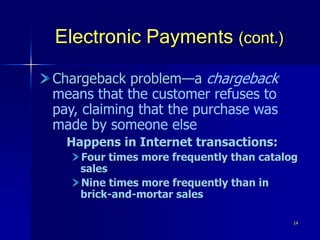

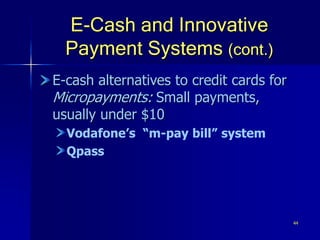

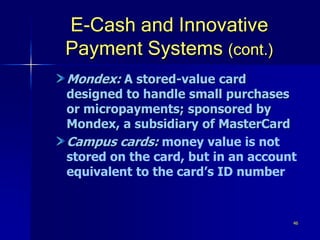

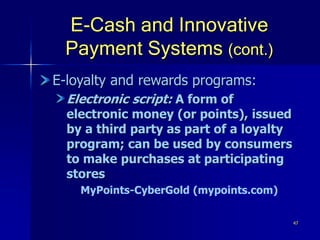

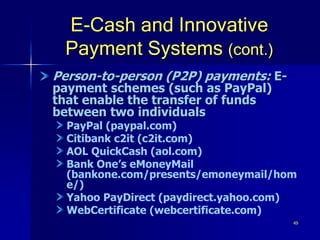

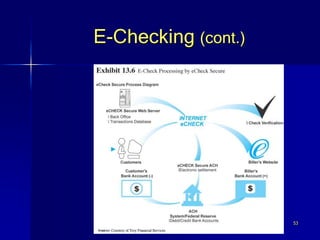

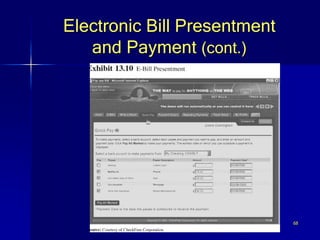

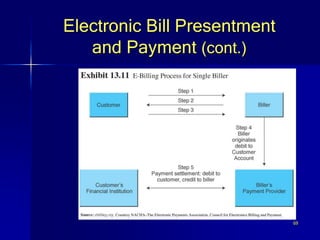

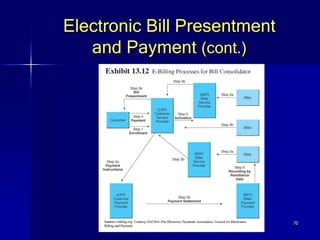

The document discusses various electronic payment methods for e-commerce, including their advantages and disadvantages. It describes credit cards, smart cards, electronic wallets, e-cash, and other methods. It also outlines the key parties involved in electronic payments and security considerations for different payment systems.