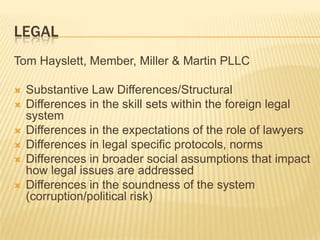

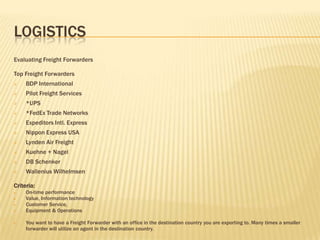

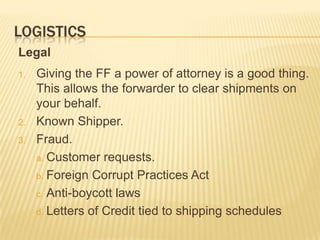

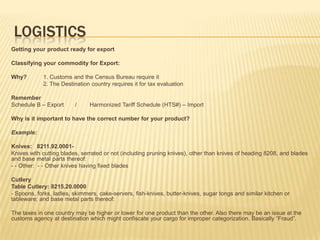

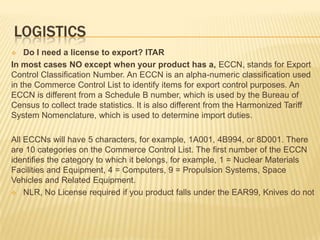

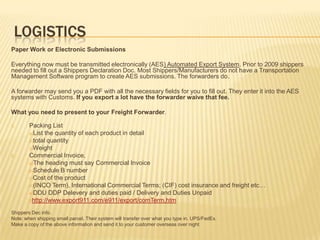

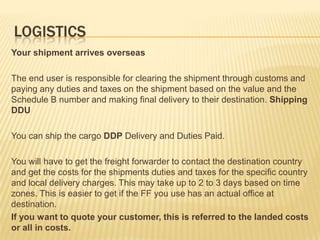

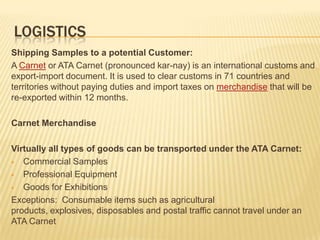

Company X is considering expanding globally but lacks international expertise. The World Trade Society of Chattanooga advisory board meeting provided information on key considerations for going global including culture, legal, accounting, logistics, and finding expertise. Topics discussed included cultural education, legal structures and protocols between countries, tax implications, evaluating freight forwarders, export documentation, and product classification for customs. The meeting aimed to help identify resources to guide Company X's global expansion process.