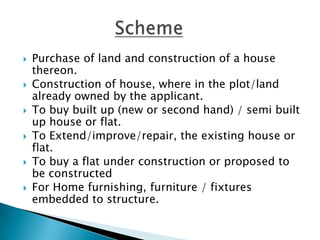

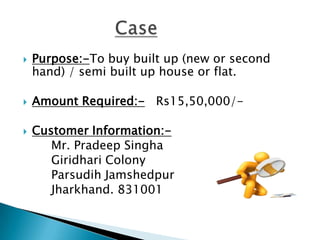

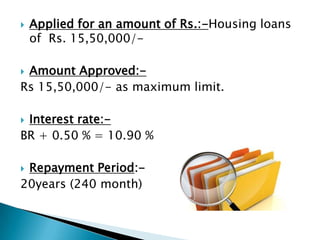

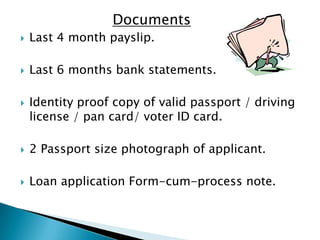

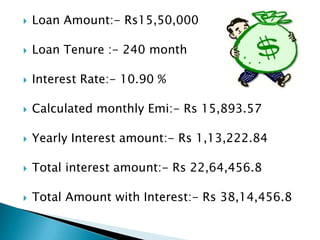

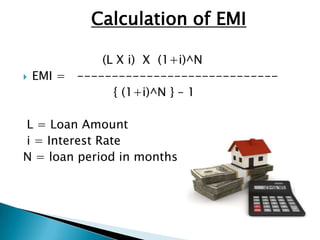

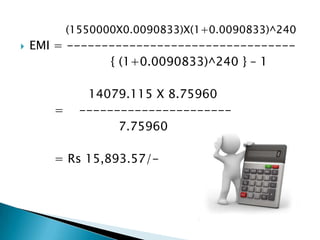

The document discusses a home loan application from Mr. Pradeep Singha for Rs. 15,50,000 to buy a built up house or flat. Key details include an interest rate of 10.90% and repayment period of 20 years. The bank will conduct verification of income, credit check, and property assessment before conditional loan sanction and final disbursement. Required documents include payslips, bank statements, identity proof, and loan application form. The calculated monthly EMI is Rs. 15,893.57 over the loan term.