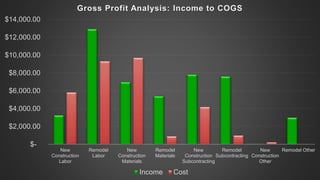

The document outlines an agenda for a Quickbooks seminar, including breaks and lunch. It discusses setting up the Quickbooks environment, reports and reporting tools, bills and payables, banking, and integrations. Charts show income vs costs of goods sold for new construction vs remodeling, and expenses by category. The presentation recommends next steps like customizing reports in Excel and joining a training program. It emphasizes setting up preferences, permissions, accounts, and backups correctly in Quickbooks.