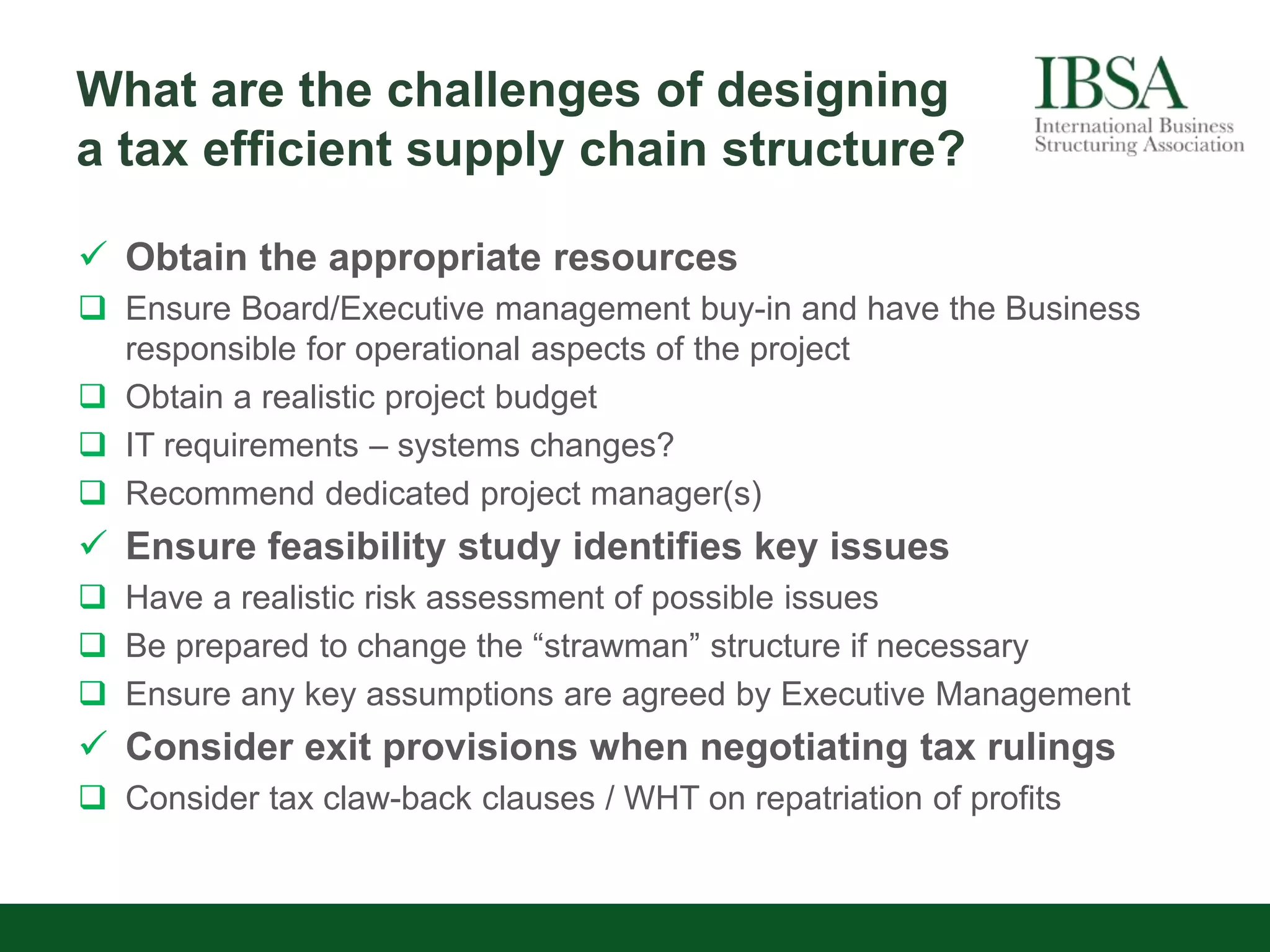

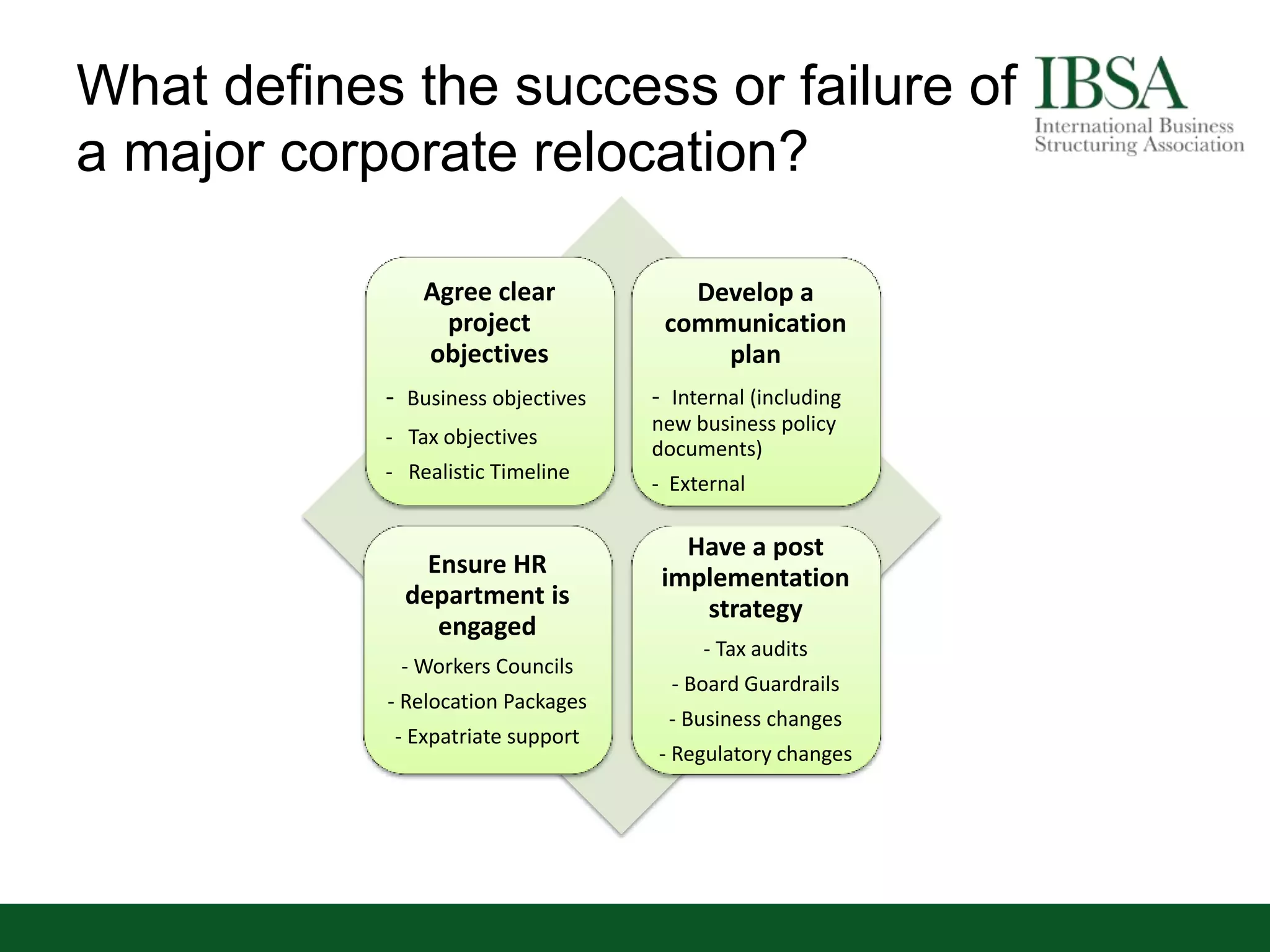

The document discusses the evolution of international taxation amidst globalization, highlighting the shift towards tax-efficient structures for multinational companies. It outlines challenges in designing tax-efficient supply chains, the importance of setting clear objectives, and the UK's attractiveness for international business due to its reduced tax rates and favorable regulatory environment. The future of tax planning will be dictated by increasing compliance burdens, BEPS legislation, and the necessity for substantial business justification in tax arrangements.