The document discusses different types of loans:

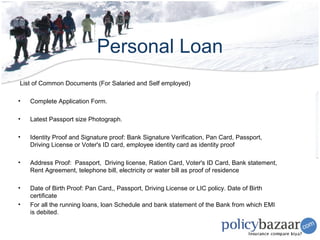

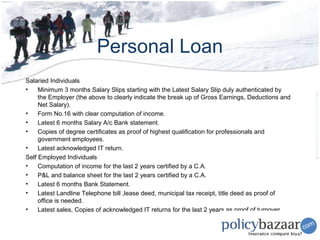

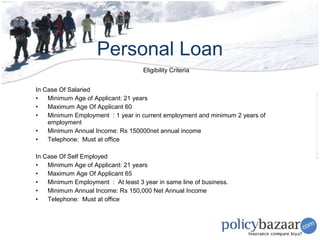

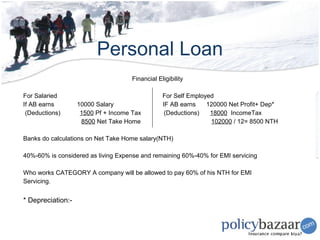

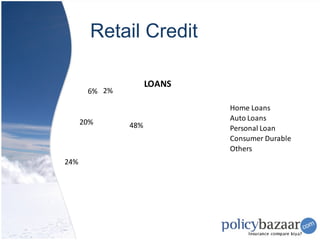

1. Personal loans that do not require collateral and can be used for any purpose.

2. Home loans to purchase, construct, or renovate a home. Banks typically limit loans to 75-85% of the property value.

3. Loans against property that use existing residential or commercial property as collateral. Banks provide 40-70% of the property's market value.

4. Auto loans to purchase new or used vehicles, with monthly payments capped at 50% of income and loans up to 80% of the car's price.