The document discusses key aspects of working capital management for companies. It defines gross working capital as a company's investment in current assets like cash, market securities, receivables and inventories. Net working capital is defined as the difference between a company's current assets and current liabilities. The management of working capital aims to balance optimizing investment in current assets with financing those assets, in order to avoid having too much or too little invested in current assets based on business needs. Working capital management focuses on arranging short-term funds to finance fluctuations in current assets driven by changes in business activity levels.

![• Advertising of the insurance product should stress on the need of security.

• Insurance should be popularized as the means of securing future rather than saving

tax.

• New entrants should come out with innovative riders.

• Policies should be issued quickly and with less formalities

• Other service should also be improved.

• Newspaper/Magazines and television are the most effective medium of advertising

life insurance.

• Insurance agents should be well trained.

Dividend for the Financial Year 2004-05

The Board of Directors of the Corporation has recommended payment of dividend of

170% (Rs. 17 per share), for the financial year ended March 31, 2007, for approval of the

shareholders at the AGM. [Previous year 135% (Rs. 13.50 per share)].

Dividend entitlement is as follows:

• For shares held in physical form: shareholders whose names appear on the

register of members of the Corporation as at the close of business hours on June

30, 2007.

• For shares held in electronic form: beneficial owners whose names appear in the

statements of beneficial position furnished by NSDL and CDSL as at the close of

business hours on June 30, 2007.

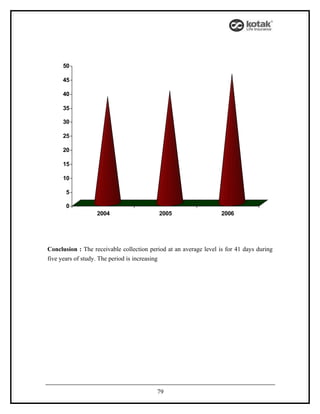

Findings:

• Current assets comprise a significant portion i.e. 30.89% (average for three years

of study) of total investment in assets of the company. There is fluctuating and

rather increasing trend of this ratio during the period which shows management

in-efficiency in managing working capital in relation to total investment. Further

current assets to fixed assets ratio also shows on fluctuating trend during the study

period which substantiate above mentioned criterion of in-effectiveness in

management of working capital by the company.

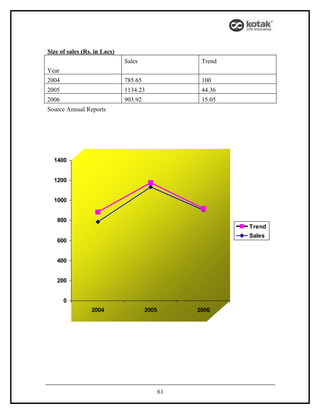

• Current assets turnover ratio for the first three years of study shows fluctuating

trend which is due to significant increase in sales. In 2005 current assets turnover

ratio is highest one i.e. 2.98 during the study, reasons being during this year

company has achieved sales growth 44.36% over the previous year.

107](https://image.slidesharecdn.com/projectreportonworkingcapitalmanagement-110506114639-phpapp02/85/Project-report-on-working-capital-management-107-320.jpg)