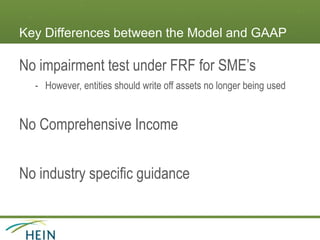

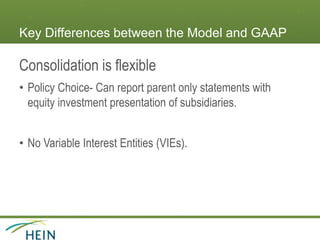

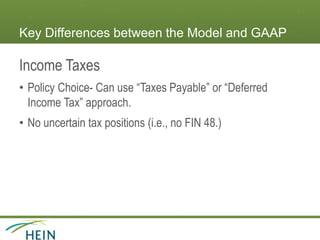

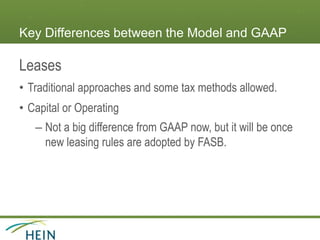

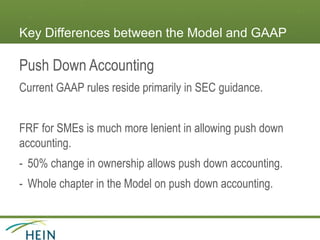

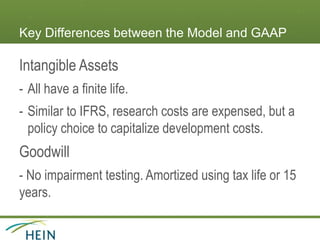

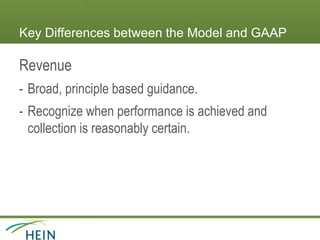

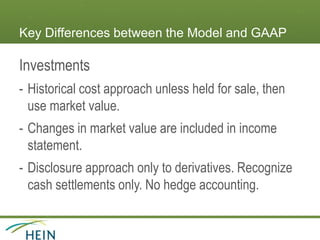

This document provides an overview of the Financial Reporting Framework for Small- and Medium-Sized Entities (FRF for SMEs). It was developed as a simplified alternative to US GAAP for private companies. Key highlights include that the FRF for SMEs is principles-based, organized in one reference manual, and allows for more flexibility compared to GAAP in areas like consolidation, taxes, leases, and business combinations. The presentation also outlines differences between the FRF for SMEs and GAAP such as the use of market value over fair value, no impairment tests, and more lenient rules for pushdown accounting. Additional resources on the framework are available at the provided website.