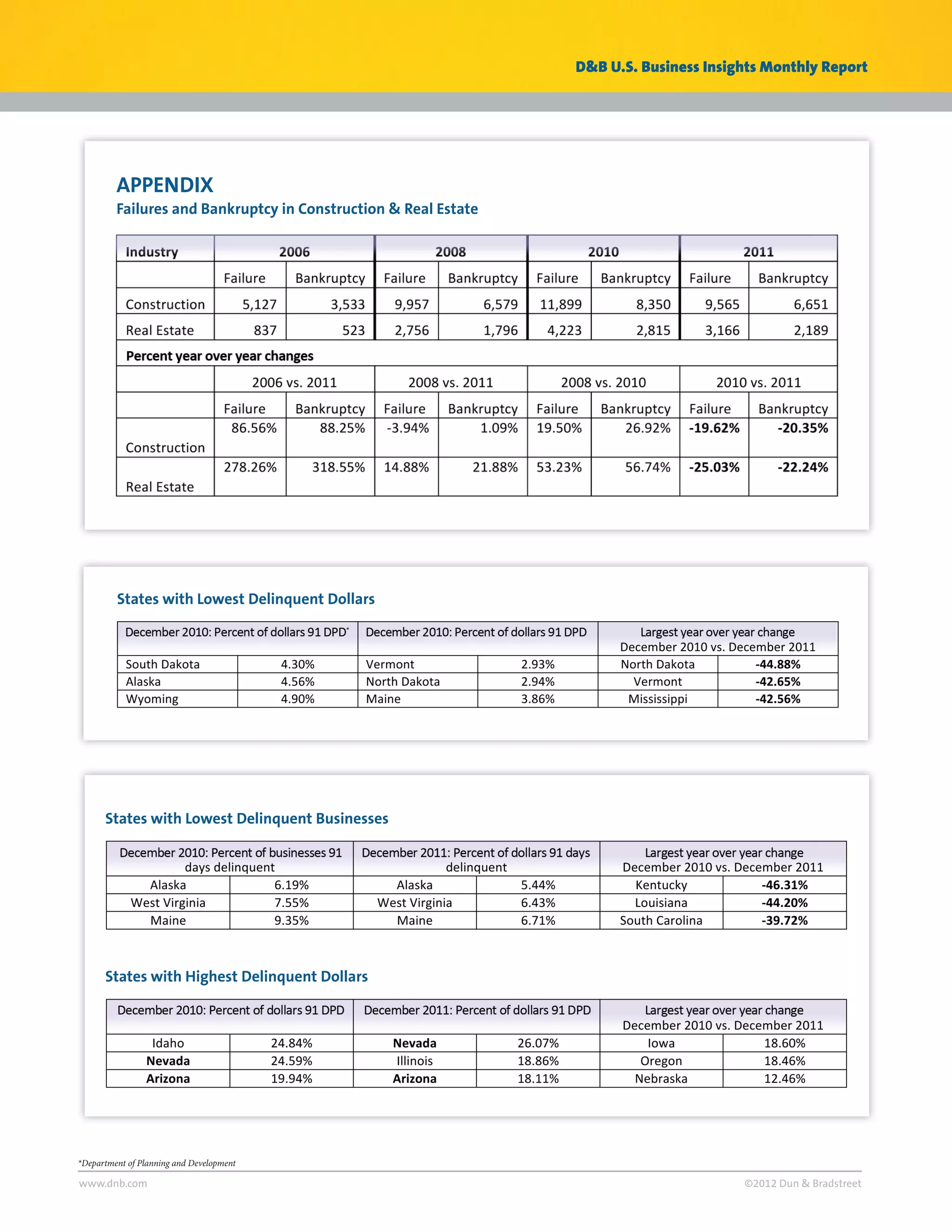

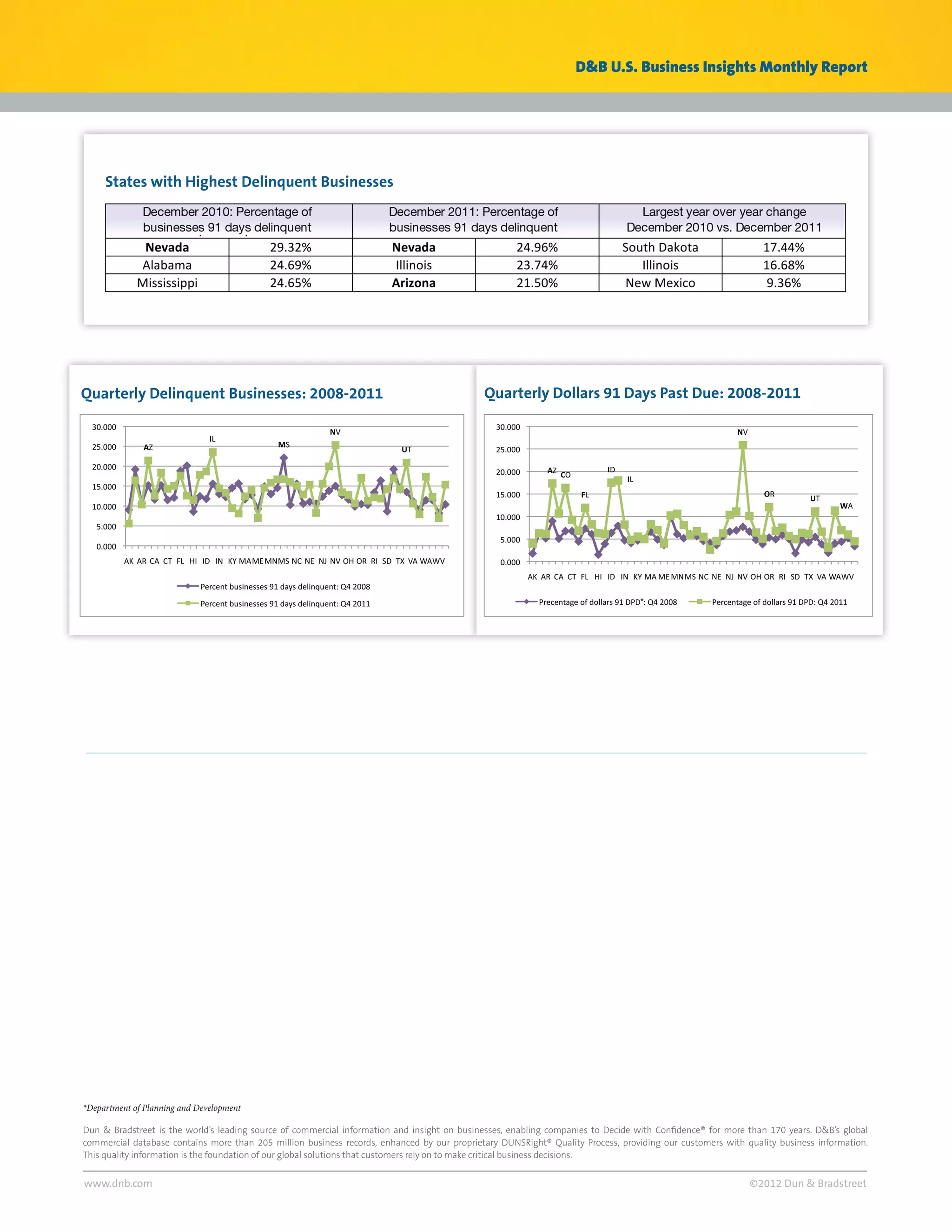

The D&B U.S. Business Insights report from March 2012 discusses the ongoing recovery of the housing industry, which was severely impacted by the housing bubble and subsequent downturn. It notes that while the healing process is underway, significant regional disparities exist, with some states showing improvement while others continue to struggle. Overall, delinquencies are decreasing, indicating a gradual recovery, but the process remains incomplete and uneven across different regions.