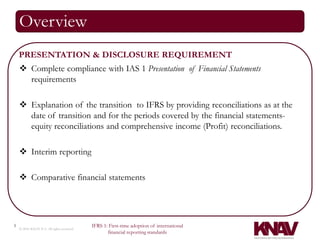

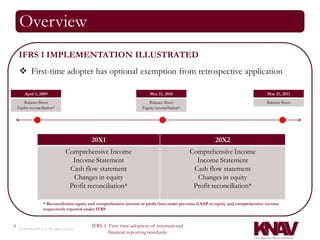

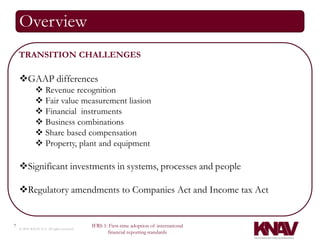

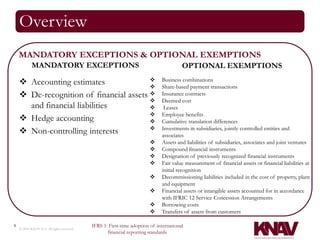

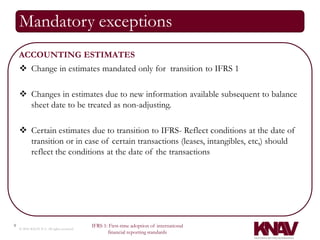

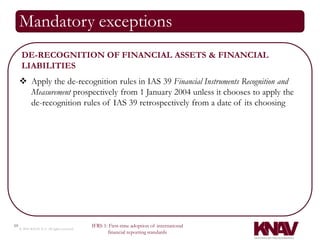

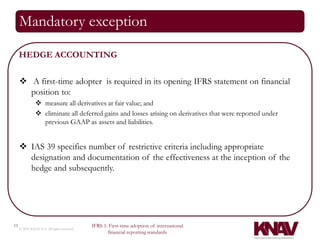

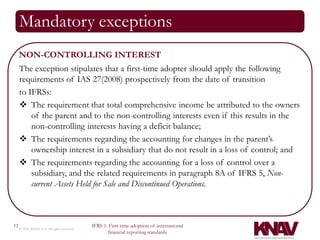

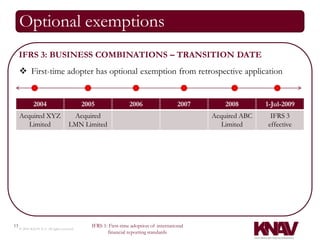

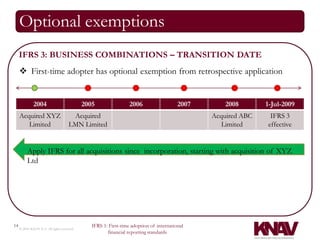

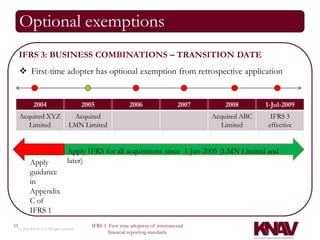

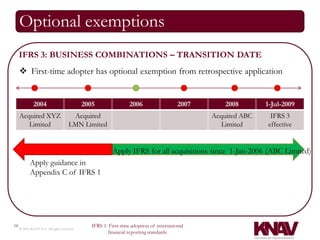

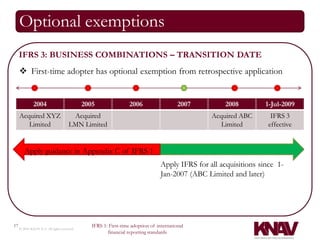

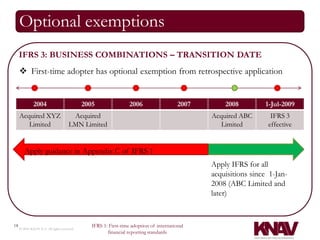

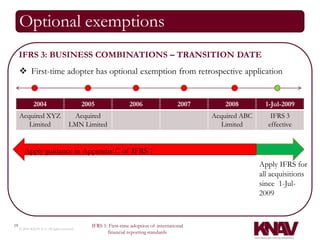

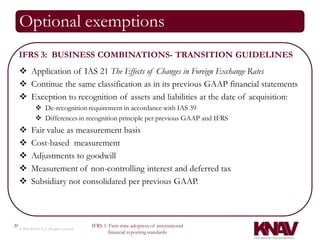

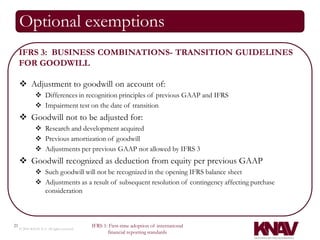

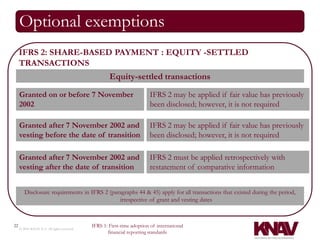

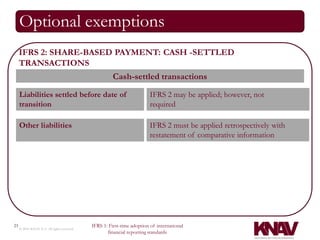

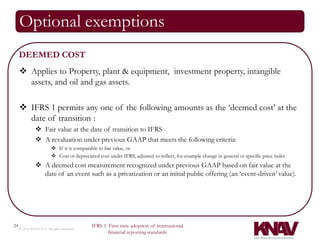

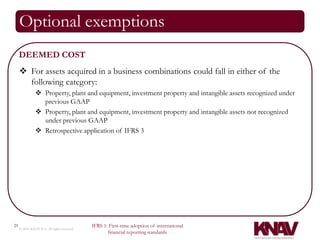

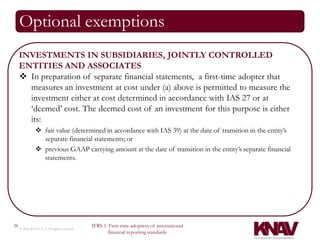

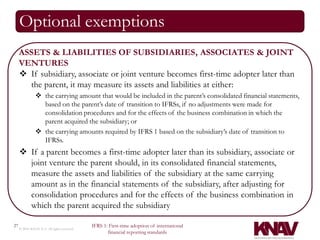

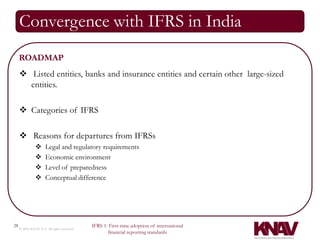

The document provides an overview of IFRS 1, which outlines the requirements for an entity's first adoption of International Financial Reporting Standards. It discusses the mandatory exceptions and optional exemptions allowed by IFRS 1, including exemptions from full retrospective application for business combinations, share-based payments, and certain assets and liabilities. The document also summarizes the implementation of IFRS 1, including preparation of an opening IFRS balance sheet and reconciliation requirements for financial statement disclosures.