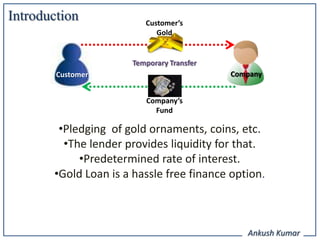

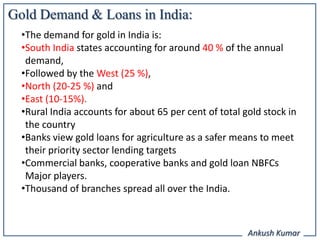

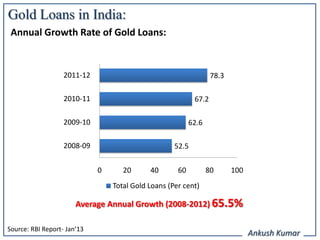

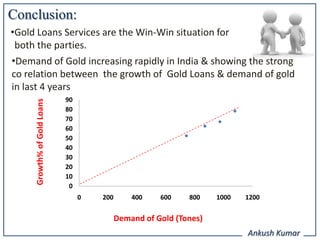

Gold loans allow individuals to borrow money using gold as collateral. Some key features of gold loans include being secured, having a short disbursal time, and providing a high loan-to-value ratio. Benefits include not having to sell gold during financial difficulties, no prepayment charges, and interest rates that depend on the amount pledged. Gold loan demand and growth has increased in India in recent years, particularly in rural areas, with commercial banks and NBFCs being major players. There is a strong correlation between growing gold demand and gold loan growth in India.