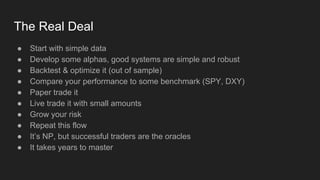

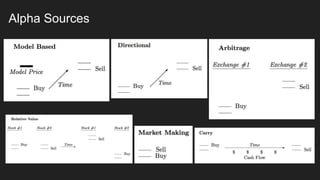

This document provides an introduction to algorithmic trading, including frameworks, tools, and examples. It discusses using algorithms to automatically execute trading strategies in order to invest passively in indexes or actively try to beat the market. Sources of trading alpha and example alpha strategies are presented. Data sources, tools for analysis like Pandas and TA-LIB, and backtesting/strategy evaluation platforms like Quantopian and Numerai are described. The document emphasizes starting simply, backtesting strategies, and gradually transitioning to live trading over years of practice and refinement. Resources for further learning about investment management, quantitative finance, and relevant tools are also listed.

![Data

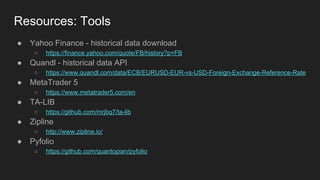

● ['datetime', 'open', 'high', 'low', 'close', 'volume', 'adj close']

● Yahoo Finance

○ Anything (except FX), daily

● Quandl

○ Anything, daily

○ Paid subscriptions

● MetaTrader 5

○ FX, CFD, indices

○ M5, M15, …, MN1

● Quantopian

○ Proprietary, no downloads

○ Anything (except FX), daily](https://image.slidesharecdn.com/introductiontoalgorithmictrading-170406043830/85/Introduction-to-Algorithmic-Trading-6-320.jpg)