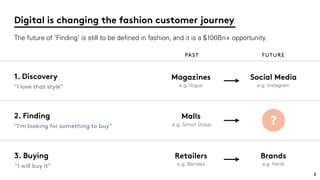

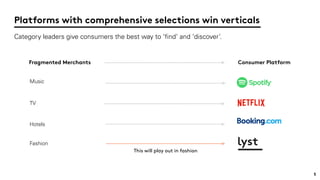

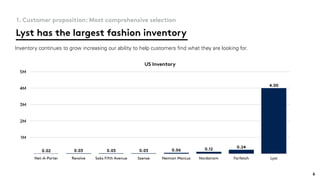

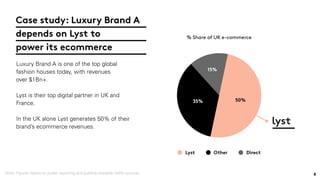

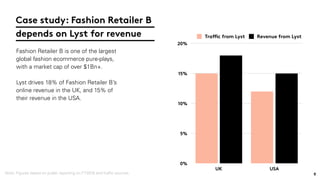

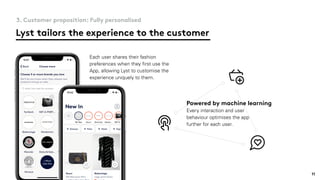

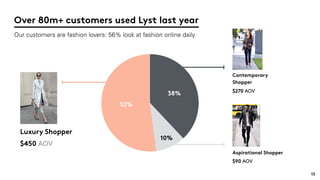

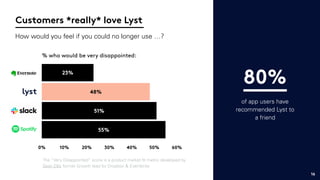

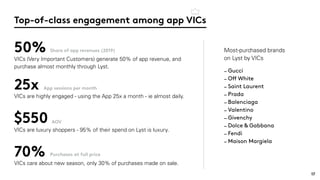

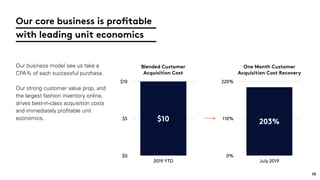

The document discusses the evolving landscape of digital fashion retail, emphasizing the importance of discovery, finding, and buying in the customer journey as it represents a significant market opportunity. It highlights Lyst as a leading multi-brand platform that offers comprehensive selections and personalized experiences for shoppers, leveraging machine learning to optimize user interactions. Additionally, case studies show Lyst's impact on major fashion brands' e-commerce revenues and its growing customer engagement through its app.