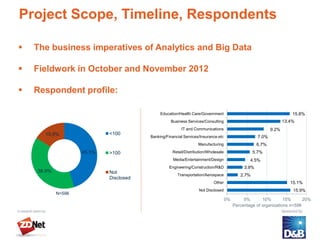

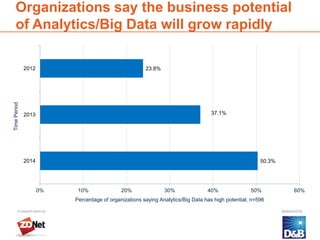

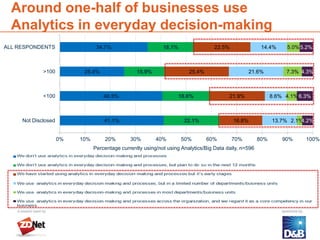

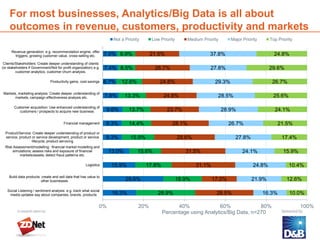

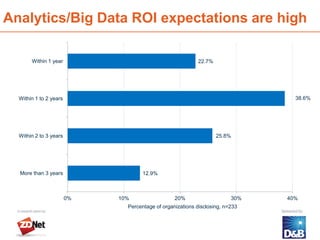

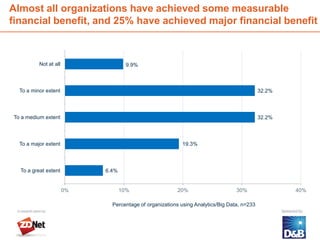

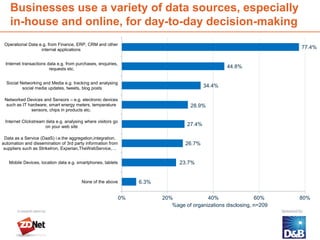

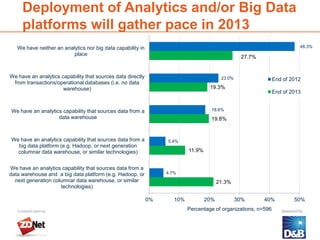

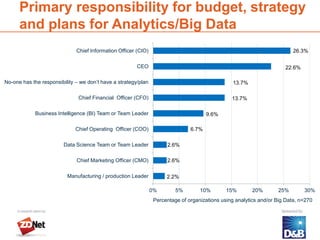

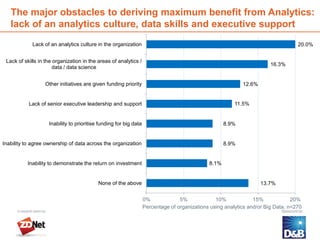

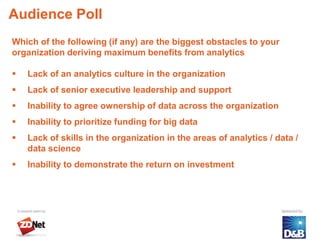

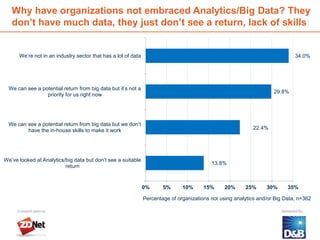

The January 24, 2013, webinar discussed key findings from ZDNet's Big Data Priorities research, highlighting that over half of organizations recognize the high potential impact of analytics and big data on business performance by 2014. Key obstacles to maximizing benefits include a lack of analytics culture, data skills, and executive support, while many organizations are still in early stages of deploying advanced analytics solutions. The discussion stressed the importance of utilizing both internal and external data sources for decision-making, with expectations for significant growth in analytics capabilities in 2013.