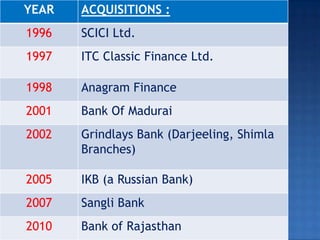

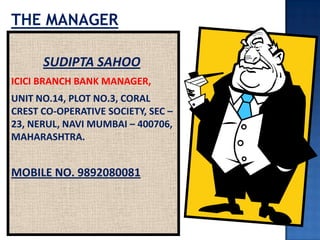

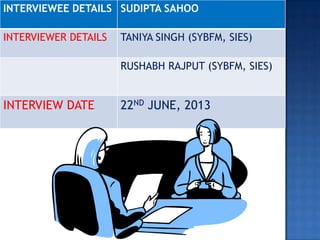

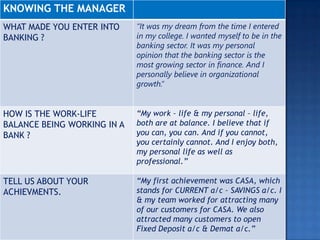

ICICI Bank, founded in 1994 and headquartered in Mumbai, is one of India's largest private sector banks, with subsidiaries in 19 countries and over 3,130 branches. The bank has earned a reputation for technological advancement and has significant market capitalization, with total assets of $98.99 billion and a revenue of $13.52 billion. Insights from an interview with the branch manager highlight the importance of customer relationship management, staff motivation, and the expected growth in the banking sector with plans for new branch openings.