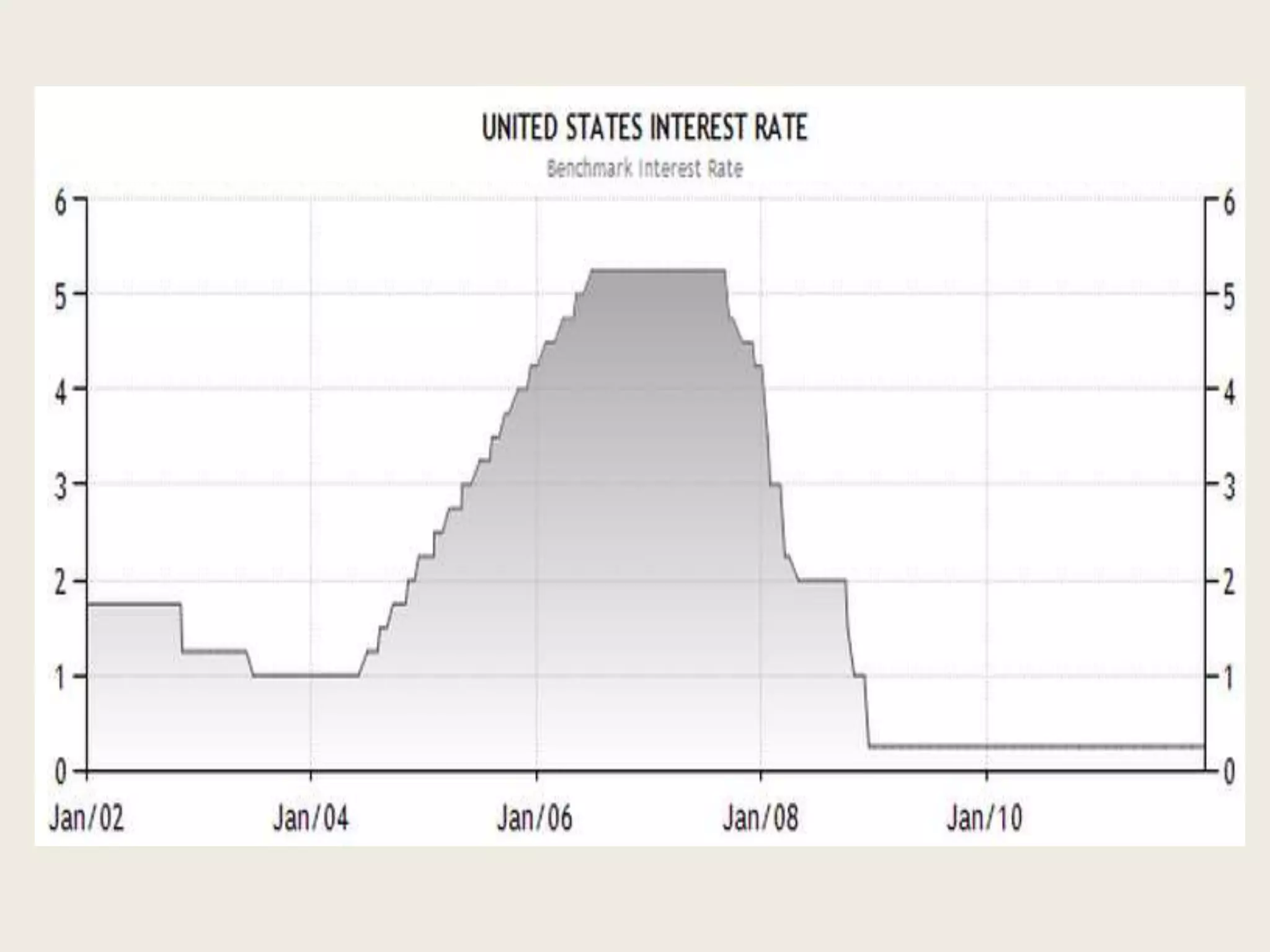

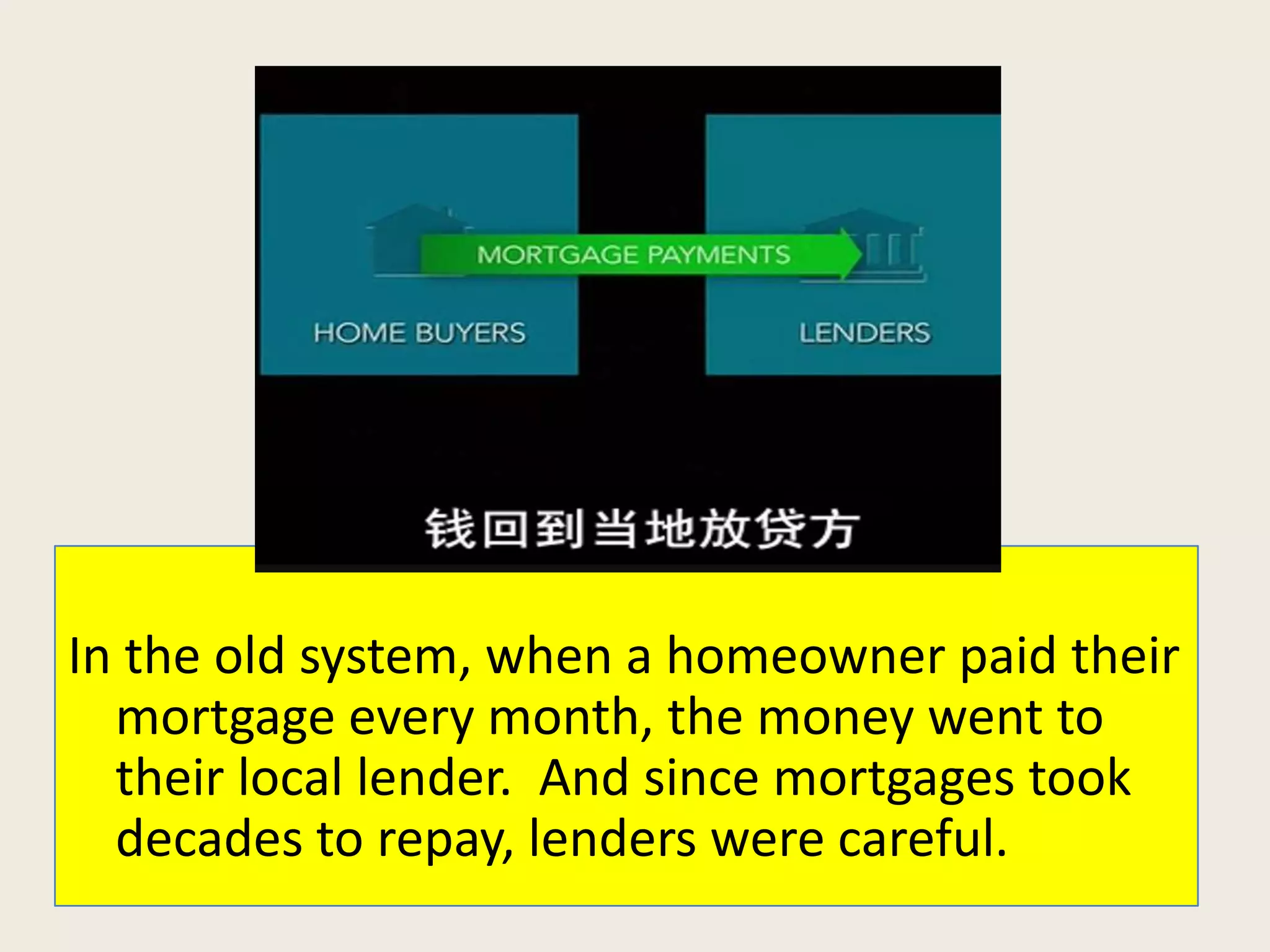

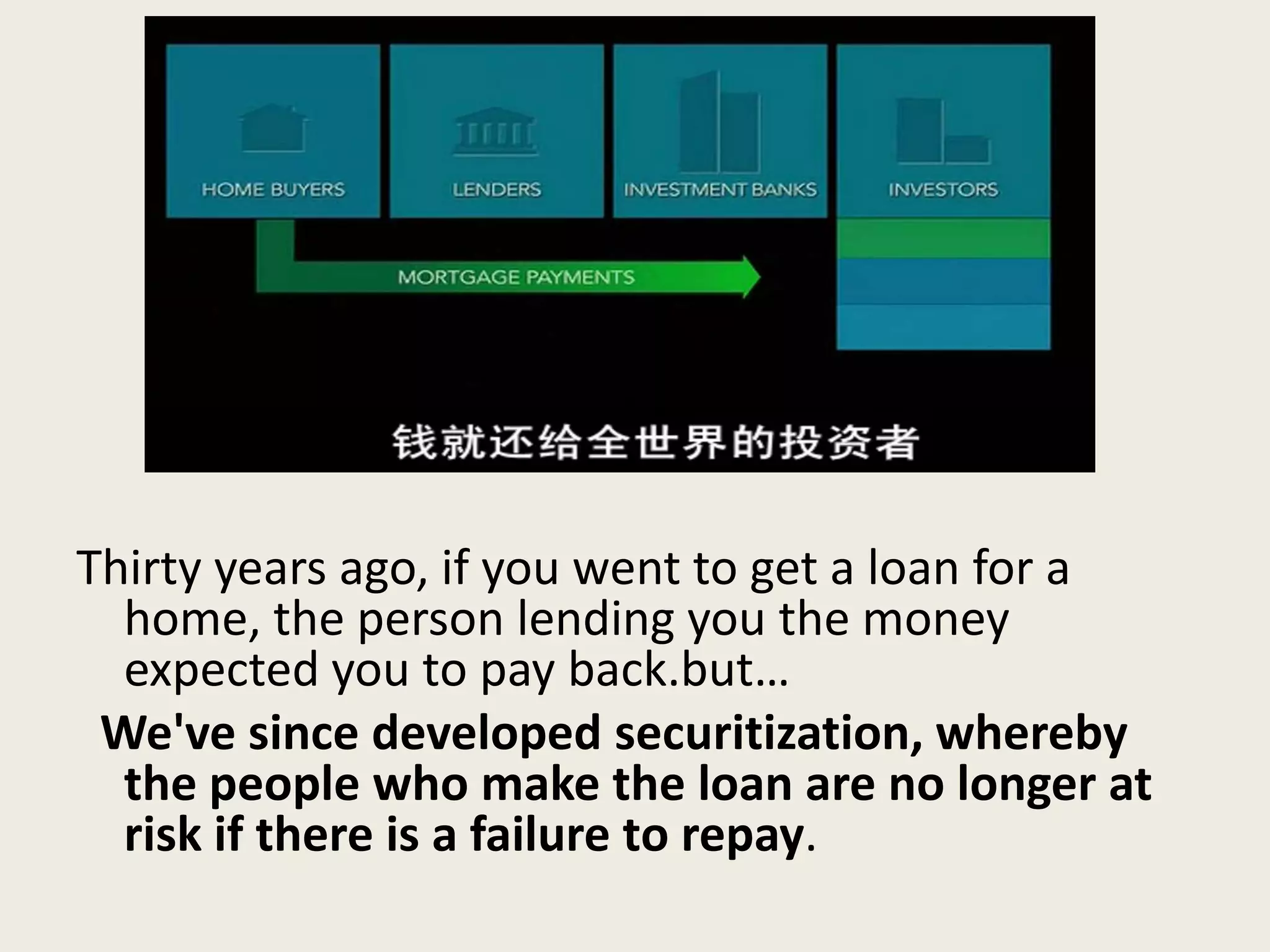

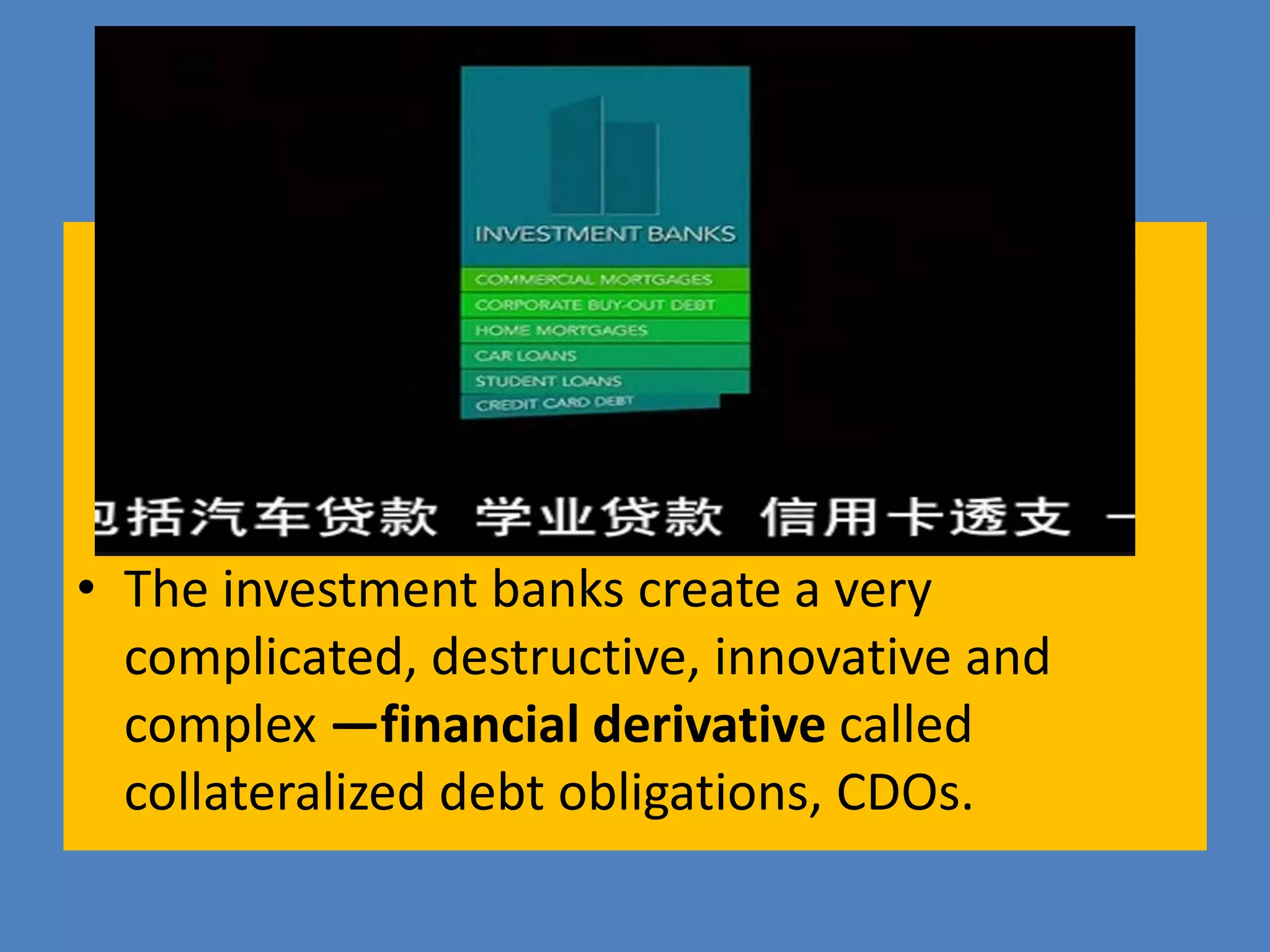

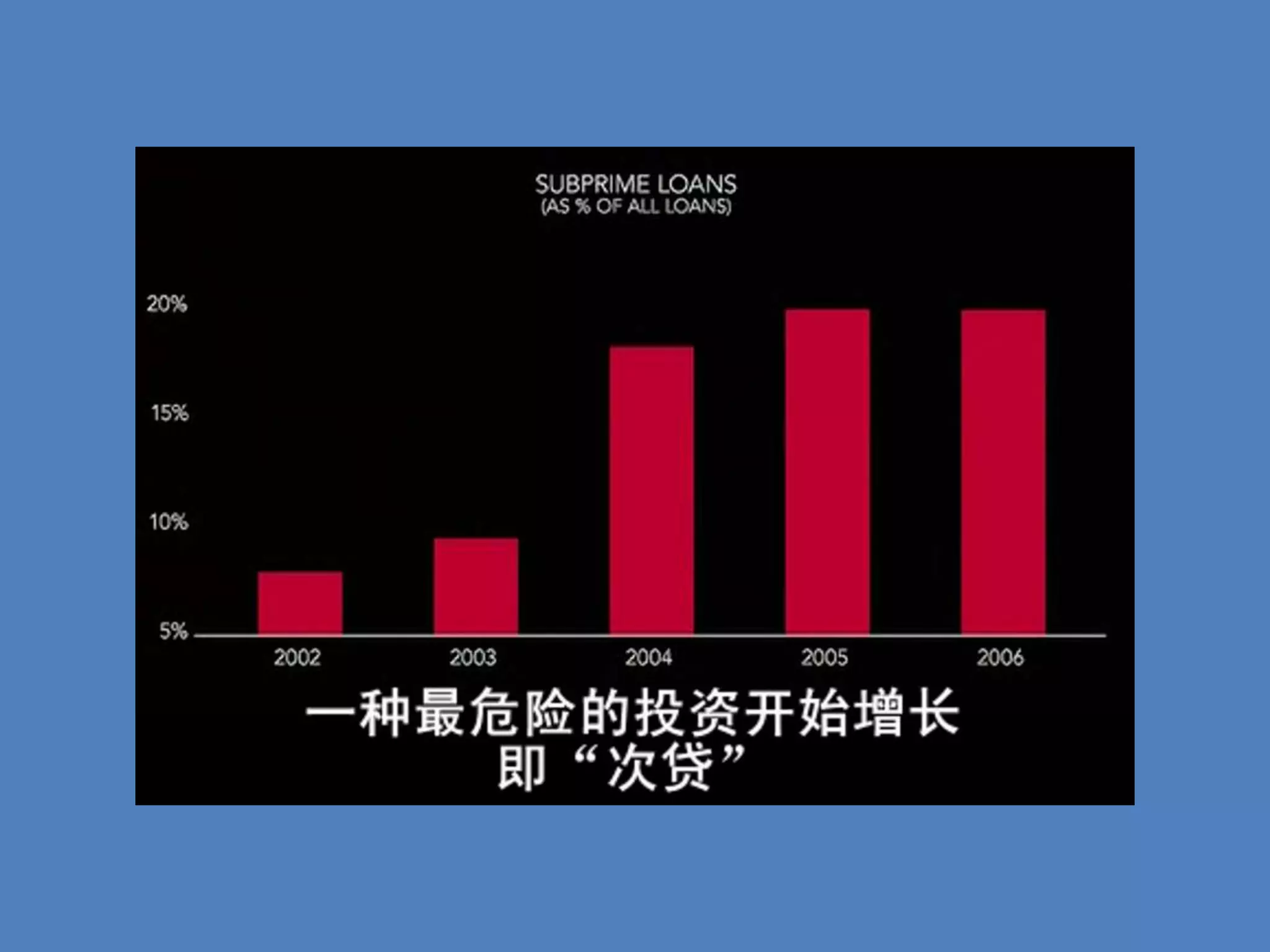

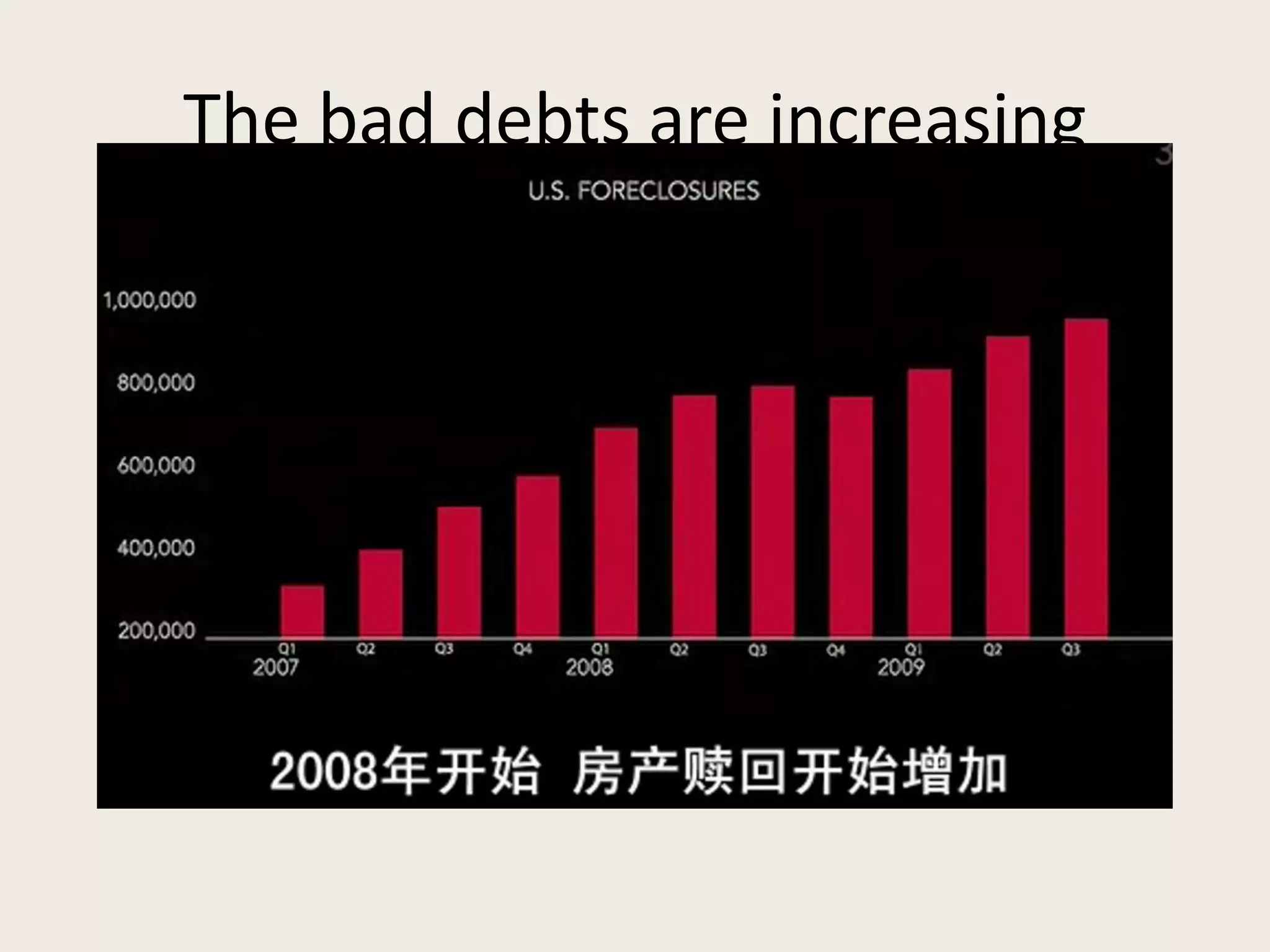

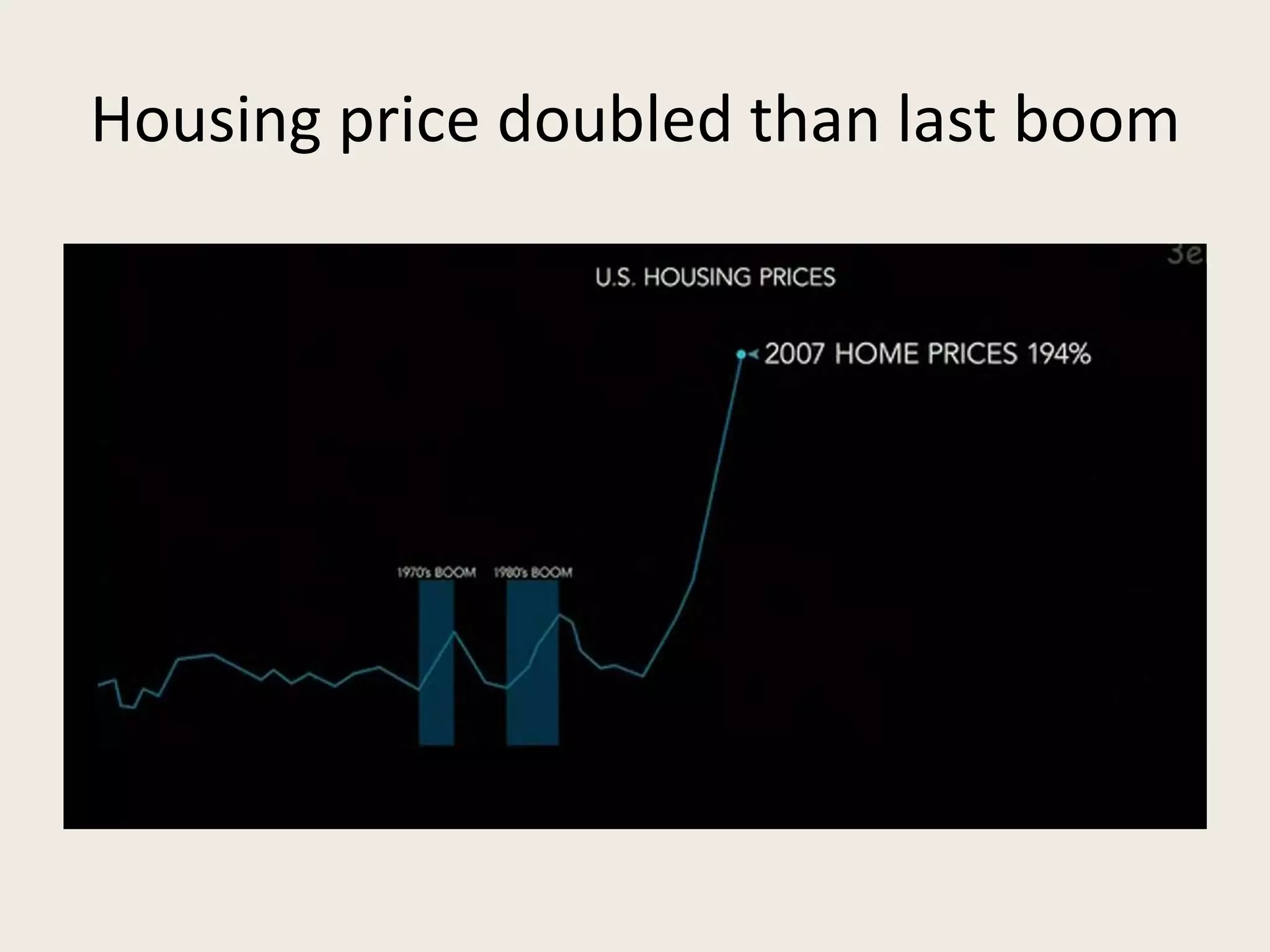

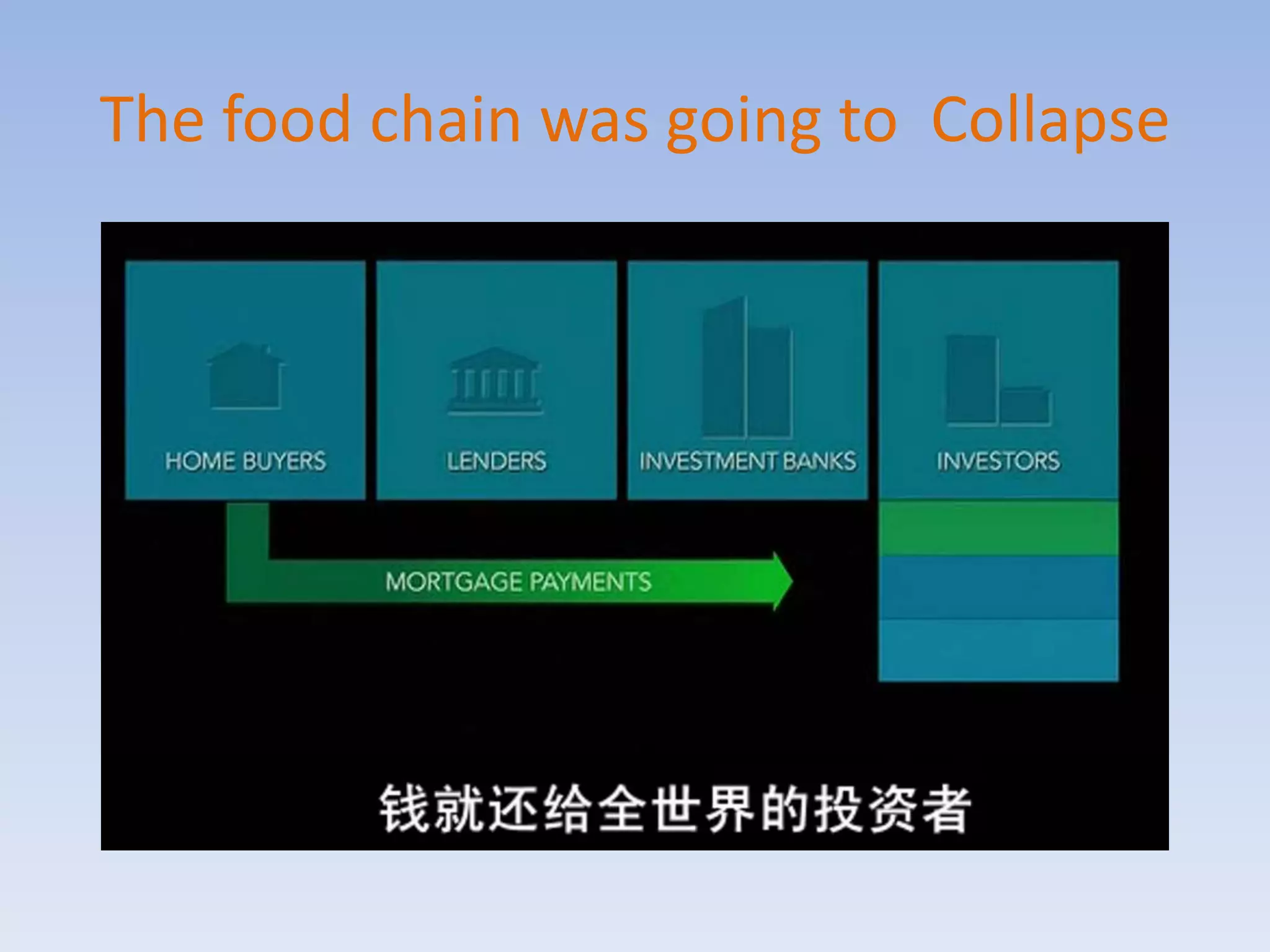

The document summarizes the causes and effects of the 2008 financial crisis. It identifies low interest rates, lack of regulations, risky subprime lending, securitization of mortgages, and conflicts of interest between banks, rating agencies, and borrowers as contributing factors. Major effects included destruction of wealth, rising poverty, job losses, increased food stamp usage, and a domino effect of bank failures exacerbating the crisis. The crisis disproportionately hurt the poor and middle class while concentrating more wealth among the richest 1%.