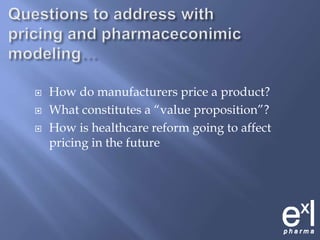

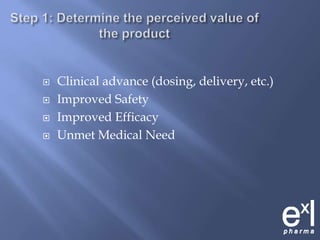

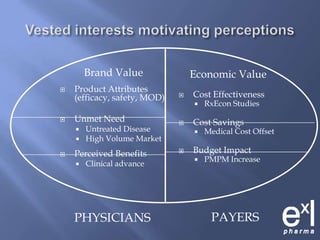

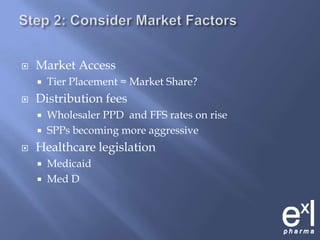

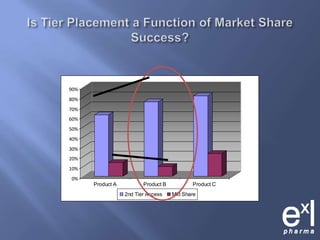

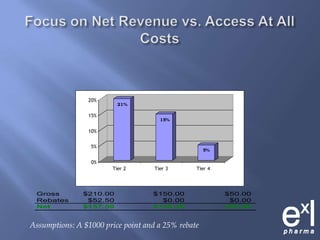

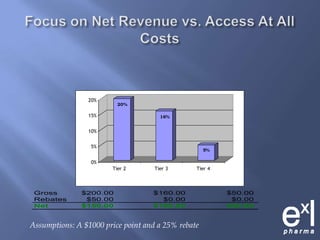

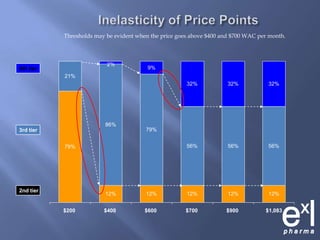

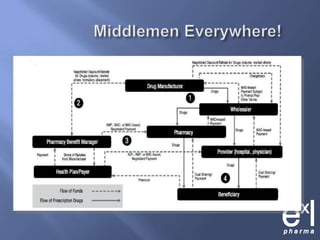

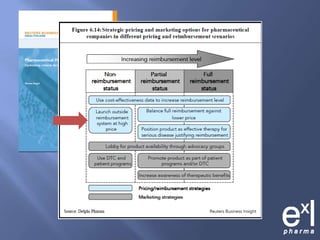

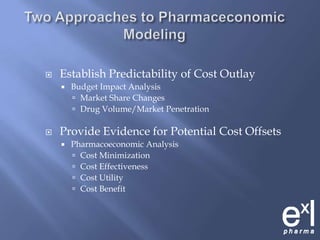

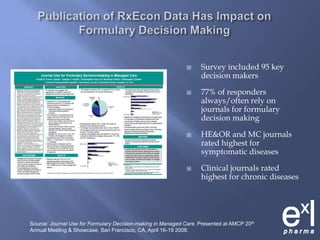

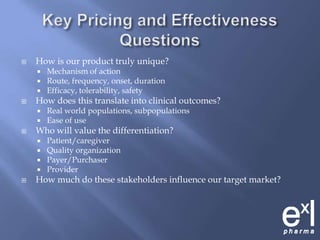

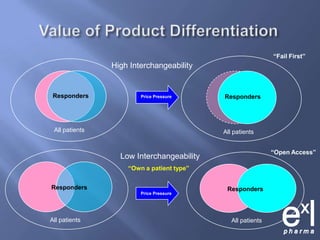

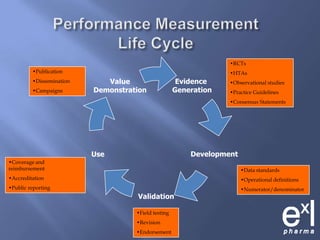

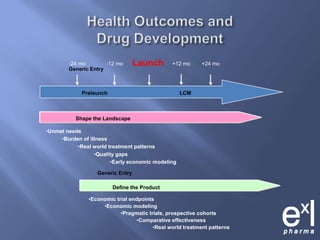

This document summarizes key topics from ExLPharma's 6th Pharmaceutical & Medical Device Pricing & Reimbursement Conference in July 2010. It discusses how manufacturers determine drug prices by establishing perceived value based on clinical benefits and cost-effectiveness studies. Market factors like pricing tiers, healthcare legislation, and distribution fees are also considered. The document outlines approaches to pharmacoeconomic modeling to provide evidence for cost offsets. Finally, it discusses how quality and health outcomes data can support pricing and reimbursement decisions.