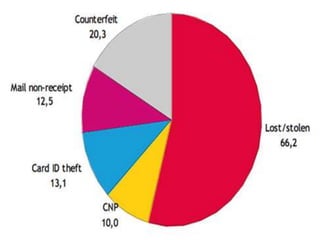

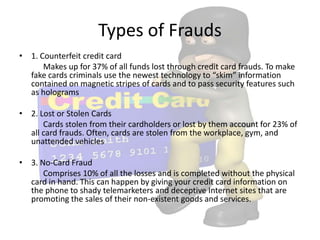

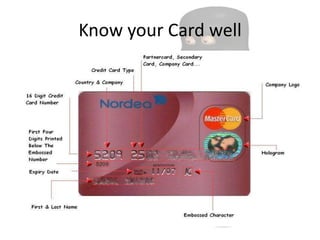

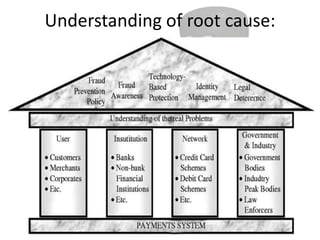

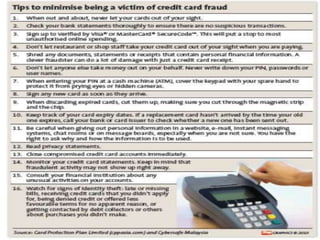

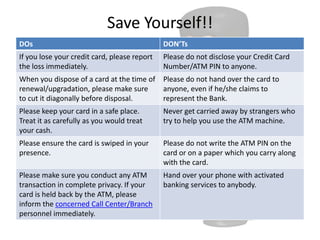

Credit card fraud is a type of theft where a credit card or payment information is used without authorization to obtain money or goods. Common types of credit card fraud include counterfeiting cards, using lost or stolen cards, providing card details without the physical card, and identity theft. An estimated Rs 8.2 crore is lost annually in India to credit card fraud. Victims have included ordinary citizens as well as prominent individuals. Fraud can be committed by cloning cards using scanning devices or stealing card information through unsecure online transactions. Consumers should protect themselves by being vigilant with their cards and payment details.