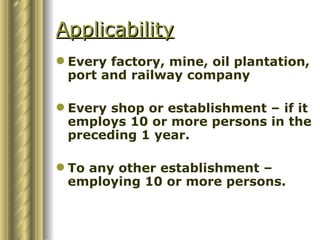

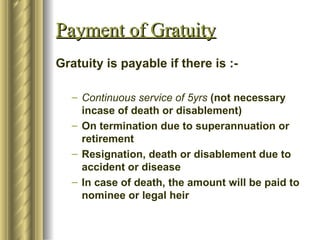

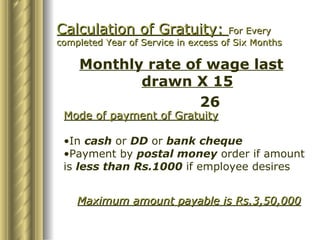

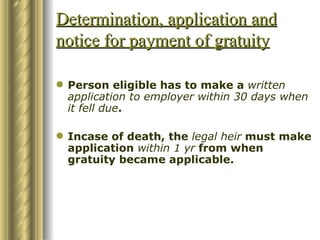

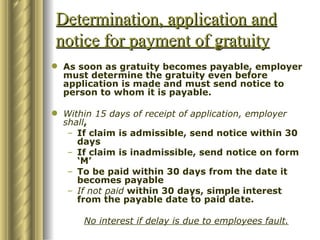

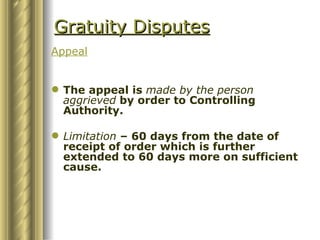

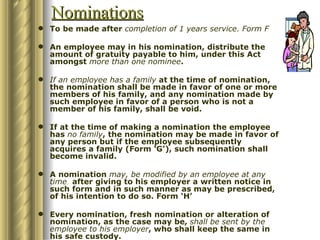

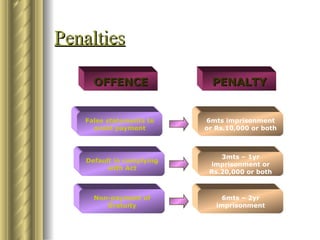

The Payment of Gratuity Act of 1972 requires employers in factories, mines, ports, and other establishments employing 10 or more persons to pay gratuity to their employees. Gratuity is payable when an employee has 5 years of continuous service and is terminated due to superannuation, retirement, death, or disability. Gratuity amount is calculated as 15 days wages for every completed year of service, with a maximum of 3.5 lakhs. Employers must make payment within 30 days of application, and interest is payable for delayed payments. Disputes can be appealed to controlling authorities within time limits defined in the Act.