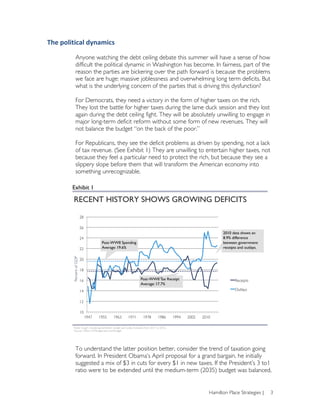

This document discusses the political challenges facing efforts to address the US economy and long-term deficits. It finds that Democrats will not support major entitlement reforms without tax increases on the rich. Republicans view higher taxes as a slippery slope that will undermine the economy. The document proposes that successful negotiations must start by agreeing on a long-term tax revenue goal, separate from how that revenue is raised and spent, to address each party's concerns and narrow policy choices on entitlements.