Henry okech june 25, 2016 cv

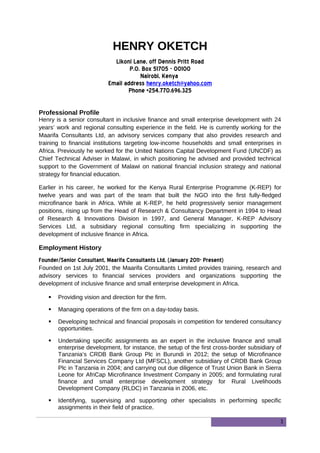

- 1. HENRY OKETCH Likoni Lane, off Dennis Pritt Road P.O. Box 51705 - 00100 Nairobi, Kenya Email address henry.oketch@yahoo.com Phone +254.770.696.325 Professional Profile Henry is a senior consultant in inclusive finance and small enterprise development with 24 years’ work and regional consulting experience in the field. He is currently working for the Maarifa Consultants Ltd, an advisory services company that also provides research and training to financial institutions targeting low-income households and small enterprises in Africa. Previously he worked for the United Nations Capital Development Fund (UNCDF) as Chief Technical Adviser in Malawi, in which positioning he advised and provided technical support to the Government of Malawi on national financial inclusion strategy and national strategy for financial education. Earlier in his career, he worked for the Kenya Rural Enterprise Programme (K-REP) for twelve years and was part of the team that built the NGO into the first fully-fledged microfinance bank in Africa. While at K-REP, he held progressively senior management positions, rising up from the Head of Research & Consultancy Department in 1994 to Head of Research & Innovations Division in 1997, and General Manager, K-REP Advisory Services Ltd, a subsidiary regional consulting firm specializing in supporting the development of inclusive finance in Africa. Employment History Founder/Senior Consultant, Maarifa Consultants Ltd, (January 2011- Present) Founded on 1st July 2001, the Maarifa Consultants Limited provides training, research and advisory services to financial services providers and organizations supporting the development of inclusive finance and small enterprise development in Africa. Providing vision and direction for the firm. Managing operations of the firm on a day-today basis. Developing technical and financial proposals in competition for tendered consultancy opportunities. Undertaking specific assignments as an expert in the inclusive finance and small enterprise development, for instance, the setup of the first cross-border subsidiary of Tanzania’s CRDB Bank Group Plc in Burundi in 2012; the setup of Microfinance Financial Services Company Ltd (MFSCL), another subsidiary of CRDB Bank Group Plc in Tanzania in 2004; and carrying out due diligence of Trust Union Bank in Sierra Leone for AfriCap Microfinance Investment Company in 2005; and formulating rural finance and small enterprise development strategy for Rural Livelihoods Development Company (RLDC) in Tanzania in 2006, etc. Identifying, supervising and supporting other specialists in performing specific assignments in their field of practice. 1

- 2. Forging strategic partnerships with associate consultants and relevant professional networks in the two fields of inclusive finance and small enterprise development Promoting the services and operations of the firm And maintaining excellent relationships with the public and client organizations. Chief Technical Advisor, Inclusive Finance, United Nations Capital Development Fund (UNCDF), (1 December 2008- 31 December 2010) The UNCDF is the United Nations agency with the mandate to create opportunities for poor people and small businesses in 23 of the 48 least developed countries in the world by increasing access to financial services and investment capital. Specific duties included: Providing technical leadership and managing the overall activities of the USD 6.2 million multi-donor funded partnership program on a day-to-day basis. Ensuring that the project produces the results (outputs) specified in the project document and proper use of resources to the required standard of quality and within the specified constraint of time and cost. The primary responsibility for managing resources and first authority for all transactions. Providing programme management for FIMA and supporting the regional UNCDF unit management; Providing policy advice, strategic leadership, and technical support for the effective and innovative strategies for the implementation of the programme, to improve the national strategy and to guide UNDP and UNCDF; Applied business development strategy in developing partnerships with the national counterparts and other development partners including DfID, AfDB, USAID, and the World Bank; Providing support and inputs that contribute to improved portfolio management and planning at national and regional level and contributing to the incorporation of lessons learned from financial inclusion experience in the country; Initiating and supporting discussions with donors at the field level and liaising with the regional office unit based in Johannesburg, South Africa, and HQs in mobilizing additional funding / new partnership development by attracting other donors to join the Investment Committee or to coordinate with the Investment Committee decisions; Providing substantive inputs into Regional Unit Work Plan and UNCDF Business Plan. General Manager, K-Rep Advisory Services Ltd, (1 July 1998 – 30 June 2001) The Kenya Rural Enterprise Program (K-REP) is a leading private small enterprise development company founded by USAID in April 1984. Within a decade of establishment, it had evolved into prominent group of companies, including the first NGO microfinance institution in Africa to transform into a regulated commercial bank specializing in microfinance. Specific responsibilities included: Being member of the group’s Executive Management team and hence contributing to defining the overall strategic direction for the company. 2

- 3. Providing policy advice, strategic leadership, and technical support for the effective and innovative delivery of advisory services, research, and training to client financial institutions targeting the poor and low-income households. Providing overall strategic leadership in the planning, management and implementation of the subsidiary company. Undertaking client assignments in area of specialization, e.g., market research and product development, strategy and business development, developing and delivering training, and conducting due diligence/ appraisal and evaluation of financial institutions or activities targeting the poor and low-income households. Developed bids for international tenders for contracts in microfinance and SME Development in the Africa region. Negotiating, coordinating, and supervising other consultants during the implementation of major contracts. Leading and managing the growth of the division into a reputable and profitable regional advisory services firm with clients throughout the African region, including UNDP, The World Bank, African Development Bank (AfDB), and European Union, etc. Head Of Research & Consultancy Department, K-Rep, (1 July 1994 – 30 June 1998) Prior to transforming into the first fully-fledged microfinance bank in Africa and group of companies in 1997, K-REP had evolved from a local NGO involved in the provision of credit and small enterprise development initially founded by USAID in April 1984. Specific responsibilities included: Providing policy advice, strategic leadership, and technical support for the effective and innovative delivery of advisory services, research, and training to client financial institutions targeting the poor and low-income households. Providing overall strategic leadership in the planning, management and implementation of the subsidiary company. Undertaking client assignments in area of specialization, e.g., market research and product development, strategy and business development, developing and delivering training, and conducting due diligence/ appraisal and evaluation of financial institutions or activities targeting the poor and low-income households. Developed bids for international tenders for contracts in microfinance and SME Development in the Africa region. Negotiated, coordinated, and supervised other consultants during the implementation of major contracts. Headed the growth of the division into a reputable and profitable advisory firm with clients throughout the African region. Was a member of K-REP Holdings’ Executive Management Committee and hence contributed to defining the overall strategic direction for the company. Senior Research & Evaluation Officer, K-Rep, (3 December 1990 – 30 June 1994) The Kenya Rural Enterprise Programme (K-REP) was established in 1984 by USAID as an NGO to promote and support the development of small enterprises in rural and peri-urban areas with the aim of creating jobs and improving incomes. 3

- 4. Specific responsibilities included: Being member consultant and local counterpart to the Kenyan project office of the five-year USAID funded Growth and Equity through Microenterprise Investments and Institutions (GEMINI) research project. The GEMINI project (1989-1995) carried out more than 100 applied research, design, and implementation activities in 60 countries, including 5 long-term projects. Co-designing and supervising three national censuses of micro- and small-scale enterprises in Kenya in 1991, 1993, and 1999. Conducting several studies, including four in-depth micro- and small-scale enterprises sub-sector studies and two bore assessment of the carpentry and shoe- making sub-sectors. Analyzing and publishing the results of studies done under GEMINI and making presentations to the government and other industry stake holders. Organizing regular monthly seminars on access to finance and business development services for the Kenyan micro- and small-scale enterprises sector. Undertaking relevant studies commissioned by third parties, for instance an impact study commissioned by Ernst & Young on the contribution of microfinance to jobs creation, improving incomes, and promoting savings mobilization and thrift among the poor in Kenya in 1991; and another as team member of the first globally coordinated effort to measure the impact of microcredit commissioned by USAID and led by Management Systems International (MSI) in 1998. Education Master of Arts, Economics, University of Nairobi (September 1988 – July 1990) Bachelor of Education, Economics and Business Studies, Kenyatta University (September 1983– July 1986) Additional Skills Twenty three years of consulting experience in inclusive finance and small enterprise development (see Appendix A for details). Specific country experience in three continents: Asia: Bangladesh; Africa: Ethiopia, Ghana, Kenya, Malawi, Italy, Sierra Leone, Tanzania, Uganda, Zimbabwe, South Sudan, Senegal, The Gambia, Nigeria, Swaziland, South Africa, Zambia, Burundi, Rwanda, Mozambique, Benin, and Cote d’Ivoire; and Europe: United Kingdom and Italy. Awarded $120,000 innovation grant by USAID in August 1998 (under the MIP) project to develop relevant delinquency course for microfinance institutions in Kenya, Uganda, and Tanzania. Awarded a certificate in facilitating the development of curriculum and materials for a postgraduate diploma course on microfinance jointly supported by Swisscontact East Africa and Makerere University, Uganda, in 2004 4

- 5. Holds a postgraduate Certificate in Appraisal, Monitoring, and Evaluation of Small- Enterprise Development projects, Durham University Business School, Durham, United Kingdom, 20 February /18 March 1994. Holds a Certificate in Green Performance Agenda for Microfinance Institutions (MFIs) in Eastern and Southern Africa: a Regional Capacity Building Initiative for Consultants and MFIs, Hivos and Enclude, Harare, Zimbabwe, Pat 1 February 2014/August 2014; Part 2 May 4 2015- September 2, 2015. Holds a Certificate of completion, Management Concentration, The Boulder Microfinance Training, Boulder Institute of Microfinance, Turin, Italy, July 17/August 8, 2009. Holds a Certificate of Expert Adjudicator in the Development of Entrepreneurship and Small Business in Kenya at the 2012 Enablis ILO Safaricom Foundation Plan Competition, Nairobi, Kenya, February 2013 Holds a Certificate of Appreciation awarded for having contributed to the conduct of the INAFI Global Conference on Microfinance, Remittances, and Development held at Palais Des Congres, Benin, November 7-9, 2007. Holds a Certificate in Financial Services for the Poor: How Donors Can Make a Difference, CGAP & UNCDF Microfinance Donor Training, November 10-14, 2003. Holds a Certificate in Trainer of Trainers Course in Microfinance, University of Dar es Salaam, Entrepreneurship Center (UDEC), Tanzania Association of Microfinance Institutions (TAMFI), and Swisscontact East Africa, Dar es Salaam, Tanzania, August 22-25, 2005. Holds a Certificate for successfully completing the USAID/REDSO/ESA Workshop on Partnering for Performance Monitoring, January 5-10, 1997. Proficiency in statistical analysis using SPSS and Microsoft Office. Appendix A Selected Consultancy Assignments Client UNIFEM East and Horn of Africa Regional Office Date 12 November 2008/ 17 January 2009 Location Kenya International Consultant: Rapid Assessment of the Women Enterprise and Development Fund, Government of Kenya, Ministry of Gender and Social Development • Identified and assessed the programs’ affiliate partner microfinance intermediaries and framework for disbursement of the Fund. • Reviewed the Fund’s disbursement processes for each of the two components (MFIs and CWEF) • Identify the challenges facing each disbursement mechanism • Assessed the coverage of the MFIs in various parts of the country • Reviewed the minimum conditions for accessing the fund through the Divisional Committees and made appropriate recommendations for enhancing and strengthening the Fund. 5

- 6. • Reviewed the minimum conditions for accessing the Fund through the Microfinance Institutions component and made appropriate recommendations. Client Novib (Oxfam Netherlands) Date 2 February 2004/ 5 March 2004 Location Kenya Lead Consultant, Due diligence: Monitoring of WEDCO Ltd, a MFI based in Kisumu, Western Kenya and being a recipient of a loan of Euro 450,000. • Made an assessment of the loan portfolio quality • Evaluated financial performance in the entire period ending on 31 December 2003 • Evaluated the newly developed MIS to determine if it was working well • Evaluated the organizational and management aspects of the MFI, e.g. quality of management; quality of staff; organizational culture at all levels (Credit officer, Branch Management, head office, and general management) • Head office support to branch management and credit officers • Communication and information flows from management to field staff and vice-versa • Evaluated board functioning, internal audit • Assessed the level of customer satisfaction Client Medical Credit Fund (MCF) Africa Date 23 July 2013/31 August 2013 Location Kenya Consultant: Providing an overview of banking opportunities in designated countries in the African region, starting and for now limited to Tanzania, to establish a potential business case for MCF partner bank(s) Carried out a desk review of the relevant literature, to establish the size of the private healthcare market in Tanzania. Computed the eligible demand for capital by the private healthcare sector, notably for two regions targeted for a pilot initiative. Composed a write-up on the overview of the desk study and presented a report (maximum eight pages) to MCF, which it shared with the National Microfinance Bank (NMB), this being the first identified partner bank. Client Stichting INAFI International (INAFI International Foundation) Date 1 September 2008/ 20 September 2008 Location Senegal Consultant: Prepare a report on Remittances and Microfinance based on regional mappings in Africa, Asia, and Latin America (maximum of 20 pages) with information and analysis on the following topics: history of INAFI; past activities on remittances, 6

- 7. strategy of INAFI to harness the development potential of migrants’ remittances for development, and possible activities in the future. Conducted a desk review of the various existing materials on microfinance and remittances in the three regions, e.g., the regional mapping presented at the Ougadougou Expert Group meeting, Manuel Orozco’s mapping in the three regions, and all relevant documents on the subject on the three regions, and the INAFI project document on Remittances and Microfinance. Reviewed and analyzed primary data collected on the subject by Orozco in an earier mapping of the regions Designed and conducted an online interview with member organizations that were already involved in remittances or were in the process of entering into remittances business by end of 2007 to update progress. Writing the draft and incorporating member organizations’ comments on the draft report on Remittances and Microfinance in Africa, Asia, and Latin America Client Rural Livelihood Development Company (RLDC) Date 10 July 2006/ 22 September 2006 Location Tanzania Team Leader and Rural Finance Specialist: Combined Baseline Survey for the Formulation of Strategies for the Promotion of Financial Services, Micro- and Small- Scale Enterprise, and Media. Identified and analyzed the needs and demands for financial services among the rural poor households in the four regions of Morogoro, Dodoma, Singida, and Sinyanga, also known in Tanzania as the Central Corridor. Investigated and analyzed the current provision of financial services in the Central Corridor in qualitative and quantitative terms, besides indicating also the existing and planned initiatives of Government or donors. Identified qualitative and quantitative supply gaps by relating the established needs and demands with existing provision of financial services. From both the perspective of financial services providers and customers/potential customers, identified constraints and opportunities in the provision of financial services in the Central Corridor, particularly from the situations’ influence on livelihoods development. Assessed potential of linkages between financial member organizations and formal financial sector. Based on all insights from the above five tasks, proposed detailed strategies for the promotion of financial services by RLDC. Client African Union commission (AUC) Date 9 April 2007/ 5 August 2008 Location Ethiopia, Tanzania, Africa International Consultant: Elaborated the first-ever Road Map for the Development of Microfinance in Africa. The primary objective of the exercise was to propose a minimum set of policies and strategies, including the legal, regulatory, and operationa framework for the development of microfinance infrsutcture and services in Africa. The work recognized the critical role that microfiannce plays in engaging the poor in productive income-generating and sustainable ventures that contribute to economic growth in the region. Carried out a situation analysis of microfinance policies, strategies, and the legal, regulatory and supervisory frameworks in each member state and at the level of regional economic communities; Reviewed the policies and strategies and the legal framework with a view to harmonize them 7

- 8. across the continent; Assessed the role played by local authorities in facilitating the operations of microfinance service providers and the clients’ needs of other resources other than finance; Assessed member states capacity to adhere to best practices in microfinance service provision, facilitation, and promotion benchmarked against high performing regions or countries in Africa and elsewhere; Elaborated the minimum policies and strategies as well as the legal framework that member states, individually and collectively, would need to adopt to make microfinance a valuable and credible contributor to poverty reduction in Africa; Elaborated best practices to be adhered to and what benchmarks could be applied to assess progress in building the right environment for the development of microfinance in Africa; and, presented the draft final report to a workshop of member states for validation. Client African Rural and Agricultural Credit Association (AFRACA) for the Rural Finance Knowledge Management Partnership (KMP) Date 22 October 2015/ 15 December 2015 Location Kenya (Nairobi) Position held: Consultant to Develop Business case for the incorporation of the Knowledge Management Partnership (KMP) into the Institute of Rural Finance in Africa ( IRFA). Specific tasks: Review the conference proceedings report and individual presentations made at the June 2015 conference and distill new major strategic objectives and strategies for the partnership. Establish whether some of the development partners would be interested in becoming part of the partnership and, if so, to assess their motivation, vision, and current agenda for the sector. Ddevelop a business case for the KMP next round of activities and operations covering a new three-year period of 2016-2019, with clear direction on: ownership/vision; new partnerships; and institutional and operational design.. Organize a stakeholder’s workshop and present the draft business case for validation. Client Bank of Tanzania (BoT) (with The World Bank funding) Date 8 April 1997/ 30 September 1997 Location Tanzania Team Leader, Institutional and Policy Assessments: Conduct a national survey of institutions and projects involved in the supply of rural finance/microfinance, e.g., commercial banks, savings groups, cooperative banks, community banks, NGOs, financial cooperatives, etc. Design and carry out a statistically representative national survey of institutions and projects involved in the provision of rural /micro finance throughout Tanzania Analyse the financial intermediation capacity and financial performance of 14 branches of the [then] two leading commercial banks in Tanzania (National Bank of Commerce and CRDB Bank Ltd.), 10 rural and urban SACCOs, the Kilimanjaro Co-operative Bank, and five financial NGOs. Based on the results, develop five model cases of best practice for the different institutions and projects involved in rural/micro finance Propose a national strategy and regulatory, supervisory, and legal framework for developing capacity for financial institutions in Tanzania. Present the findings and proposals at a national forum for investors and policy makers and participate in the policy dialogue. 8

- 9. Client INAFI Africa Trust Limited Date 1 December 2007/ 31March 2008 Location Kenya Consultant: Assessment of Member Organizations’ capacity building needs and development of a funding proposal to Oxfam-Novib A survey of members’ capacity building needs and industry challenges Strategy formulation and development for a 3-year capacity building plan of action And developing a € 500,000 funding proposal for the 54-member INAFI Africa network. Client Swedish Cooperative Centre Date 8 July 2003 / 29 August 2003 Location Kenya Lead Consultant: Community Finance and Empowerment (COFEP) Project COFEP (Community Finance and Empowerment) was a five-year project implemented by the Cooperative Bank of Kenya and designed to support community-based financial intermediaries in expanding and deepening outreach through market research, product development, and broad based improvements to their management systems and service delivery methodologies. Conduct Baseline Surveys and Socio-economic Studies of Community-Based Financial Intermediaries in Kenya Assist in preparing an Initiation report to set visions regarding the modernization and development of model operating system for community-based financial cooperatives and institutions in Kenya Develop terms of references and review the quality of manuals developed by subject specialist consultants; and, Design and facilitate two workshops (a) to present the results of the baseline surveys, formulate visions for modernized operating systems for community-based financial intermediaries, and (b) present draft operating systems. Identified and assessed the programs’ affiliate partner microfinance intermediaries and framework for disbursement of the Fund. Client Government of Kenya, British ODA (DfID) Date 1 March 1994/30 June 1994 Location Kenya Team Leader/Researcher in the design and conduct of a national survey/inventory of the literature, projects and institutions involved in micro, small and medium size enterprise in Kenya Developed the project concept note and funding proposal in response to request for proposal from the ODA (now DfID) Developed the survey methodology, implementation plan, and budget Coordinated and supervised the hiring of project personnel Supported the Deputy Director responsible for the Research and Consultancy Department in Communicating with major stakeholders about the project and implementation plan to receive their feedback and support Trained librarians, enumerators, and other staff involved in identifying and collection of relevant information for the exercising Conceptualized and designed three different databases for the project Coordinated the recruitment and engaged of the systems designed and developed Coordinated and supervised the review of materials and documentation 9

- 10. Monitored and supervised project implementation Supervised the overall project implementation and delivery Based on the results of the survey, developed a database and an annotated bibliography (published) of such institutions and projects. One of the recommendations, which was later funded by the ODA and institutionalized into a dedicated resource center for microfinance and small-enterprise development, was the setup of the Arifu Resource Center (hosted at the K-Rep Bank head office). 10