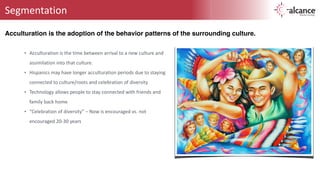

This document discusses US Hispanic trends and behaviors across various topics:

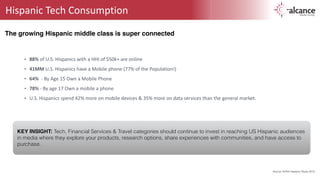

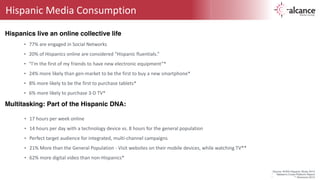

- Hispanic audiences are highly connected digitally, with high rates of internet, mobile, and social media usage. Younger Hispanics in particular are early adopters of new technologies.

- Hispanic shopping behaviors are influenced by their use of digital media - they are more likely to shop online and use mobile devices to find deals. Social media also influences their purchases.

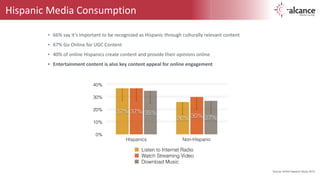

- Hispanic media consumption varies by generation, but overall they spend significant time with various digital and online media platforms and content, especially on mobile devices.