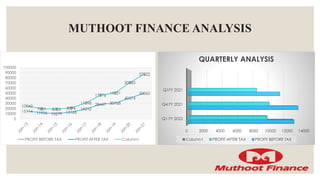

Muthoot Finance is India's largest gold loan NBFC. It provides gold loans to individuals and businesses, with over 3,000 branches across India. Muthoot has been successful due to its large branch network in Southern India, where 85-90% of gold loans are concentrated. It offers gold loans with quick processing, minimum documentation, and lower interest rates than other lenders. While dependent on gold prices, Muthoot has consistently grown its revenues and profits over the past years through its market leading position in the gold loan industry.