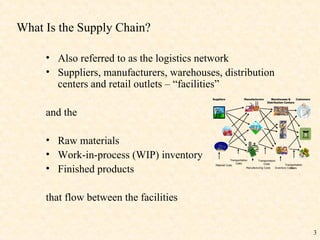

The document discusses supply chain management. It defines a supply chain as including suppliers, manufacturers, warehouses, distribution centers, and retail outlets that facilitate the flow of raw materials, work-in-progress inventory, and finished products. It also discusses the challenges of managing supply chains due to uncertainty, and techniques for improving demand forecasting and reducing variability through collaboration and information sharing.