1. A bank guarantee is a written contract issued by a bank on behalf of a customer, where the bank takes responsibility for payment of a sum of money if the customer does not pay. The bank charges a commission for issuing the guarantee.

2. Bank guarantees provide benefits for both governments and private sectors. For governments, it increases private financing for infrastructure and reduces government risk exposure. For private sectors, it reduces risks and opens new markets.

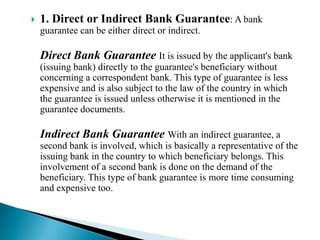

3. There are different types of bank guarantees including direct/indirect guarantees, confirmed guarantees, tender bonds, performance bonds, rental guarantees, and credit card guarantees which are used for various commercial purposes.