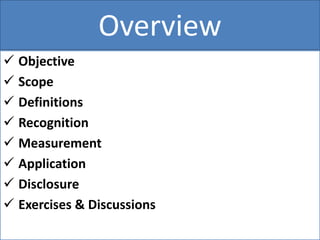

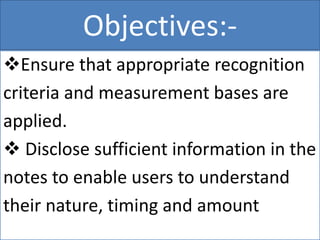

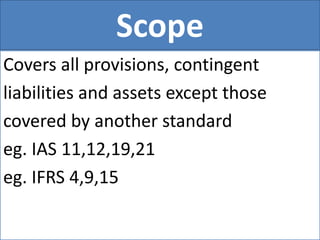

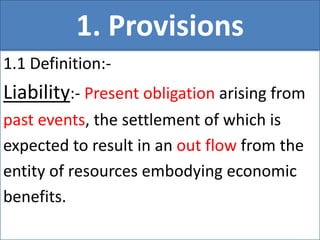

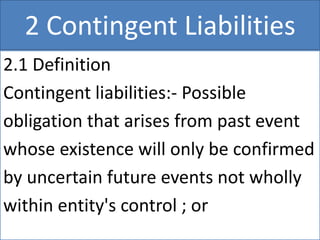

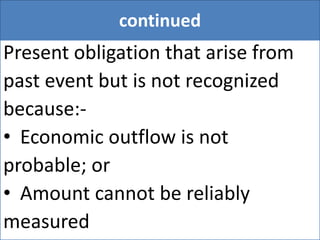

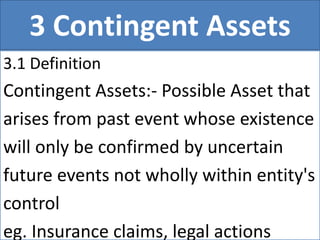

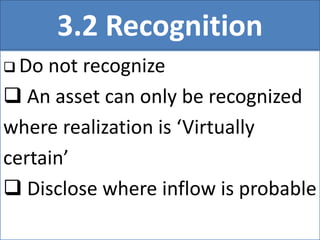

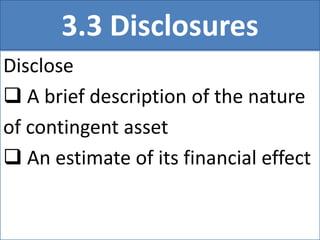

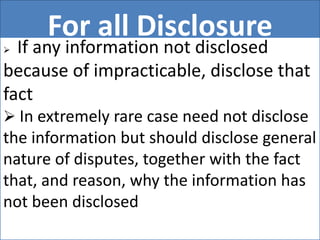

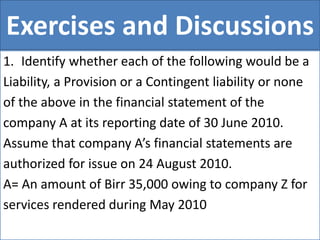

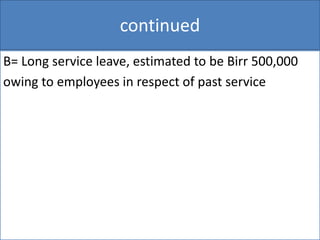

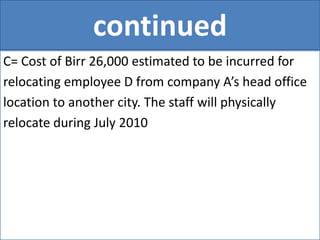

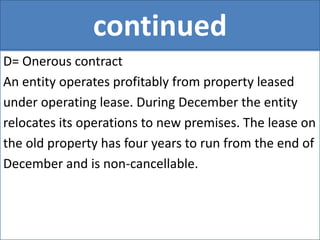

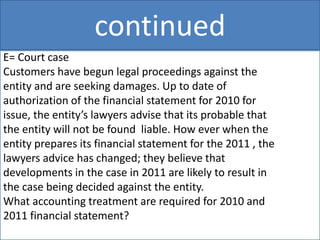

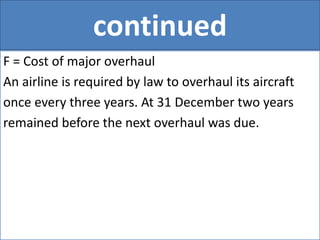

This document provides an overview of IAS 37 Provisions, Contingent Liabilities and Contingent Assets. It defines key terms including provisions, present obligations, past events, and probable outflows. It discusses the recognition and measurement of provisions, contingent liabilities, and contingent assets. Examples are provided for applying the standard to issues like warranties, legal claims, and restructuring plans. The document concludes with exercises assessing various scenarios in light of IAS 37 requirements.