This document provides an overview of the lender's appraisal process for home loans. It discusses the key phases including information acquisition, credit appraisal and sanction, and disbursement. The appraisal process begins with an application form that collects relevant information for deciding loan eligibility. Next is the credit appraisal phase where officers scrutinize information and set loan terms. The final phase is disbursement by cheque or bank transfer. The document also includes a sample application form and discusses the procedures lenders follow internally and principles underlying the process.

![36 RETAIL BANKING

Over the years, announcements have been made in the Union Budgets for tax concessions, waivers, etc. to encourage

housing & housing finance so as to counter the shortage of houses in India. The benefits available & use of the benefits

to reduce one's tax liability are being detailed below.

Tax benefits in respect of Housing Finance

In respect of Loan taken for Purchase/Construction of a Residential Unit, the borrower can avail benefit of payment of

interest as well as repayment of principal.

Interest on housing loan can be claimed as a deduction from income from property, salary, business/ profession, capital

gains, or any other source upto a maximum of Rs. 1,50.000 under section 24(b) of the Income-tax Act, 1961 every year

subject to fulfilment of the following conditions.

(a) Loan has been taken on or after 1st April 1999.

(b) Loan is for purchase or construction of a residential property or as re-finance (takeover) of the principal amount

outstanding under a loan taken earlier for purchase or construction of a residential property. However, in case of

loan for construction, the construction should get completed within 3 Years of raising the Loan. Deduction can be

claimed only from thefinancial year when the purchase/ construction is completed.

(c) The lender issues a certificate at the end of the financial year mentioning therein the interest & principal paid

during the year in respect of that loan.

If any of the first 2 Conditions mentioned above is not satisfied, i.e., loan was taken before 1st April 1999 &/or loan is

for repairs/renovation/reconstruction, deduction of only upto a maximum of Rs. 30,(K)() every year can be claimed.

The third condition mentioned above, however, has to be satisfied.

In case the Loan is for repairs/renovation/reconstruction, deduction on account of interest on that loan can be claimed

only if the property is self-occupied or if the owner is not able to occupy the property only because of his

employment/business/profession at another place, where he/she resides in a building not owned by him/her or his/her

spouse/close blood relatives.

The deductions are permissible only in respect of one property of the borrower, i.e., if he/she has raised loans for

multiple properties, interest can be claimed as a deduction only in respect of one property, depending upon the

borrower's choice.

As regards principal repayment, it can be claimed as a deduction from the gross total Income only by an

Individual/HUF borrower under section 80C of the Income Tax Act, 1961. However, the maximum deduction which

can be availed under Section 80C [deduction in respect of life insurance premium, deferred annuity, contribution to

provident fund, repayment of housing loan, etc.], Section 80CCC [deduction in respect of pension fundi, & Section

80CCD deduction in respect of contribution to pension scheme of Central Government] cannot exceed Rs. 1,00,000.

If the property is rented out, interest paid on Loan can be fully deducted from the Income derived from the property

without thelimit of Rs. 1,50,000 or Rs. 30,000, as the case may be.

Interest on loan taken for commercial property or on loan taken for business/personal needs against the mortgage of

property by an individual/HUF/partnership firm/company/any other person can be fully claimed as deduction from

income from rent/business/profession/other sources, as the case may be. However, the benefit on account of principal

repayment shall not be available in such cases.

Interest on unpaid interest, i.e., penal interest, is not deductible. Use of

Benefits to Reduce Tax Liability

We shall consider the Scenario of a 35-year old man.

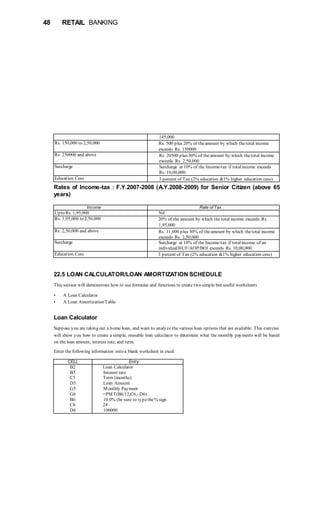

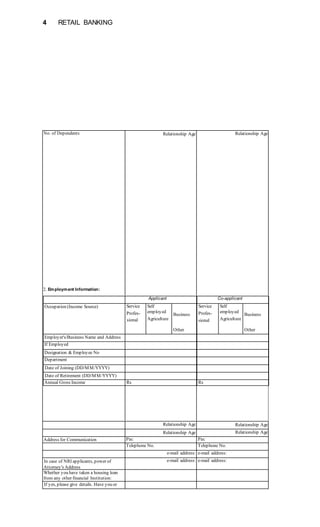

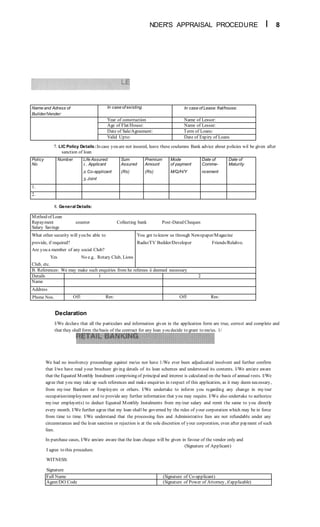

HOUSING FINANCE& TAX PLANNING

No Housing Loan Housing Loan taken for Purchase/

Construction of Residential Unit on or after 1st

April1999 for Self-occupation

Income declared in ITR Rs. 4,50,000 Rs. 4,50,000

Contributions eligible for deduction

under section 80C of the Income

Tax Act, 1961

Rs. 1,00,000 Rs. 1,00,000

Interest paid on Housing Loan

during F.Y. 2006-07

- Rs. 1,68,000

Repayment towards principal

amount of housing loan during F.Y.

Rs. 21,000](https://image.slidesharecdn.com/retail003-150103083402-conversion-gate01/85/Retail003-36-320.jpg)

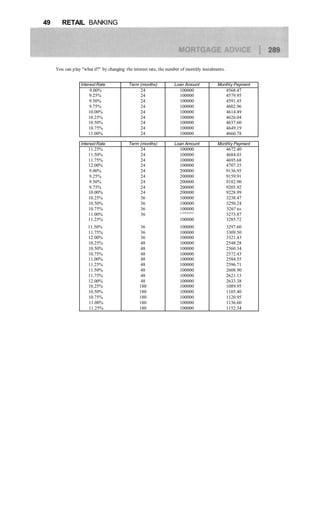

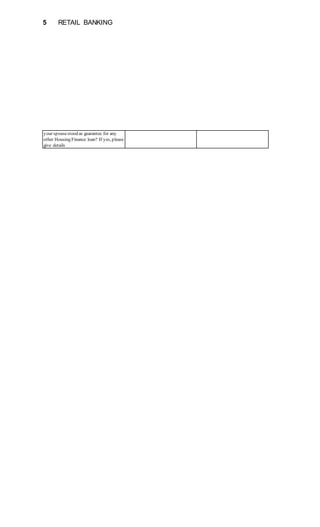

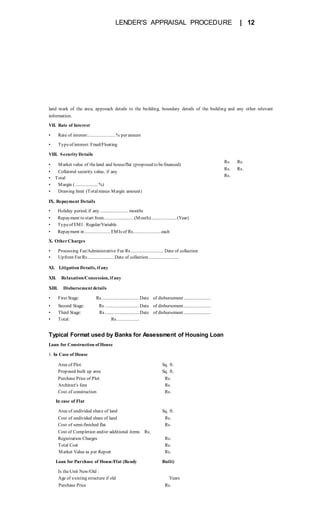

![37 RETAIL BANKING

2006-07

Basic Tax Liability, excluding

surcharge & education cess as per

Income Tax Slabs & Rates

applicable to A.Y. 2007-08

Rs. 54,000 [On Net

Income of Rs. 3,50,000

(i.e., Rs. 4,50,000 -Rs.

1,00,000]

Rs. 14,000 [On

Net Income of Rs. 2,00,000 (i.e., Rs. 4,50,000 -

Rs. 1,50,000 {max. permissible Dedn. towards

Interest} - Rs. 1,00,000 (max. permissible dedn.

under Sec. 80C, 80CCC, & 80CCD}]

Suppose in the above Case, the Income of Rs. 4,50,000 included Rs. 30,000 as rental income from the property

purchased/constructed with the Loan, the basic tax liability could have reduced to Rs. 8,600 [On Net Income of Rs.

1,74,800 (i.e., Rs. 4,50,000 - Rs. 9,000 {Standard Deduction @ 30% of Rs. 30,000 under Section 24 (a) 1 -Rs.

1,68.0(H) {full interest amount as property is rented out) -Rs. 1,00.000].](https://image.slidesharecdn.com/retail003-150103083402-conversion-gate01/85/Retail003-37-320.jpg)

![38 RETAIL BANKING

However, if in para 12.3.1 above, the man had taken the loan before 1st April, 1999 &/or taken the loan for

repairs/renovation/reconstruction, his basic tax liability for A.Y. 2007-08 would have been Rs. 45,000 [On Net Income

of Rs. 2,00,000 (i.e., Rs. 4,50,000 - Rs. 30,000 (Maximum permissible Deduction towards Interest) - Rs. 1,00,(XK)

{Maximum Permissible Deduction under Sections 80C, 80CCC, & 80CCD)].

No Tax Benefit is available in respect of Loan taken for purchase of plot of land. Hence, instead of taking a Loan for

purchase of plot, he/she should take loan for purchase of plot as well as construction of house & complete construction

of a self-sufficient House within 3 Years of raising the Loan.

If Loan is raised jointly by husband & wife or any other combination of persons acceptable to the lender, the interest &

principal can be claimed by the co-borrowers in proportion to the amounts paid by them, subject to the combined

maximum limit of Rs. 1,50,000 (or Rs. 30,000) & Rs. 1.00.000 towards interest & principalrespectively.

If the housing loan is taken before 1st April, 1999, deduction on account of interest shall be limited to Rs. 30,000 every

Year. However, if the loan is taken after 1st April, 1999, deduction of interest upto Rs. 1,50,000 can be claimed every

Year.

Keywords

HUF:Hindu Undivided Family ITR:

Income Tax Return A.Y.: Assessment

Year FY: Financial Year

Let Us Sum Up

Raising a housing loan can not only help in lowering one's tax liability, but can more importantly, allow one to get his/

her home for self-occupation or for supplementing his/her existing Income. However, the benefits have to be used

judiciously.

Check Your Progress

1: Fill in the Blanks by choosing theappropriateWords from the Bracket.

(a) An Individual took a Loan of Rs. 15.00 Lacs for purchasing a flat for self-occupation on 30/03/

1999 & paid Rs. 1,20,000 towards Interest during FY. 2006-07. The maximum amount of

Interest which he can claim as a deduction would be .................................. (Rs. 1,50,000; Rs. 1,20,000;

Rs. 30,000).

(b) Husband & Wife jointly raise a loan in April 2005 for constructing a house for self-occupation.

The construction was completed in July 2006. They have been paying the housing loan

instalments on 50:50 Basis from their respective Incomes. During FY 2006-07, they paid](https://image.slidesharecdn.com/retail003-150103083402-conversion-gate01/85/Retail003-38-320.jpg)

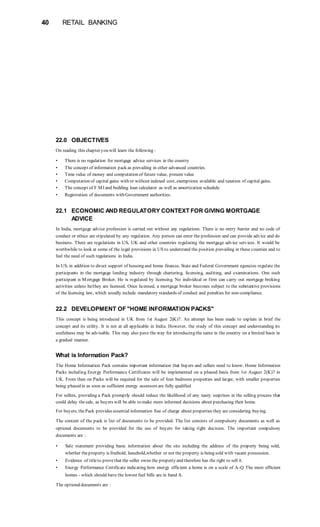

![41 RETAIL BANKING

• Home Condition Report containing information about the physical condition of a property, which sellers, buyers

and lenders will be able to rely on legally as an accurate report.

• Legal summary giving summary of the legal aspects helpful to buyers. However, buyer can take his own legal

advice as well.

• Home use/contents forms providing information on a range of matters relating to the property. These include

information on boundaries, notices, services, sharing with neighbours, and other matters of interest to potential

buyers. It is usual for sellers to declare which fixtures and fittings and other contents of the property are included

in the sale, are excluded from the sale, or are subject to negotiation.

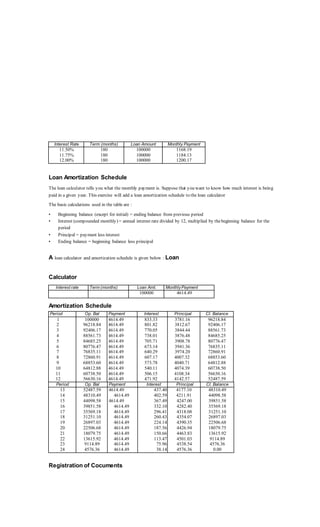

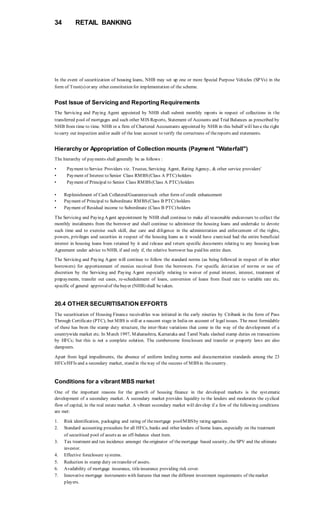

22.3 TIME VALUE OF MONEY-INTEREST AND ANNUITIES

A rupee today is worth more than a rupee tomorrow. To permit realistic appraisal the value of a cash payment or

receipt must be related to the time when the payment takes place. In particular, it must be recognised that Re. 1

received today is worth more than Re. 1 receivable at some future date, because Re. 1 received today could be earning

interest in theintervening period. This is the concept of the time value of money.

To illustrate this if Rs. 100 was invested today at 5% per annum compound interest, it would accumulate to Rs. 105 at

the end of one year (i.e. Rs. 100 x 1.05) to Rs. 110.25 at the end of two years (i.e. Rs. 100 x 1.05 x 1.05 or Rs. 105 x

(1.05)2 and so on. In other words, Rs. 110.25 receivable in two years time is only worth Rs. 1(X) today if 5% per

annum can be earned in the meantime, [i.e. 110.25/( 1.05 x 1.05) = 100].

The process of converting future sums into their present equivalents is known as discounting, which is simply the

opposite of compounding. Compounding is used to determine the future value of present cash flows, whereas

discounting is used to determine the present value of futurecash Hows.

| ------------►----------- ► Compounding --------»--------► j

Present j J Future

| -« -------------■*--------- Discounting ■» -------- « ----- J

Frequently compounding of interest What if interest is paid

more frequently?Annually = P( 1 + r) = Annual

compounding Quarterly = P(l + r/4)4

= Quarterly

compounding

Monthly = P(l+r/l2)12

= montly compounding

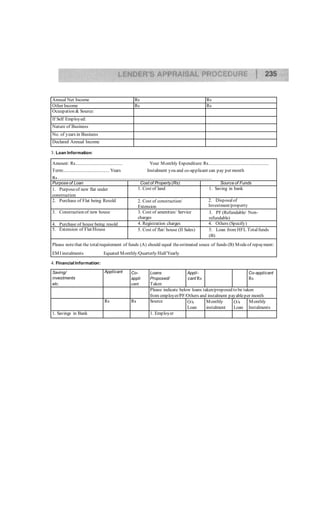

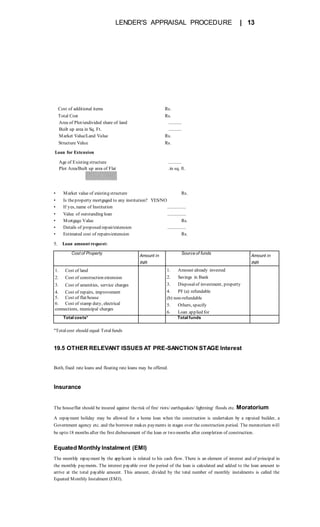

The following table shows the final principal (p) after t = 1 year of an account initially with P= 10000 at 6% interest

rate with given compounding (n)

n P

1 (yearly) 10600

2 (semiannually) 10609

4 (quarterly) 10613

12 (monthly) 10616

52 (weekly) 10618

The Rule of 72

This rule allows you to determine the number of years before your money doubles whether in debt or investment. Here

is how to do it.](https://image.slidesharecdn.com/retail003-150103083402-conversion-gate01/85/Retail003-41-320.jpg)

![Solving problem through MSEXCEL program

The in-built function of FV in excel is----------------

FV (RATE, NPER, PV, TYPE)

FV = Future value, RATE = rate of interest, NPER=Total number of periods, PV = present value. PMT and TYPE are

included to handle annuities (a series of payments equally spaced over a period of time). TYPE is for indicating whether

the cash flow occurs at the beginning (1) or at the end (0) of the period.

In order to do calculation with EXCEL go to Insert, go to function, click financial function.

Exam pl e :

If Rs. 100000 is invested for a period of 6 years at interest at 11% p.a. find the future value at the end of the period.

Enter: FV (0.11,6,0, - 100000, 0) [Please do not forget to put minus sign (-) before PV] The result is Rs. 187041. Future

value of annuities

Annuities are essentially series of fixed payments required from you or paid to you at a specified frequency over the

course of a fixed period of time.

• Ordinary Annuity : Payments are made/received at the end of each period.

• Annuity Due : Payments are made/received at thebeginning of each period.

Calculating the Future Value of an Ordinary Annuity

If you know how much you can invest per period for a certain time period, the future value of an ordinary annuity

formula is useful for finding out how much you would have in the future by investing at your given interest rate. If you

are making payments on a loan, the future value is useful for determining the total cost of the loan. In order to calculate

the futurevalue of the annuity, we have to calculate thefuture value of each cash flow.

i

Where F = future value of an annuity A =

annuity i = interest rate n = term

Calculating the Future Value of an Annuity Due

Since each payment in the series is made one period sooner, we need to discount the formula one period back. A slight

modification to theFV-of-an-ordinary-annuity formula accounts for payments occurring at the beginning of each period.](https://image.slidesharecdn.com/retail003-150103083402-conversion-gate01/85/Retail003-43-320.jpg)

![45 RETAIL BANKING

Present Value

Present value is nothing but the reverse of future value.For finding out present value (PV), we must use discounting

formula which is given below

PV = FV + (1 +r)n

Where PV means present value, I means one rupee, r means rate of interest and n means period or term and FV means

future value

Example:

If Rs. 16KMX) is the maturity value(future value) of investment, invested for a period of 5 years at interest at 10% p.a.

find the amount invested (present value)

Solution:

The formula for finding PV is-------------

PV = FV/( 1 + r)n

= 161000/(1 +0.10)5 =

161000/(1.61) =

161000(1.61) = 100000

So thepresent value will be Rs. 100,000

The same value can be calculated by using present value table.

Present value = FV x Present value factor

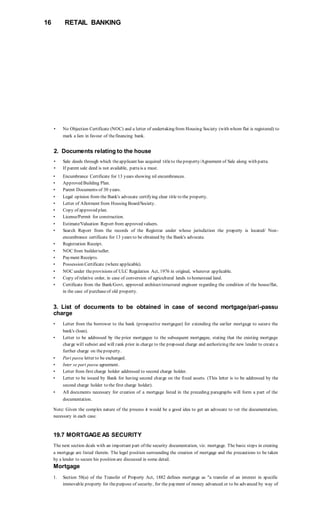

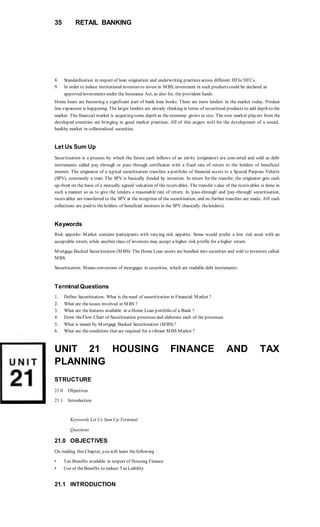

Present value factors(PVF) of Rs. 1 at different rates of interest are given below for information

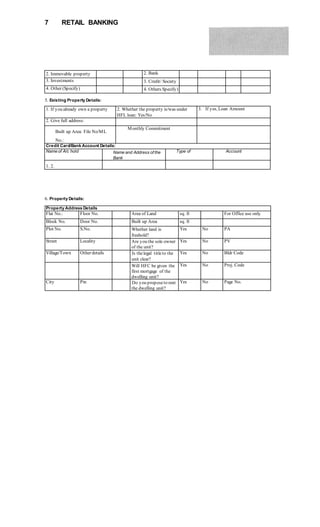

Year 7% 8% 9% 10% 11% 12%

1 0.93 0.93 0.92 0.91 0.90 0.89

2 0.87 0.86 0.84 0.83 0.81 0.80

3 0.81 0.79 0.77 0.75 0.73 0.71

4 0.76 0.74 0.71 0.68 0.66 0.63

5 0.71 0.68 0.65 0.62 0.59 0.57

6 0.66 0.63 0.60 0.56 0.53 0.51

Solving Present Value problems with the use of Excel Program.

The in-built function of PV in excel is---------------

PV (RATE, NPER, FV, TYPE)

PV = Present value. RATE = rate of interest, NPER = Total number of periods FV = Future value. TYPE is for

indicating whether thecash flow occurs at thebeginning (1) or at the end (0) of the period.

In order to do calculation with EXCEL go to Insert, go to function, click financial function. Example :

If the maturity value of an amount invested for a period of 6 years at interest at 11% p.a. is Rs. 187041 find the amount

invested at thebeginning (find present value)

Enter: PV (0.11,6, -187041, 0) [Please do not forget to put minus sign (-) before FV] The result is Rs. 100000.

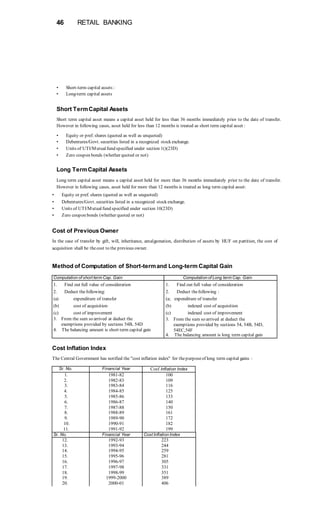

22.4 CAPITAL GAINS

Any profit or gain from sale or transfer of a capital asset is chargeable to tax under the head "capital gains" Capital

asset means any property whether movable or immovable, tangible or intangible. Transfer, in relation to capital asset,

includes sale, exchange of the asset.

The following assets are, however, excluded from the definition of capital assets :

(a) Stock-in-trade, stores, raw material

(b) Personal effects (excluding Jewellery)

(c) Agricultural land outside the limit of municipality or notified area.

The transfer of assets on account gift, will etc. so also distribution of assets by HUF to its members on partition are not

transfer from the point of capital gains chargeability. As such no capital gains arises from such transactions

Types of Capital Assets](https://image.slidesharecdn.com/retail003-150103083402-conversion-gate01/85/Retail003-45-320.jpg)

![47

21. 2001-02 426

22. 2002-03 447

23. 2003-04 463

24. 2004-05 480

25. 2005-06 497

26. 2006-07 519

Capital Gains - When and to What Extent Exempt from Tax

1. Capital gains arising from the sale of residential house property (Section 54) is exempted provided the property is

held for more than 36 months before sate and transferor has purchased another residential house by utilizing the

capital gain amount within one year before sale of old house or within 2 years from the date of sale or construct a

new house within a period of three years from the date of sale. If the amount of capital gain is not fully utilized

for above, then only proportionateamount that is utilized will only be exempt.

2. Capital gains from transfer of land used for agricultural purpose (Section 54 B) is exempt if utilized for purchase

of another land.

3. Capital gains on compulsory acquisitions of land and building of an industrial undertaking - (Section 54 D) is

exempt if utilized for purchaseof another land and building

4. Capital gain is invested in bonds issued by National Highway Authority of India or RECL (Section 54 EC)

5. Capital gains on transfer of long term capital assets other than a house property - (Section 54 F) is exempt

provided the transferor has purchased residential house by utilizing the capital gain amount within one year before

the date of transfer or within 2 years from the date of transfer or construct a new house within a period of three

years from the date of transfer. If the amount of capital gain is not fully utilized for above, then only proportionate

amount that is utilized will only be exempt.

Capital Gain Tax Calculator

• Long term capital gain on transfer of property is taxable at a flat rate of 20% (plus surcharge and education cess). The

surcharge @> 10% is applicable if the total income including capital gains exceeds Rs. 10 lakh. The education

cess @3% of income-tax (2% education cess and 1% Secondary and Higher education cess) is applicable.

• Deductions under sections 80C to 80U are not available in respect of long term capital gains.

• In case of resident individual or Resident HUF, if the taxable income minus long term capital gain is less than the

amount of exemption limit (e.g. Rs. 185000 for senior citizen), the relief in capital gain upto exemption limit is

available, e.g. if Mr. Manohar, a senior citizen, has total income of Rs. 300000 consisting of Rs. 200000 from

capital gain and Rs. 100000 from other sources (interest) relief in capital gain to the extent of Rs. 85000 will be

available to Mr. Manohar. [Rs. 185000 -(300000- 200000) = Rs. 85000]

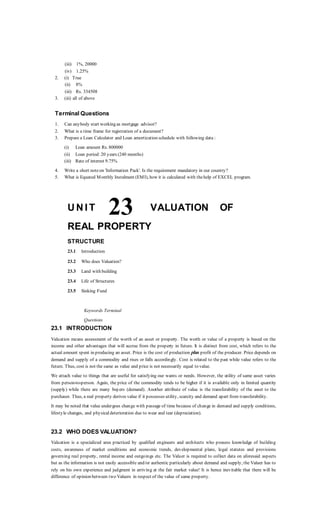

Rates of Income-tax : F.Y. 2007-2008 (A.Y. 2008-2009) for Individual/HUF/AOP/BOl

Income Rate of Tax

Upto Rs. 110,000 Nil

Rs. 110,000 to 1,50,000 10% of the amount by which the totalincome exceeds Rs.

110000

Income Rate of Tax

Rs. 150,000 to 2,50,000 Rs. 4000 plus 20% of theamount by which thetotal income

exceeds Rs. 150000

Rs. 250000 and above Rs. 24000 plus 30% of theamount by which thetotal income

exceeds Rs. 2,50,000

Surcharge Surcharge at 10% of the Income-tax if totalincome of an

individual/HUF/AOP/BOl exceeds Rs. 10,00,000.

Education Cess 3% of Tax (2% education &1% higher education cess)

Rates of Income-tax: F.Y.2007-2008 (A.Y.2008-2009) for resident woman (below 65

years)

Income Rate of Tax

Upto Rs. 1,45,000 Nil

Rs. 145,000 to 1,50,000 10% of the amount by which the totalincome exceeds Rs.](https://image.slidesharecdn.com/retail003-150103083402-conversion-gate01/85/Retail003-47-320.jpg)