VRL Logistics IPO: An attractive investment opportunity

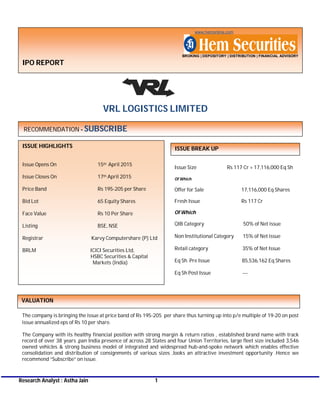

- 1. Research Analyst : Astha Jain 1 www.hemonline.com BROKING | DEPOSITORY | DISTRIBUTION | FINANCIAL ADVISORY IPO REPORT VRL LOGISTICS LIMITED The company is bringing the issue at price band of Rs 195-205 per share thus turning up into p/e multiple of 19-20 on post issue annualized eps of Rs 10 per share. The Company with its healthy financial position with strong margin & return ratios , established brand name with track record of over 38 years ,pan India presence of across 28 States and four Union Territories, large fleet size included 3,546 owned vehicles & strong business model of integrated and widespread hub-and-spoke network which enables effective consolidation and distribution of consignments of various sizes ,looks an attractive investment opportunity .Hence we recommend “Subscribe” on issue. Issue Size Rs 117 Cr + 17,116,000 Eq Sh Of Which Offer for Sale 17,116,000 Eq Shares Fresh Issue Rs 117 Cr Of Which QIB Category 50% of Net issue Non Institutional Category 15% of Net issue Retail category 35% of Net Issue Eq Sh Pre Issue 85,536,162 Eq Shares Eq Sh Post Issue --- ISSUE HIGHLIGHTS Issue Opens On 15th April 2015 Issue Closes On 17th April 2015 Price Band Rs 195-205 per Share Bid Lot 65 Equity Shares Face Value Rs 10 Per Share Listing BSE, NSE Registrar Karvy Computershare (P) Ltd BRLM ICICI Securities Ltd, HSBC Securities & Capital Markets (India) RECOMMENDATION - SUBSCRIBE ISSUE BREAK UP VALUATION

- 2. www.hemonline.com Hem Research Company is one of the leading pan-India surface logistics and parcel delivery service providers. Company provide general parcel and priority parcel delivery (less than truckload services, (“LTL”), courier and full-truckload (“FTL”) services through its widespread transportation network in 28 States and four Union Territories across India. Co’s operational infrastructure for the goods transportation business as of December 31, 2014 comprised 624 branches (comprising 604 leased branches and 20 owned branches) and 346 agencies across India, and of such 624 branches, 48 (41 leased branches and seven owned branches) served as strategic transshipment hubs for its operations. Co’s differentiated service offerings, large integrated hub-and-spoke transportation network, extensive operational and maintenance infrastructure and in-house technology systems have enabled company to develop its brand across India. Co’s goods transportation service business serves a broad range of industries, including the fast moving consumer goods (FMCG) sector as well as other industries including food, textiles, apparel, furniture, appliances, pharmaceutical products, rubber, plastics, metal and metal products, wood, glass, automotive parts and machinery. Company also provide luxury bus services across the States of Karnataka, Maharashtra, Goa, Andhra Pradesh, Telengana, Tamil Nadu, Gujarat and Rajasthan. Co’s longest route of operation in India stretches from Bengaluru to Jodhpur. As of December 31, 2014, company owned and operated 455 buses (including 53 staff buses). As of December 31, 2014, company had 81 branch offices (of which 74 were leased offices and seven were owned offices), 739 agencies and 416 prepaid agencies for its bus operations business. Company also provide ticketing facilities through its website www.vrlbus.in, as well as through its network of commission agents and online travel agents such as www.redbus.in, www.mybustickets.in, www.makemytrip.com, and www.abhibus.com. Company also operate car carrier vehicles for transportation of cars, vehicles for liquid transportation, as well as a courier service business across the State of Karnataka. Company also have minor business interests in wind power, air charter services and hospitality. Co’s fleet size for goods and passenger transport business grew from 2,730 as of March 31, 2010 to 3,874 as of March 31, 2014: As of March 31, Number of Vehicles Total Revenue ( Rs Million) 2010 2,730 7,146.13 2011 2,978 8,929.15 2012 3,528 11,352.78 2013 3,590 13,353.24 2014 3,874 15,037.77 Proceeds of the Offer for Sale Company will not receive any proceeds from the Offer for Sale and the proceeds received from the Offer for Sale will not form part of the Net Proceeds. Fresh Issue Objects of raising funds are : Purchase of goods transportation vehicles worth of Rs 67.415 Crores. Repayment/pre-payment , in full or part, of certain borrowings availed by Company worth of Rs 28.00 Crores General Corporate Purpose. BUSINESS OVERVIEW OBJECTS OF ISSUE

- 3. www.hemonline.com Hem Research 0 COMPANY’S STRENGTHS Pan-India surface logistics services provider with an established brand and one of the largest distribution networks in India : Company is a pan-India surface logistics services provider and company is one of the leaders in parcel delivery services across India. Co is an established brand name in the transportation industry in India with over 38 years of operations. It have received various industry awards and recognition over the years, including: the India Logistics Voice of Customer Award by Frost and Sullivan in 2014 for achieving excellence in logistics and Service Provider of the Year (luxury coaches) in 2013 from World Travel Brands to Vijayanand Travels for co’s bus operations. BOOK R VBVBVBNXNVBXBVB Integrated hub-and-spoke operating model ensuring efficient consignment distribution: Co’s differentiated service offerings, large integrated hub-and-spoke transportation network and extensive operational infrastructure, including advanced technology systems, have enabled company to establish a leadership position in the surface logistics industry with a strong brand across India. Co’s hub-and-spoke operating model enables it to transport various parcel sizes and provide its customers with access to multiple destinations for booking and delivery of goods, and provide “last mile” connectivity to even remote locations in India. This involves effective consolidation of goods from multiple locations at its transshipment hubs, which are continuously operated on a 24X7 basis throughout the year, and re- distribution thereof to their respective destinations, resulting in operating and cost efficiencies, optimal capacity utilization of co’s transportation vehicles, rationalization of routes, as well as flexibility in operation, allocation and optimal utilization of resources including manpower. In addition, co’s “paid” and “to pay” customers, primarily small and medium enterprises, distributors and traders, represent a significant majority of its goods transportation revenues. Revenues from co’s “paid” and “to pay” customers (excluding FTL customers) represented 10.84% and 59.20%, respectively, of co’s revenues from goods transportation in fiscal 2014 while they represented 10.97% and 59.16%, respectively, of co’s revenues from goods transportation in the nine months ended December 31, 2014. Large fleet of owned vehicles ensuring reliable, quality services: As of December 31, 2014, co’s goods transportation fleet included 3,546 owned vehicles, of which 1,166 vehicles were less than five years, 2,375 were debt free and 1,235 were fully depreciated. As of December 31, 2014, company owned and operated 455 buses (including 53 staff buses), of which 399 were less than five years, 87 were debt free and six were fully depreciated. RISK FACTORS Fluctuation in fuel prices may affect business: Fuel costs, toll charges and rent represent most significant operating costs as in fiscal 2012, 2013, 2014 and in the nine months ended December 31, 2014, fuel costs represented 24.94%, 26.96%, 28.36% and 29.62%, respectively, of co’s total expenditure and an increase in such costs or inability to pass on such increases to co’s customers will adversely affect co’s business. High Debt: Company has incurred heavy debt as co’s debt(short & long term borrowings) during FY12,FY13, FY14 & 9 Months ended FY15 were Rs 476.41 Cr, Rs 379.01 Cr, Rs 362.30 Cr & Rs 317.61 Cr respectively . Due to this co’s interest cost increases & thus turning up in lower interest coverage ratio.

- 4. www.hemonline.com Hem Research FINANCIAL STATEMENTS Consolidated Financial Statement Rs Crore Particulars FY’11 FY’12 FY’13 FY’14 9MFY15 Total Revenue 888.80 1130.38 1325.50 1493.78 1273.81 Total Expenses 722.93 938.47 1130.28 1287.21 1059.89 EBIDTA 165.87 191.91 195.22 206.58 213.92 EBIDTA Margin 18.66 16.98 14.73 13.83 16.79 Other Income 4.11 4.90 9.83 9.99 5.57 Depreciation 50.93 69.60 82.34 86.62 69.18 EBIT 119.05 127.21 122.71 129.95 150.32 Interest 47.91 65.14 59.12 59.91 44.99 PBT 71.14 62.06 63.59 70.04 105.33 Tax 19.47 -14.66 17.89 19.50 33.64 PAT 51.66 76.72 45.70 50.54 71.69 Excep & Extraord Items 0.00 0.00 0.00 6.64 0.00 Adjusted PAT 51.66 76.72 45.70 57.18 71.69 NPM 5.81 6.79 3.45 3.83 5.63 Eq Capital 70.70 70.70 70.70 85.54 85.54 Pref Capital 0.00 0.00 110.47 0.00 0.00 Reserves 62.85 116.62 108.23 221.01 251.28 Net Worth 133.55 187.32 289.40 306.55 336.81 EPS 7.31 10.85 6.46 6.68 8.38 Book Value 18.89 26.49 40.93 35.84 39.38 ROE % 38.69 40.96 15.79 18.65 21.28 ROCE % 25.10 19.20 18.40 19.40 23.00 Debt To Eq ratio 2.56 2.54 1.31 1.18 0.94 Companies# EPS PE Ratio RONW % NAV /Share Face Value Total Income ( in Cr) VRL Logistics Ltd (FY’14) 6.68 --- 18.65 35.84 10 1503.77 Gati Ltd** 2.70 84.30 3.05 87.88 2 1127.18 Transport Corp Of India ** 9.82 25.84 14.58 67.33 2 2235.67 ** Source : Prospectus #: For the year ended on March 31,2014 COMPARISON WITH OTHER LISTED PLAYERS

- 5. www.hemonline.com Hem Research www.hemonline.com research@hemonline.com HEM SECURITIES LIMITED MEMBER-BSE,CDSL,SEBI REGISTERED CATEGORY I MERCHANT BANKER MUMBAI OFFICE: 14/15, KHATAU BLDG., IST FLOOR, 40, BANK STREET, FORT, MUMBAI-400001 PHONE- 0091 22 2267 1000 FAX- 0091 22 2262 5991 JAIPUR OFFICE: 203-204, JAIPUR TOWERS, M I ROAD, JAIPUR-302001 PHONE- 0091 141 405 1000 FAX- 0091 141 510 1757 GROUP COMPANIES HEM FINLEASE PRIVATE LIMITED MEMBER-NSE HEM MULTI COMMODITIES PRIVATE LIMITED MEMBER-NCDEX, MCX HEM FINANCIAL SERVICES LIMITED NBFC REGISTERED WITH RBI

- 6. www.hemonline.com Hem Research Disclaimer & Disclosure: This document is prepared for our clients only, on the basis of publicly available information and other sources believed to be reliable. Whilst we are not soliciting any action based on this information, all care has been taken to ensure that the facts are accurate, fair and reasonable. This information is not intended as an offer or solicitation for the purchase or sell of any financial instrument and at any point should not be considered as an investment advice. Reader is requested to rely on his own decision and may take independent professional advice before investing. Hem Securities Limited, Hem Finlease Private Limited, Hem Multi Commodities Pvt. Limited, Directors and any of its employees shall not be responsible for the content. The person accessing this information specifically agrees to exempt Hem Securities Limited, Hem Finlease Private Limited, Hem Multi Commodities Pvt. Limited or any of its affiliates or employees from, any and all responsibility/liability arising from such misuse and further agrees to hold Hem Securities Limited, Hem Finlease Private Limited, Hem Multi Commodities Pvt. Limited or any of its affiliates or employees free and harmless from all losses, costs, damages, expenses that may be suffered by the person accessing this information due to any errors and delays. The companies and its affiliates, officers, directors, and employees, including persons involved in the preparation or issuance of this material may from time to time, have long or short positions in, and buy or sell the securities there of, company (ies) mentioned herein and the same have acted upon or used the information prior to, or immediately following the publication. Analyst Certification The views expressed in this research report accurately reflect the personal views of the analyst(s) about the subject securities or issues, and no part of the compensation of the research analyst(s) was, is, or will be directly or indirectly related to the specific recommendations and views expressed by research analyst(s) in this report. Disclosure of Interest Statement 1. Analyst Ownership of the Stocks No 2. Hem & its Group Company Ownership of the Stock No 3. Hem & its Group Company Director Ownership of the Stock No 4. Broking relationship with Company covered No