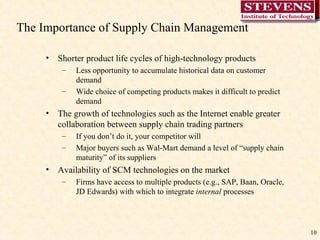

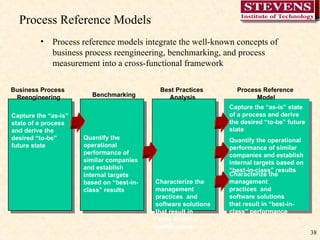

The document provides an overview of supply chain management concepts including definitions, key components of the supply chain, challenges, and best practices. It describes the supply chain as involving suppliers, manufacturers, warehouses, distribution centers, and customers. Supply chain management aims to efficiently integrate these entities to minimize costs and satisfy demand. The document discusses challenges like uncertainty and the bullwhip effect. It also outlines the SCOR model as a framework for supply chain collaboration and performance improvement.