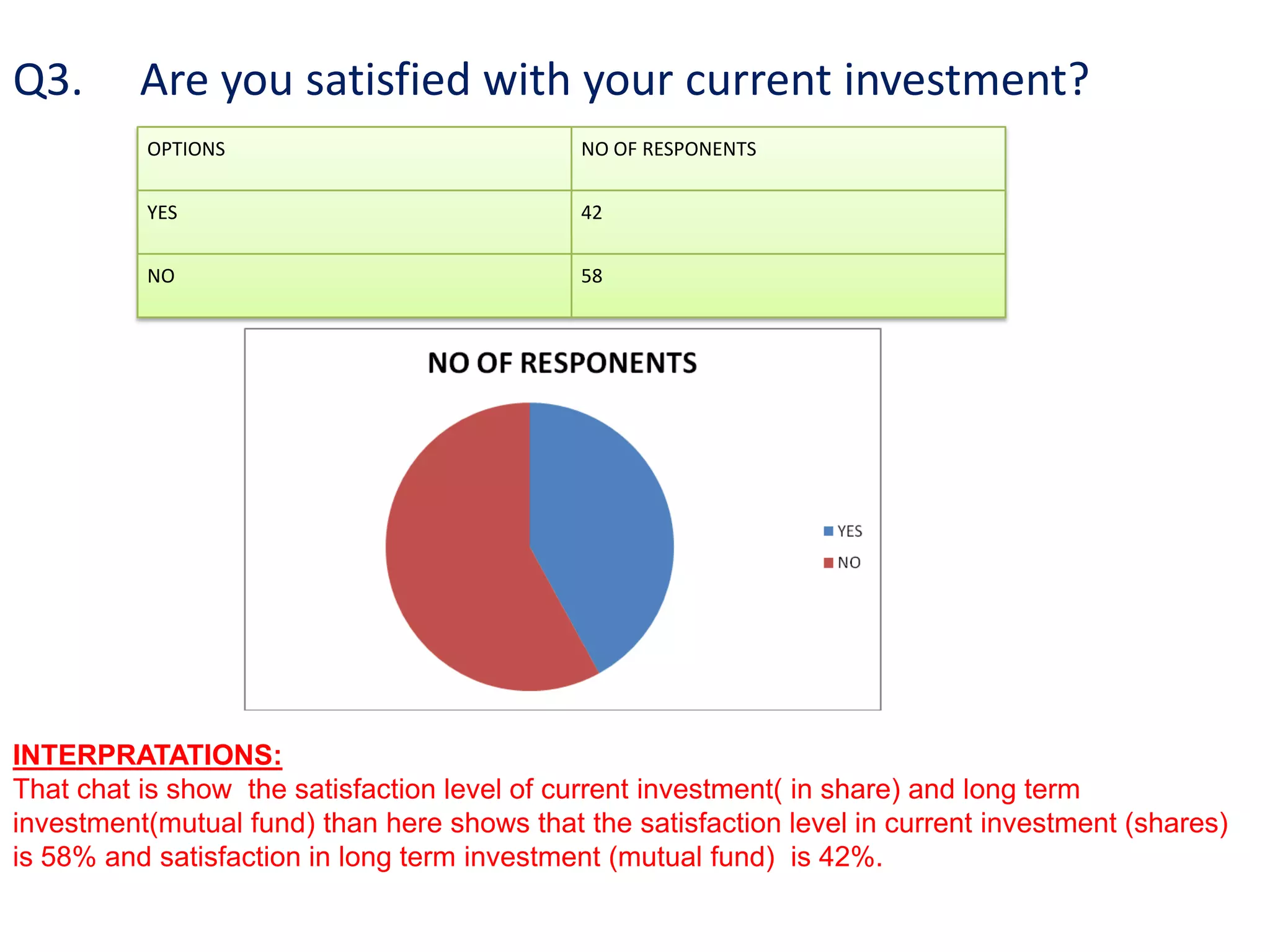

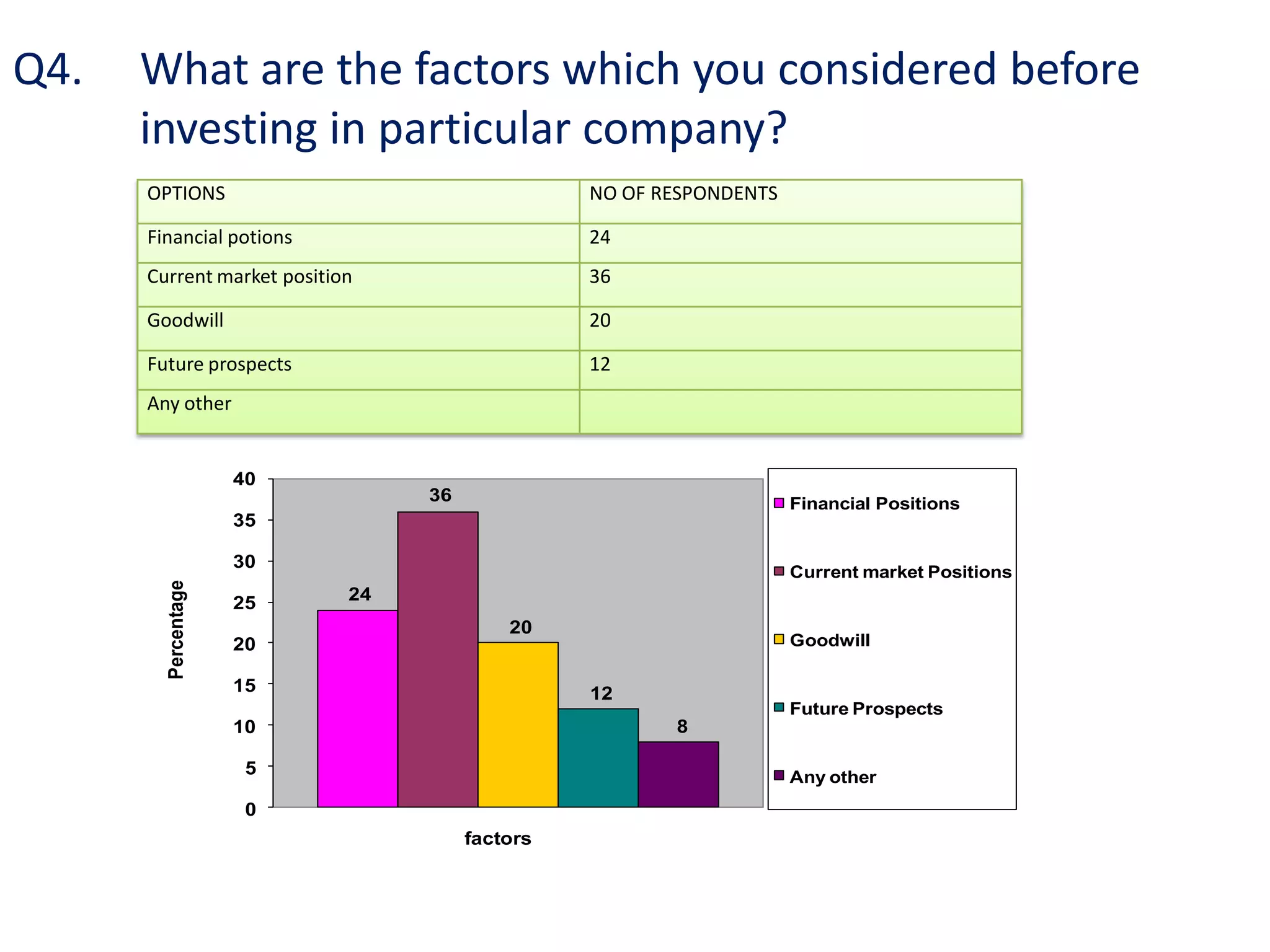

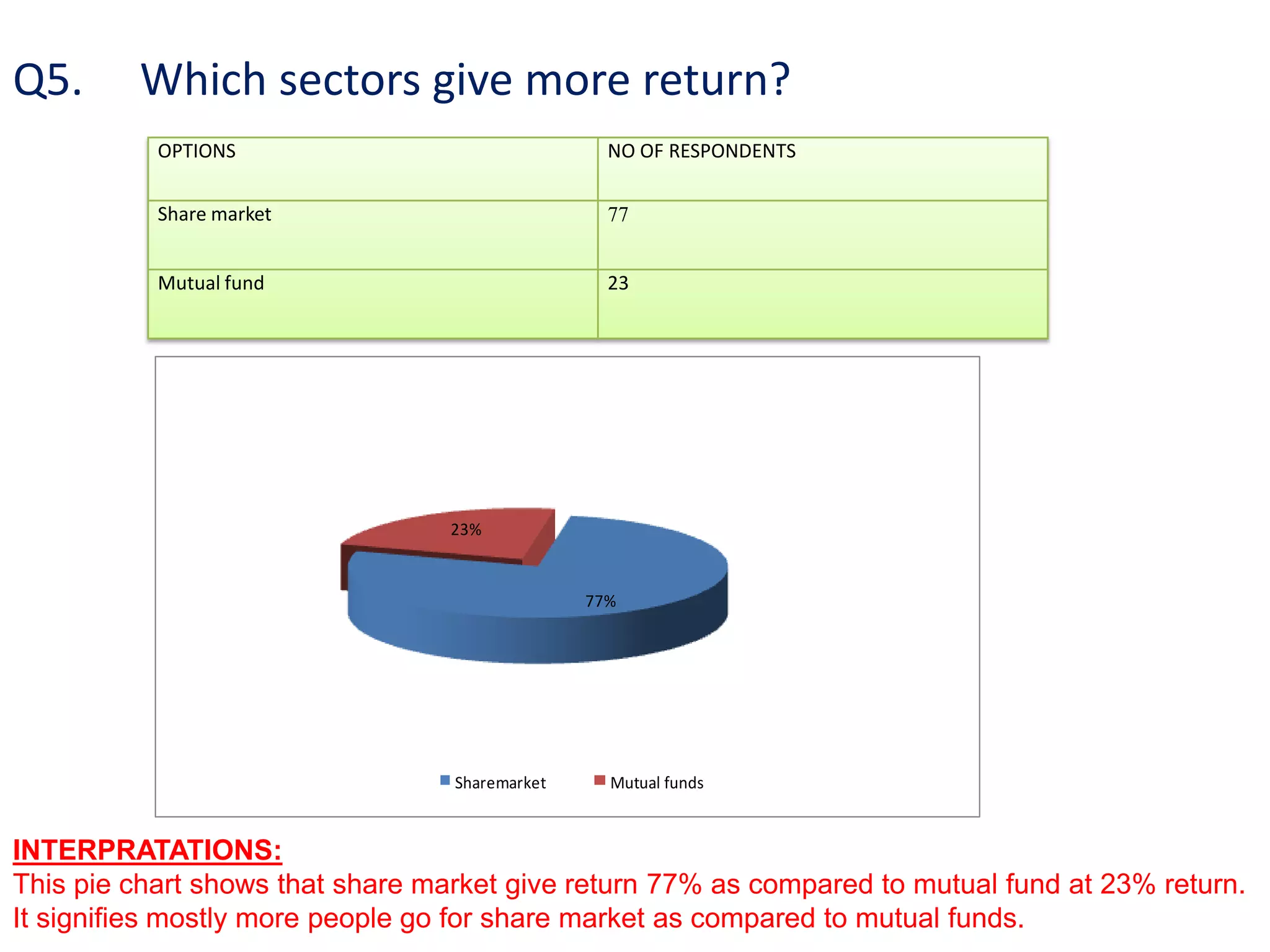

IIFL is one of India's leading brokerage firms, offering services like equity trading, depository services, and investment advice. The study analyzes customer investment decisions and satisfaction. It finds that most customers are influenced by brokers when investing. While equity investment is most popular and seen as higher returning, over half of customers surveyed were dissatisfied with their current investments. The top factors considered before investing in a company were found to be its financial position and current market position.