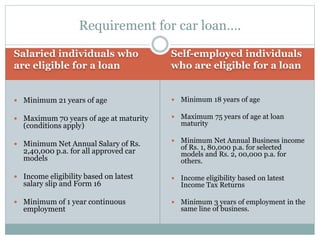

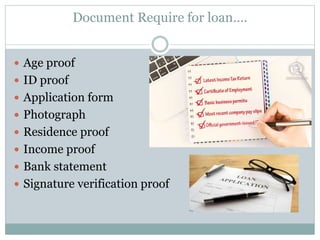

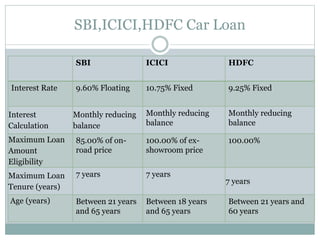

The document discusses car loans, which allow buyers to pay for a vehicle in monthly installments rather than all at once. A car loan is a personal loan where a lender pays for the car up front and the borrower repays the debt plus interest monthly. Most lenders offer secured loans, meaning the lender can repossess the car if payments are missed. Eligibility requirements include minimum income levels, proof of income, and identity documents. Interest rates and terms vary between lenders like SBI, ICICI, and HDFC.