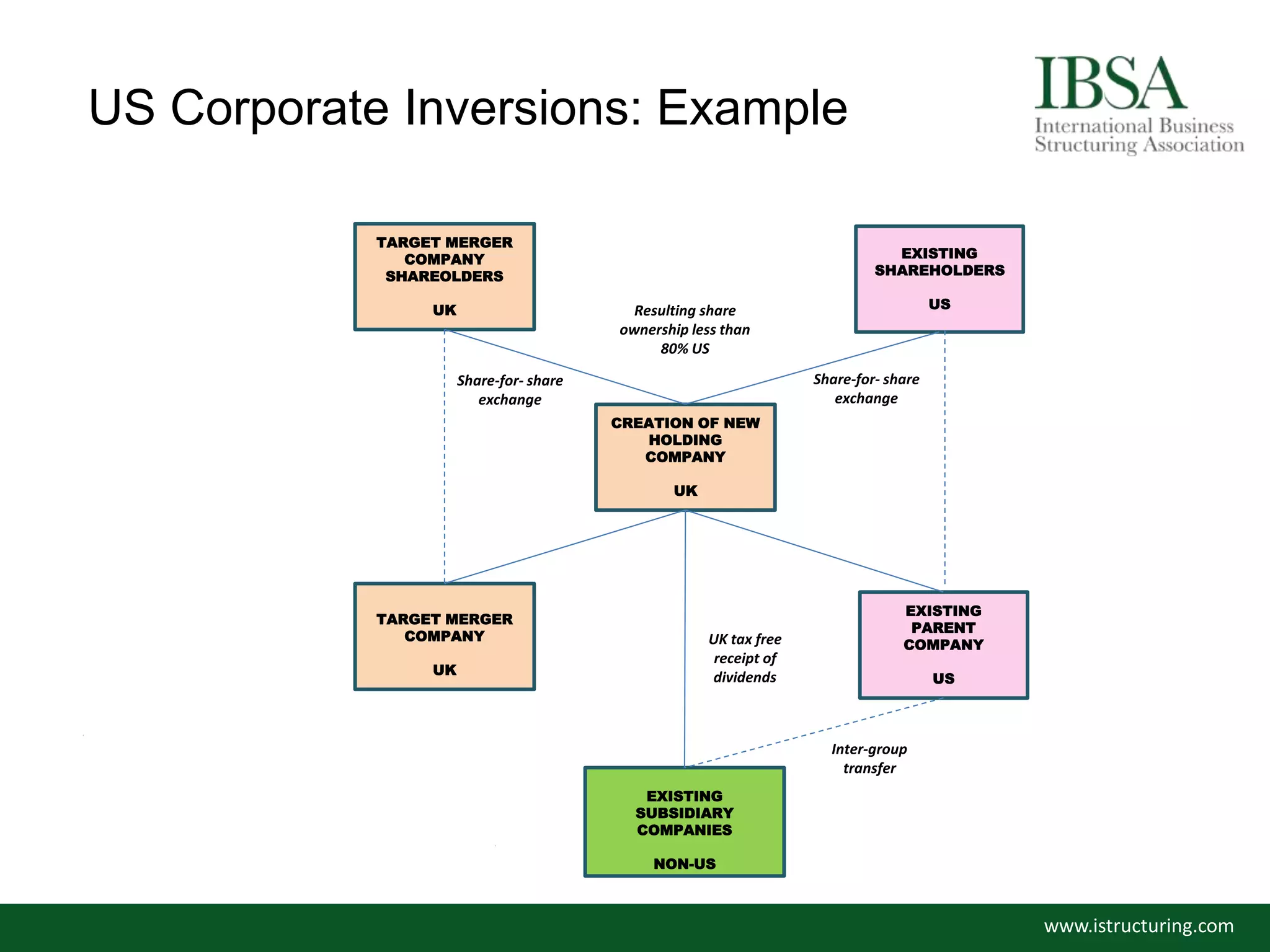

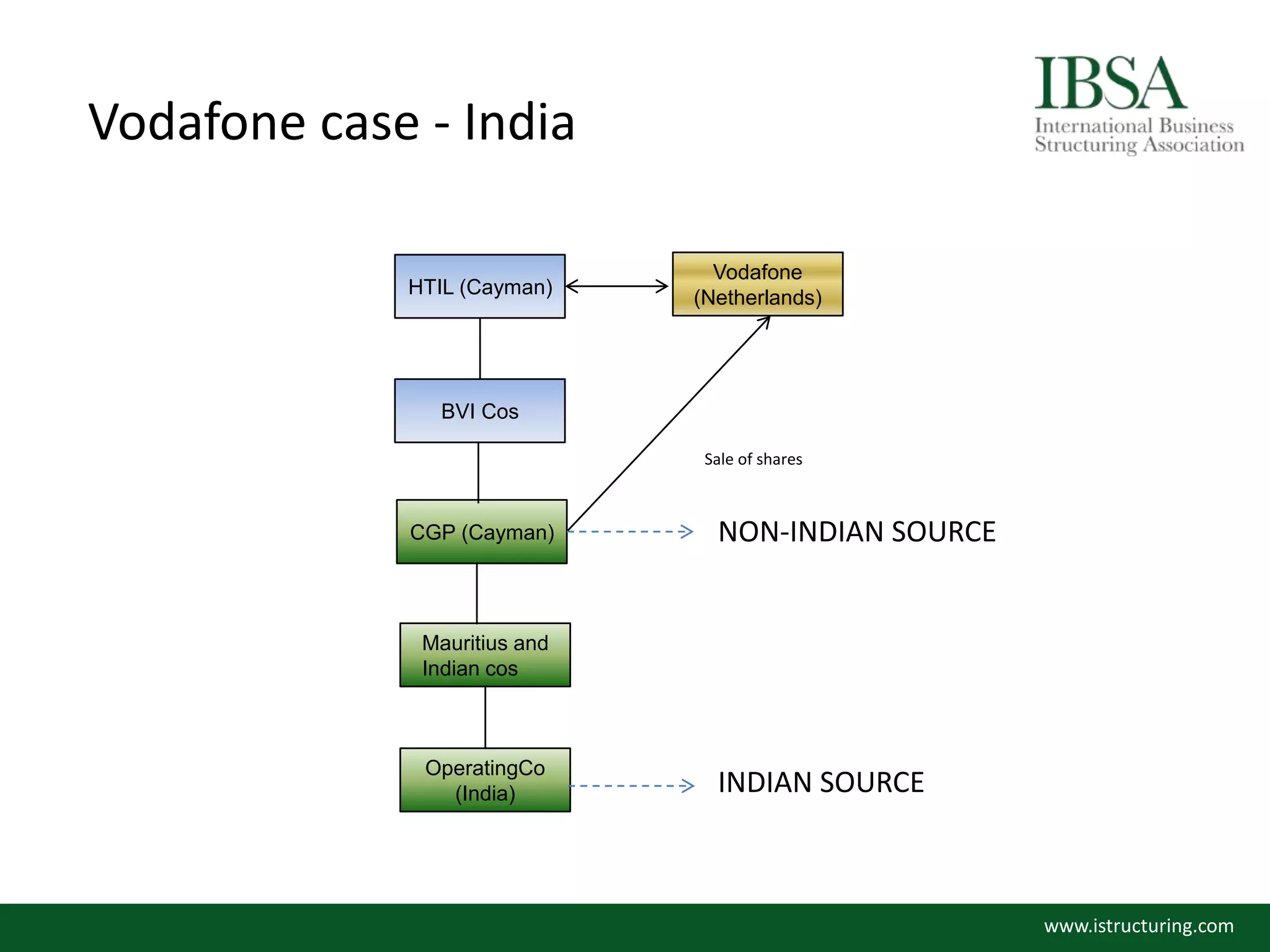

This document discusses key factors in structuring cross-border corporate acquisitions and provides an overview of developments in 2014 and a forecast for 2015. Major topics covered include the OECD's BEPS initiative targeting double non-taxation, US corporate inversions, EU state aid investigations, and developing country responses involving increased source-based taxation or alternatives to managing double taxation. The document also summarizes methods for corporate migration and key tax and intellectual property issues related to corporate acquisitions and mergers.