Ashok Leyland Fundamental Report by swastika Investmart

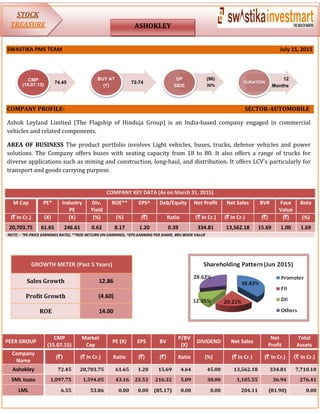

- 1. SWASTIKA PMS TEAM July 15, 2015 COMPANY PROFILE- SECTOR-AUTOMOBILE Ashok Leyland Limited (The Flagship of Hinduja Group) is an India-based company engaged in commercial vehicles and related components. AREA OF BUSINESS The product portfolio involves Light vehicles, buses, trucks, defense vehicles and power solutions. The Company offers buses with seating capacity from 18 to 80. It also offers a range of trucks for diverse applications such as mining and construction, long-haul, and distribution. It offers LCV’s particularly for transport and goods carrying purpose. COMPANY KEY DATA (As on March 31, 2015) M Cap PE* Industry PE Div. Yield ROE** EPS^ Deb/Equity Net Profit Net Sales BV# Face Value Beta (` In Cr.) (X) (X) (%) (%) (`) Ratio (` In Cr.) (` In Cr.) (`) (`) (%) 20,703.75 61.65 246.61 0.62 8.17 1.20 0.39 334.81 13,562.18 15.69 1.00 1.69 NOTE: - *PE-PRICE EARNINGS RATIO, **ROE-RETURN ON EARNINGS, ^EPS-EARNING PER SHARE, #BV-BOOK VALUE PEER GROUP CMP (15.07.15) Market Cap PE (X) EPS BV P/BV (X) DIVIDEND Net Sales Net Profit Total Assets Company Name (`) (` In Cr.) Ratio (`) (`) Ratio (%) (` In Cr.) (` In Cr.) (` In Cr.) Ashokley 72.45 20,703.75 61.65 1.20 15.69 4.64 45.00 13,562.18 334.81 7,710.10 SML Isuzu 1,097.75 1,594.05 43.16 25.53 216.32 5.09 30.00 1,105.55 36.94 276.41 LML 6.55 53.86 0.00 0.00 (85.17) 0.00 0.00 204.11 (81.90) 0.00 74.45 CMP (15.07.15) 72-74 BUY AT (`) (96) 30% UP SIDE 12 Months DURATION GROWTH METER (Past 5 Years) Sales Growth 12.86 Profit Growth (4.60) ROE 14.00 STOCK TREASURE ASHOKLEY

- 2. TECHNICAL VIEW- In the technical chart, it can be seen that the stock is in bull phase from last many trading sessions. And is also trading above its resistance level of 50 days daily moving average, hence we are recommending to ‘buy’ the particular stock at current levels. FUNDAMENTAL VIEW- The company has reported a Net sales of ` 4505.70 cr. for Q4FY15 as compared to ` 3076.78 cr. in the last quarter and Net Profit of ` 229.97 cr. as compared to ` 363.39 cr. for Q4FY14. EBITDA for the Q4FY15 has been de-growing at around (36.72)% and EPS stood at ` 0.81 in Q4FY15 as compared to ` 1.37 in Q4FY14. Net Income for the financial year ended 31st Mar 2015 was ` 13,562.18 cr. as compared to ` 9,943.43 cr., up by 36% and Net profit for the year was ` 334.81 cr. as against ` 29.38 cr. last year. Earnings per share for the year stood at ` 1.20 and the Book value per share stood at ` 15.69. NPM is 2.47% and Interest Coverage ratio is 1.87 for FY15. The company has declared an equity dividend of 45.00%, amounting to ` 0.45 per share for the financial year 2014-2015, and a dividend yield of 0.62 %. We are expecting Net Sales and PAT of the company to grow at a CAGR of 27.16% and 253.79% over 2014 to 2017E respectively. EARNINGS ALERT PARTICULARS Q4FY15 Q4FY14 Growth Q-o-Q (%) Net Sales (` In Cr.) 4505.70 3076.78 46.44 Net Profit (` In Cr.) 229.97 363.39 (36.72) EPS (`) 0.81 1.37 (39.23) EBITDA (` In Cr.) 486.31 575.77 (15.54)

- 3. ONE YEAR PERFORMANCE NIFTY VS STOCK (2014-15) KEY DISCUSSIONS The Company improved its market share from 26.1% to 28.6% in the M&HCV segment, on account of appropriate product mix in the growth segments, a sustained focus on meeting customer needs and initiatives in expansion of network. Company has been able to maintain the market share in the Small Commercial Vehicle (2-3.5T) segment on the back of sustained product improvements and variants on DOST, which is the 2nd largest player in the segment. The recent PARTNER array of products has also gained the market share in the 6-7.5T segment, its first full year post launch. The CAPTAIN series of next generation Heavy Commercial Vehicles (HCV) has been launched in select markets. With economic activity picking up in Iron Ore and Coal mining, the CAPTAIN range of products are strategically positioned to exploit growth in these sectors. Revenue from the Spare Parts business has grown by 14.90% based on better demand and improved operations. The Defence business gained impetus this year with increased domestic aids dispatches as well as significant export volumes. The Company has also won major orders from Defence establishments with newer products this year. Company had also focused on improving the network on cost effective basis particularly in North, Eastern and Central regions. In the recent past, Ashokley has received orders for buses worth US$ 82 mn from Senegal, Ministry of Transport towards building their comprehensive & integrated transportation system. Company is also targeting at around 32% of its revenues from exports in the coming 3-5 years, and is focusing on new markets like Africa, SE Asia and Russia and deeper penetration into existing markets of ME, SL, Nepal, Bangladesh, etc. Ashokley NIFTY NIFTY NIFTY CIPLA

- 4. THE YEAR AHEAD The domestic Commercial Vehicle industry appears to be coming out of the downturn after two continuous years of demand pull-off. Presently, the industry reported a growth of 2% on YoY basis driven by strong growth in the M&HCV Truck segment (23%) as well as pick up in the bus segment (24%). Within the Commercial Vehicle segment, M&HCV reported a growth of 23% in unit sales in march 2015 while the LCV segment witnessed de-growth of 10%. The Medium & Heavy Commercial Vehicles & Truck segment is likely to report lower double digit growth in fiscal year 2015-16 due to continuous trend towards replacement of ageing fleet and expectations of gear in demand from infrastructure and industrial sectors in hope of the reforms being initiated by the Government. The Light Commercial Vehicle segment is expected to grow at a moderate pace in the coming financial year as segment prospects continue to be influenced by issues of overcapacity and constrained financing environment amidst rising delinquencies. Steep decline in diesel rates improved profitability of freight operators, as freight rates declined only 3-4% v/s diesel price drop of 15-17%. As a result, replacement demand has got a boost. Over the medium term, the Commercial Vehicles will take shape through gradual acceptance of advanced trucking platforms, progression to stricter emission norms and execution of technologies such as Anti-lock Braking System (ABS), which may lead to some prior purchases by fleet operators.

- 5. NET SALES & NET PROFIT GROWTH (` In Cr.): EPS & BOOK VALUE GROWTH (In `):

- 6. FINANCIAL PERFORMANCE- Sources: Company research OUTLOOK & VALUATION- At the market price of ` 72.00 the stock PE is ~25.99 for FY16x and ~16.07 for FY17x. Earnings per share of the company for FY16E and FY17E are seen at ` 2.77 and ` 4.48 respectively. We are expecting Net Sales and PAT of the company to grow at a CAGR of 27.16% and 253.79% over 2014 to 2017E respectively. Hence, we recommend ‘BUY’ in this particular stock with a target price of ` 96.00 for Medium to Long term Investment. Source: nseindia.com, bseindia.com, Wikipedia.com, moneycontrol.com, business standard & ET. PARTICULARS FY13A FY14A* FY15A FY16E** FY17E Net Sales (` In Cr.) 12481.20 9943.43 13562.18 16725.93 20446.30 Net Profit (` In Cr.) 433.17 29.38 334.81 799.80 1300.90 EPS (`) 1.63 0.11 1.20 2.77 4.48 PE Ratio (x) 44.17 654.54 60.00 25.99 16.07 Book Value (`) 16.74 16.72 14.40 16.33 19.14 Price/Book Ratio (x) 4.30 4.30 5.00 4.40 3.76 ROE (%) 9.73 0.66 8.17 17.30 24.50 Note: - *A-Actual & **E-Estimated & (Figures on Standalone Basis for the period ended March.)

- 7. SWASTIKA PMS TEAM July 15, 2015 SWASTIKA INVESTMART LTD. PMS DESK Disclaimer: This document is solely for the personal information of the intended recipient and must not be exceptionally used as the basis for any investment decision. Nothing in this document should be construed as investment, Legal, taxation or financial advice. Swastika Investmart Ltd. is not soliciting any action based upon it. Each recipient of this document should make necessary investigations as they consider important to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved). This report has been made based on information that we consider reliable and are publicly available, but we do not state that it is accurate or complete and it should not be solely relied upon such, as this document is for. Swastika Investmart Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within this document. Swastika Investmart Limited or any of its affiliates/ group companies, or employees shall not be in any way held responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Swastika Investmart Limited has not independently verified the information contained in this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. If you have any questions about this report please get in touch with Swastika Investmart Ltd. Corporate & Administrative Office 48, Jaora Compound, M.Y.H. Road, Indore- 452 001 Ph: 0731-6644000, 2706200, 2705200, 3345000, 2703668-69, 2703661-70 Fax. 0731-6644300., Email: pms@swastika.co.in Website: www.swastika.co.in Research Team Designation Email ID Contact Sandeep Choubey Technical Research Analyst sandeep.choubey@swastika.co.in 0731-6688024 Anisha Agrawal Fundamental Research Analyst anisha.agrawal@swastika.co.in 0731-6688096 Santosh Meena Senior Research Analyst santosh.meena@swastika.co.in 0731-6688005 Amit Khare Senior Research Analyst amit.khare@swastika.co.in 0731-6644134 Sayyam Neema Technical Research Analyst sayyam.neema@swastika.co.in 0731-6688006 Manish Bimal Technical Research Analyst Manish.bimal@swastika.co.in 0731-6688012 STOCK TREASURE