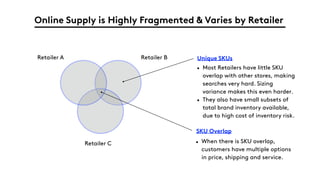

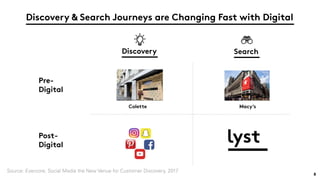

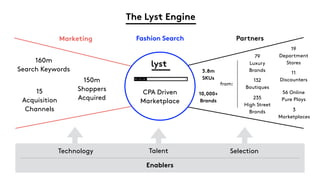

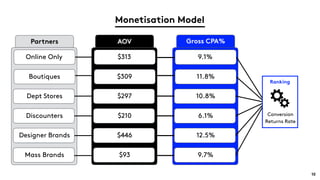

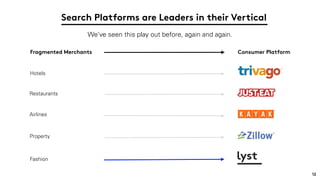

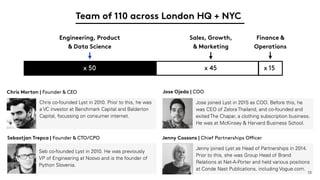

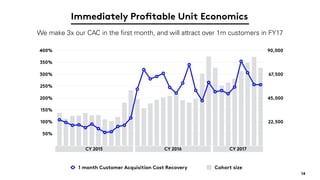

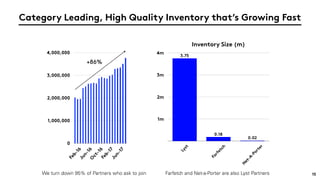

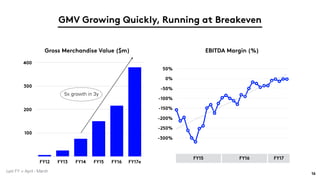

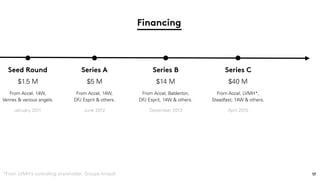

The document outlines the mission of various conferences aiming to empower the European digital ecosystem by connecting capital with entrepreneurs, particularly between Europe and Israel. It highlights a global fashion search platform that addresses the challenges fashion shoppers face in finding specific items due to fragmented online supply and sizing variations. Additionally, it discusses Lyst's growth, inventory expansion, and strong performance metrics, showcasing its significant partnerships and financial accomplishments.