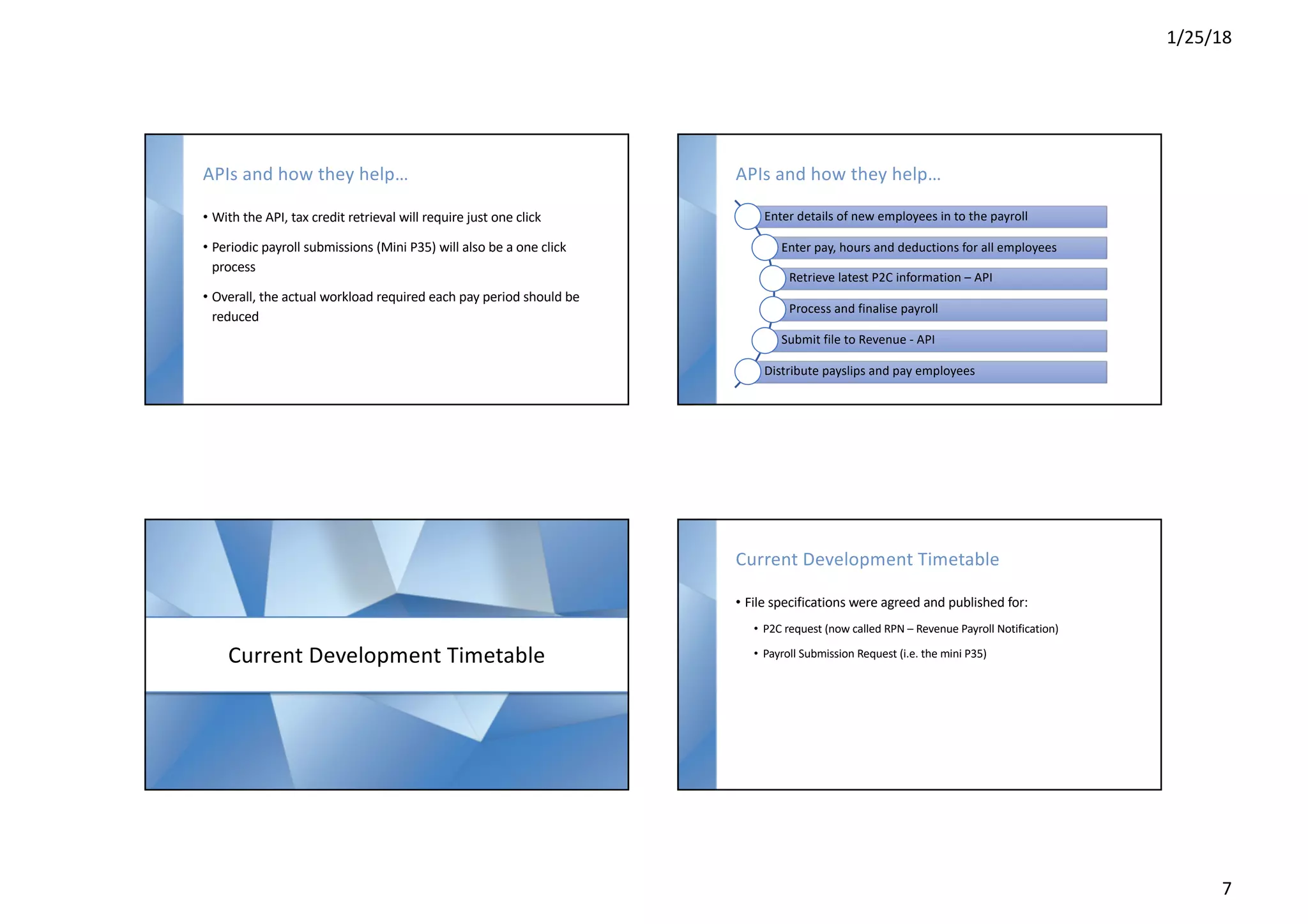

The webinar discusses how PAYE modernisation will impact employers and employees by streamlining payroll processes through real-time data submissions, resulting in more accurate tax credit allocations. Employers will no longer submit annual P35 forms but rather provide updates via a 'mini P35' each pay period, automating tax credits and reducing administrative burdens. Potential downsides include the need for reliable internet access and the necessity for employers to invest in compatible payroll software.