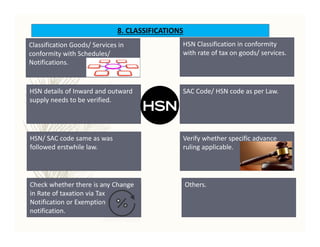

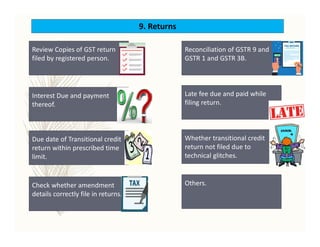

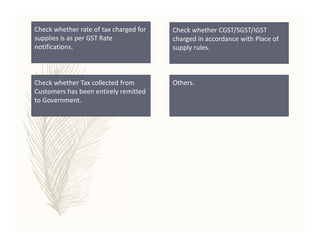

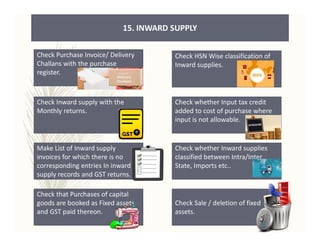

The document outlines a comprehensive GST audit checklist provided by ICAI, detailing key areas of focus such as GST registration, invoicing documentation, input tax credit verification, and proper classification of supplies. It highlights the importance of confirming adherence to GST laws regarding transactions, returns filing, and tax payments, alongside thorough checks on job work, refund eligibility, and maintenance of accounting records. Additionally, the document emphasizes compliance with anti-profiteering clauses and scrutiny of unusual transactions.