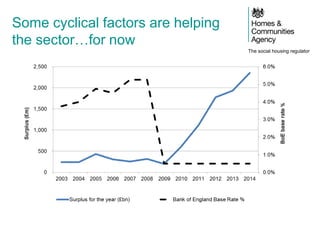

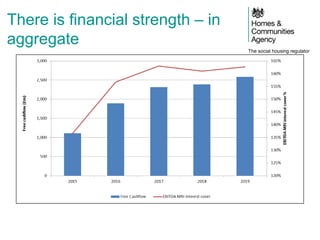

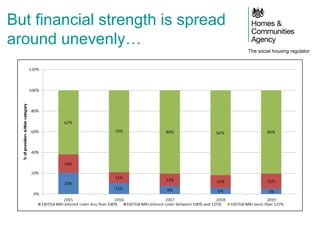

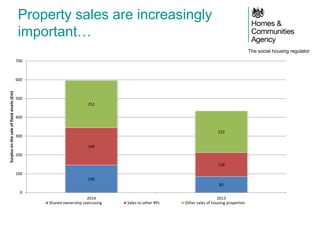

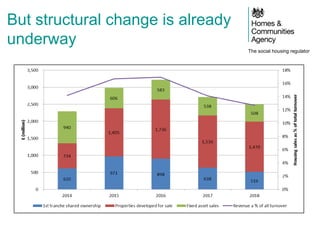

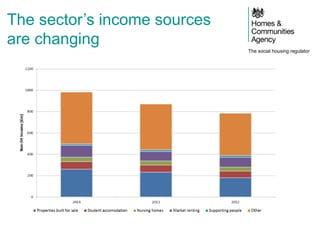

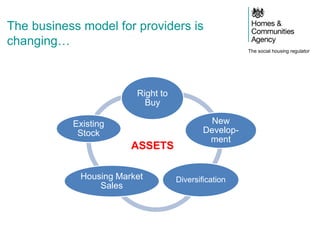

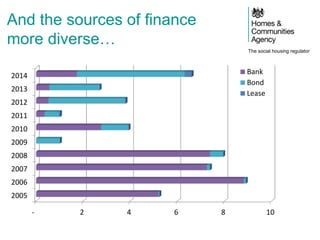

The social housing sector is facing increasing complexity and challenges, with changes in funding models, income sources, and financial management. Providers must adapt their strategies and consider their long-term goals, while the regulator seeks to ensure effective business management and compliance. The future of social housing relies on understanding risks, embracing property sales, and diversifying income streams.