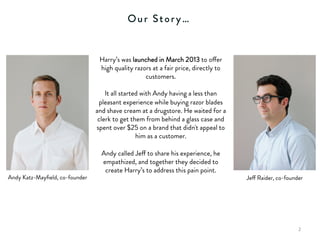

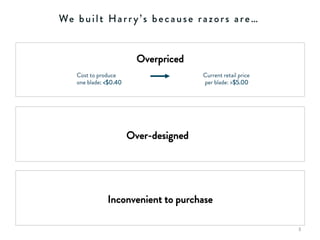

Harry's is a grooming brand launched in 2013, targeting overpriced and underperforming products in the razor industry. It has significantly grown its online sales and customer base by offering quality razors at a fair price and leveraging direct customer relationships and innovative manufacturing. The document emphasizes the company's strategy to disrupt the traditional shaving market, which is dominated by a few major players.