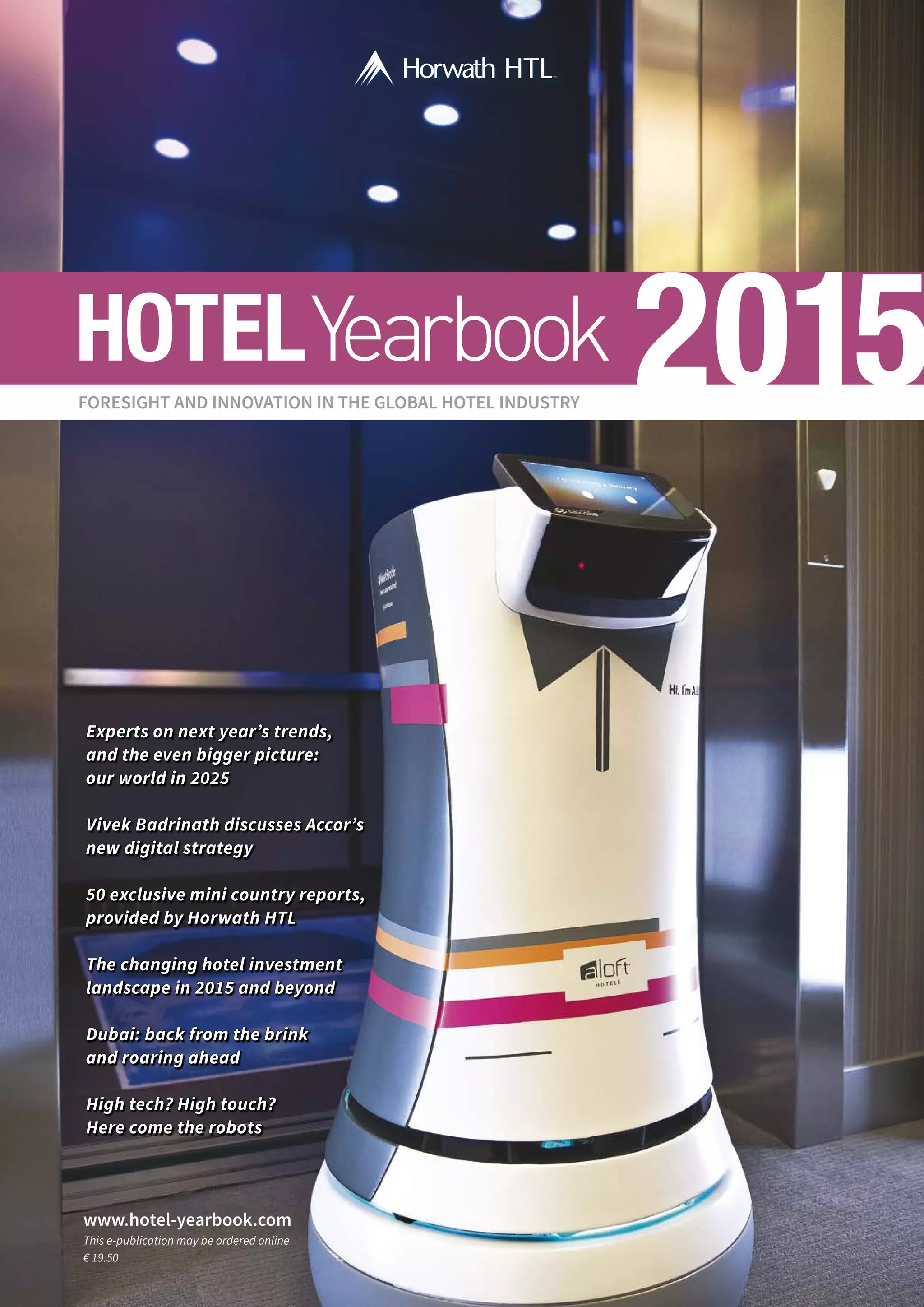

The document is an annual publication called The Hotel Yearbook 2015 that provides insights and forecasts about the hotel industry. It contains articles from over 70 industry experts and executives on trends, the future of customers, long-term forecasts, tourism outlook, interviews with hotel executives, reports on capital flows, markets in various regions, and more. It also includes 50 mini country reports on the hotel industry outlook provided by Horwath HTL, the publication's partner.

![Study

Hospitality Business

Management in

DubaiScholarships available

— Ask us how!

Internationally Accredited and Recognised Programmes:

Earn your degree and start your career

in the world's fastest growing industry!

• Master of Business Administration in

International Hospitality Management [MBA] (1 year)

• Bachelor of Business Administration (Hons.) in

International Hospitality Management [BBA] (3 years)

• Associate of Business Administration in

International Hospitality Management [ABA] (18 months)

• English as a Foreign Language Programme

(Basic/Intermediate)(3monthsperlevel)

• Study Abroad Programme

(3 months + optional internship component)

www.emiratesacademy.edu info@emiratesacademy.edu

The Emirates Academy of Hospitality Management

+971 4 315 5555

@EmiratesAcademy

| Advertisement |](https://image.slidesharecdn.com/152005691-160120172441/85/Hotel-Yearbook-2015-39-320.jpg)