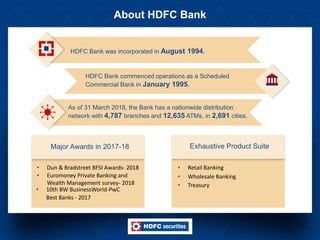

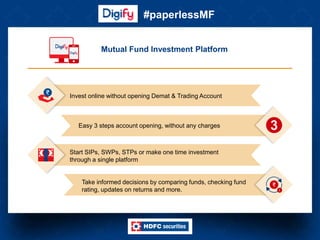

HDFC Bank provides a wide range of financial products and services including retail banking, wholesale banking, treasury services, and investment services. It has a nationwide network of over 4,787 branches and 12,635 ATMs. HDFC Securities is a subsidiary of HDFC Bank and offers investment services including equities, mutual funds, insurance, loans, and portfolio management. It provides these services through multiple platforms including a website, mobile app, branches, and a central dealing desk that can be accessed by phone. HDFC Securities has received several awards for its services and aims to provide customized investment solutions to meet customers' needs.