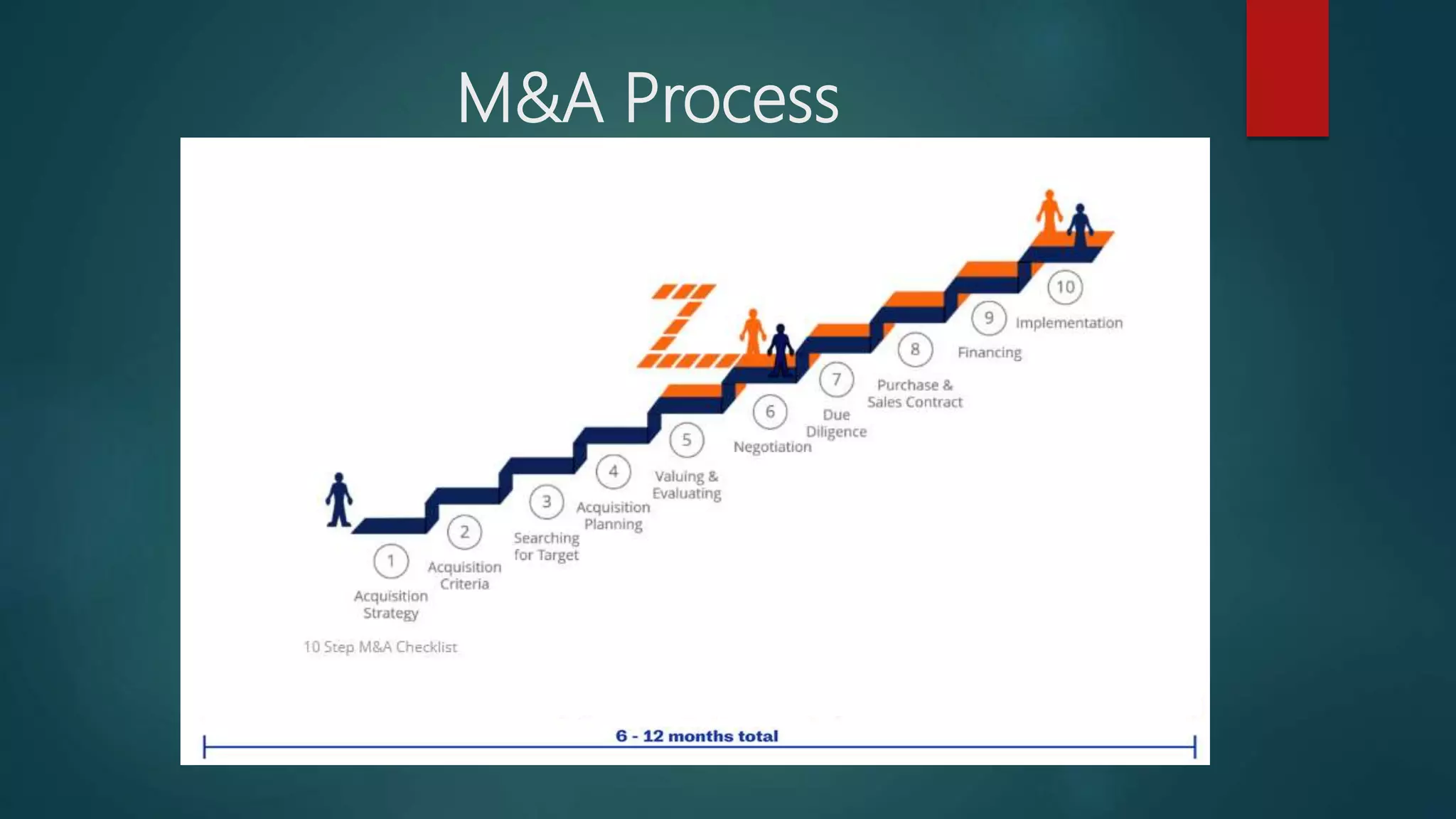

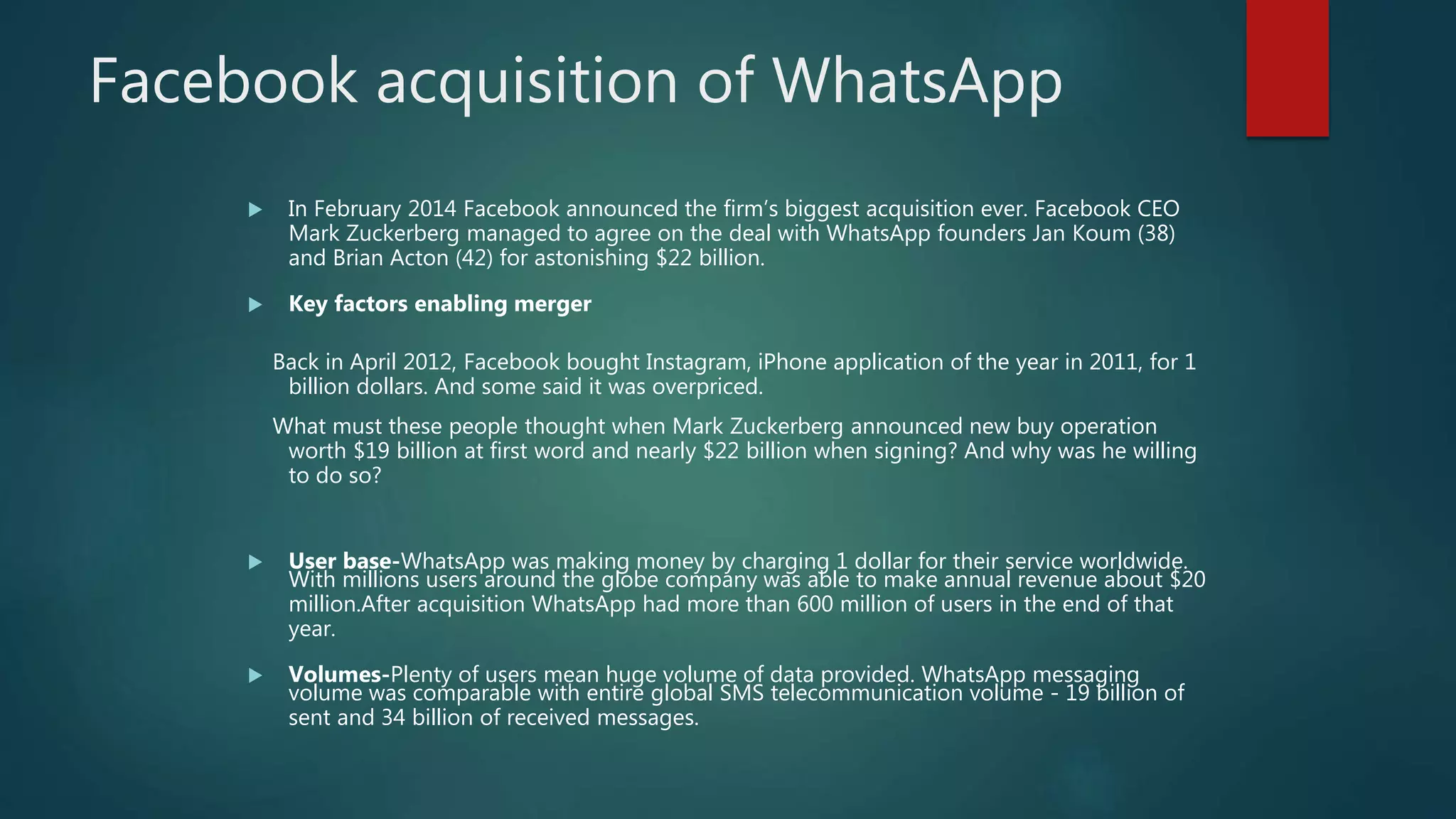

This document discusses mergers and acquisitions (M&A). It defines mergers as combinations of two companies to form one new company, while acquisitions refer to purchases of a company or portion of a company. The document provides examples of different types of M&As, including horizontal (between competitors), vertical (between suppliers and customers), conglomerate (between unrelated companies), and market/product extension mergers. It also outlines common objectives of M&As such as economies of scale, cross-selling opportunities, and access to new markets/products. Challenges of M&As include communication issues, employee retention, and cultural integration.