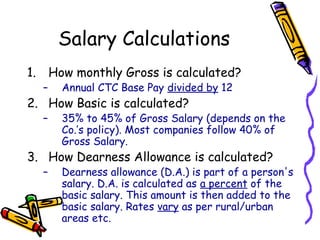

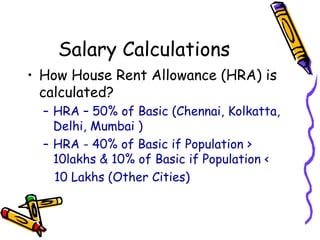

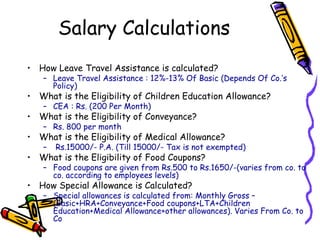

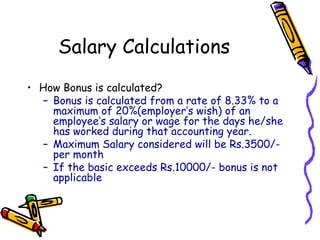

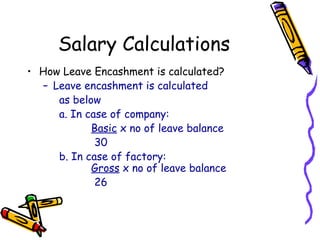

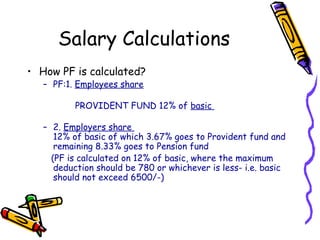

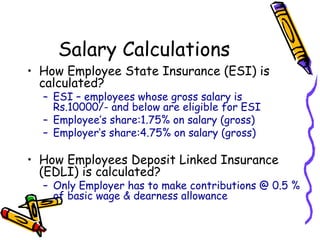

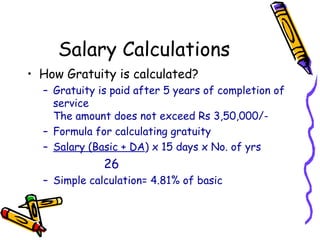

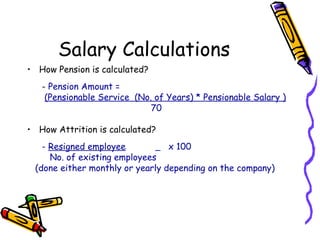

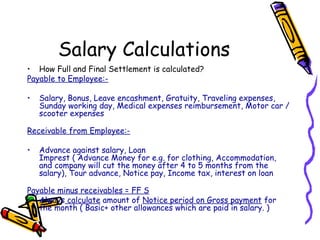

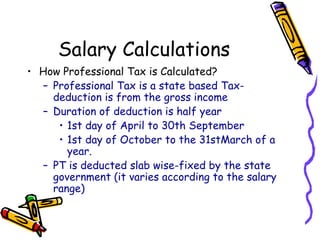

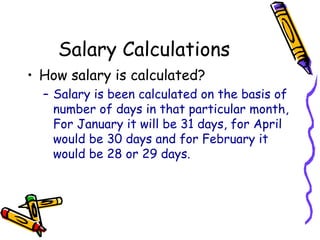

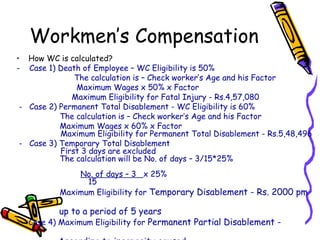

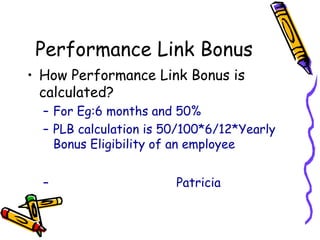

The document provides formulas and explanations for calculating various components of an employee's salary and benefits in India. It explains how to calculate monthly gross salary from annual CTC, basic salary as a percentage of gross, Dearness Allowance as a percentage of basic, and House Rent Allowance varying by city population. Formulas are also provided for calculating leave travel assistance, children education allowance, conveyance allowance, medical allowance, food coupons, special allowance, bonus, leave encashment, PF, ESI, EDLI, gratuity, pension, attrition, full and final settlement, professional tax, workmen's compensation, and performance linked bonus.