How you can get a higher pension from EPFO beyond ceiling limit?

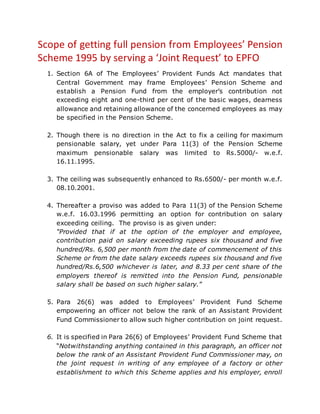

- 1. Scope of getting full pension from Employees’ Pension Scheme 1995 by serving a ‘Joint Request’ to EPFO 1. Section 6A of The Employees’ Provident Funds Act mandates that Central Government may frame Employees’ Pension Scheme and establish a Pension Fund from the employer’s contribution not exceeding eight and one-third per cent of the basic wages, dearness allowance and retaining allowance of the concerned employees as may be specified in the Pension Scheme. 2. Though there is no direction in the Act to fix a ceiling for maximum pensionable salary, yet under Para 11(3) of the Pension Scheme maximum pensionable salary was limited to Rs.5000/- w.e.f. 16.11.1995. 3. The ceiling was subsequently enhanced to Rs.6500/- per month w.e.f. 08.10.2001. 4. Thereafter a proviso was added to Para 11(3) of the Pension Scheme w.e.f. 16.03.1996 permitting an option for contribution on salary exceeding ceiling. The proviso is as given under: “Provided that if at the option of the employer and employee, contribution paid on salary exceeding rupees six thousand and five hundred/Rs. 6,500 per month from the date of commencement of this Scheme or from the date salary exceeds rupees six thousand and five hundred/Rs.6,500 whichever is later, and 8.33 per cent share of the employers thereof is remitted into the Pension Fund, pensionable salary shall be based on such higher salary.” 5. Para 26(6) was added to Employees’ Provident Fund Scheme empowering an officer not below the rank of an Assistant Provident Fund Commissioner to allow such higher contribution on joint request. 6. It is specified in Para 26(6) of Employees’ Provident Fund Scheme that “Notwithstanding anything contained in this paragraph, an officer not below the rank of an Assistant Provident Fund Commissioner may, on the joint request in writing of any employee of a factory or other establishment to which this Scheme applies and his employer, enroll

- 2. such employee as a member or allow him to contribute more than fifteen thousand rupees of his pay per month if he is already a member of the Fund and thereupon such employee shall be entitled to the benefits and shall be subject to the conditions of the Fund, provided that the employer gives an undertaking in writing that he shall pay the administrative charges payable and shall comply with all statutory provisions in respect of such employee.” 7. Para 10 of the Order of the Supreme Court of India dated 04.10.2016 on SLP(C) Nos. 33032-33033 of 2015, mandates that “if both the employer and employee opt for deposit against the actual salary and not the ceiling amount, exercise of option under paragraph 26 of the Provident Scheme is inevitable.” 8. As per Para 11 of the said SC Verdict, all that the Provident Commissioner is required to do is an “adjustment of accounts” which in turn benefit employee. The Provident Fund Commissioner can seek return of all amounts that employee may have taken or withdrawn from Provident Fund Account. 9. Ignoring the verdict of the Supreme Court of India dated 04.10.2016 on SLP(C) Nos. 33032-33033 of 2015, the Central Government has amended Para 11(3) and Para 11(4) of the Pension Scheme by G.S.R. 609(E), dated 22.08.2014 (w.e.f. 01.09.2014) as given below: 4. In the principal Scheme, in paragraph 11, … (c ) in sub-paragraph (3),- (i) for the words, letters and figures “rupees six thousand and five hundred/Rs, 6500″, the words “fifteen thousand rupees” shall be substituted; (ii) the proviso shall be omitted. (d) after sub-paragraph (3), the following sub-paragraph shall be inserted, namely:- “(4) The existing members as on the 1st day of September, 2014, who at the option of the employer and employee, had been contributing on salary exceeding six thousand and five hundred rupees per month, may on a fresh option to be exercised jointly by the employer and employee continue to

- 3. contribute on salary exceeding fifteen thousand rupees per month: Provided that the aforesaid members have to contribute at the rate of 1.16 per cent on salary exceeding fifteen thousand rupees as an additional contribution from and out of the contributions payable by the employees for each month under the provisions of the Act or the rules made thereunder: Provided further that the fresh option shall be exercised by the member within a period of six months from the 1st day of September, 2014: Provided also that the period specified in the second proviso may, on sufficient cause being shown by the member, be extended by the Regional Provident Fund Commissioner for a further period not exceeding six months: Provided also that if no option is exercised by the member within such period (including the extended period), it shall be deemed that the member has not opted for contribution over wage ceiling and the contributions to the Pension Fund made over the wage ceiling in respect of the member shall be diverted to the Provident Fund account of the member along with interest as declared under the Employees‟ Provident Fund Scheme from time to time, 10. G.S.R. 609(E), dated 22.08.2014 (w.e.f. 01.09.2014) also specifies in Para 11(3) of the Pension Scheme that maximum pensionable salary shall be limited to fifteen thousand rupees per month and Para 26(6) of Provident Funds Scheme has been amended accordingly. 11. G.S.R. 609(E), dated 22.08.2014 was challenged through writ at Kerala High Court. 12. Kerala High Court in its verdict dated 12.10.2018 on WP(C).No.13120 of 2015 set aside the Employee’s Pension (Amendment) Scheme, 2014 [brought into force by notification No. GSR. 609(E) dated 22.8.2014] which had curtailed the facility of enhanced contribution on EPS. The verdict clearly said that: (a)The stipulation introduced by the amendment that the employees should make an additional contribution of 1.16% does not find support in any statutory provision [Para- 11 of the verdict].

- 4. (b) Since insistence on a cut -off date has already been found to be bad and set aside by this Court, there is no justification for introducing the same again [Para- 13 of the verdict]. The writ petitions are all allowed as follows [last page of the verdict]: i) The Employee's Pension (Amendment) Scheme, 2014 brought into force by Notification No. GSR. 609(E) dated 22.8.2014 evidenced by Ext.P8 in W.P.(C) No. 13120 of 2015 is set aside; ii) All consequential orders and proceedings issued by the Provident Fund authorities/respondents on the basis of the impugned amendments shall also stand set aside. ii) The various proceedings issued by the Employees Provident Fund Organization declining to grant opportunities to the petitioners to exercise a joint option along with other employees to remit contributions to the Employees Pension Scheme on the basis of the actual salaries drawn by them are set aside. iii) The employees shall be entitled to exercise the option stipulated by paragraph 26 of the EPF Scheme without being restricted in doing so by the insistence on a date. iv) There will be no order as to costs. 13.Again, in a major relief to many employees, the Supreme Court has dismissed on 01.04.2019 the Special Leave Petition filed by EPFO [SLP (Civil) D No. 9610/2019] against the Kerala High Court Judgment dated 12.10.2018 setting aside Employee's Pension (Amendment) Scheme, 2014 that capped maximum pensionable salary to Rs.15, 000 per month. 14.Therefore, it appears that, on the basis of Kerala High Court verdict, employee and employer have the opportunity to submit ‘Joint Request’ for higher contribution on EPS which is mere an adjustment of accounts as money will go from EPF to EPS and employer does not have any extra burden on such higher contribution. Monthly pension will be as given below: Monthly pension after 58 yr age = {Average of Basic pay + Grade pay + D.A. of last 12 months} x {(Month and Year of retirement) – (November 1995) + 2) / 70 N.B. (a) 6 months and more=1 year, (b) 2 years added as per clause 10(2) for retirement at the age of 58 and period of contribution in EPS from Nov’95 is equal to 20years or more. (c) Amount of pension shall be increased @ 4% for every completed year if the age of drawing pension is deferred upto 60 years. 15. It is learnt in May’2019 that EPFO is planning to file a review petition before the Supreme Court for disallowance of full pension from EPS.

- 5. Joint request To The Regional Provident Fund Commissioner Employees’ Provident Fund Organization, Sub: Joint Request of employee/retired employee and his employer to contribute to EPS more than ceiling limit of his pay per month Sir, In terms of Para 26(6) of Employees’ Provident Fund Scheme 1952, I,………………………………………, do hereby exercising Joint Request of employee/retired employee and employer to contribute on actual salary exceeding ceiling limit (Rs.5000/-, Rs. 6500/- or Rs. 15000/- as applicable) from the date of commencement of Employees’ Pension Scheme 1995 i.e. 16.11.1995. Yours faithfully, Date: Signature: Name: UAN: Verification Certified that Mr./Mrs./Ms. ……………………………………………….Designation…………………………….. Employee No. …………………………………. UAN ………………………………………… is /was a member of EPS who has/had been contributing at 8.33% of ceiling salary [8.33% of Rs. 5000/- from 16.11.1995, 8.33% of Rs.6500/- from 08.10.2001 and 8.33% of Rs. 15000/- from 01.09.2014] and is exercising Joint Request of employee/retired employee and employer to contribute on actual salary (Basic Pay+ Grade Pay+ D.A.) exceeding ceiling limit (Rs.5000/-, Rs. 6500/- or Rs. 15000/- as applicable) from the date of commencement of Employees’ Pension Scheme 1995 i.e. 16.11.1995. Date: Signature of the employer