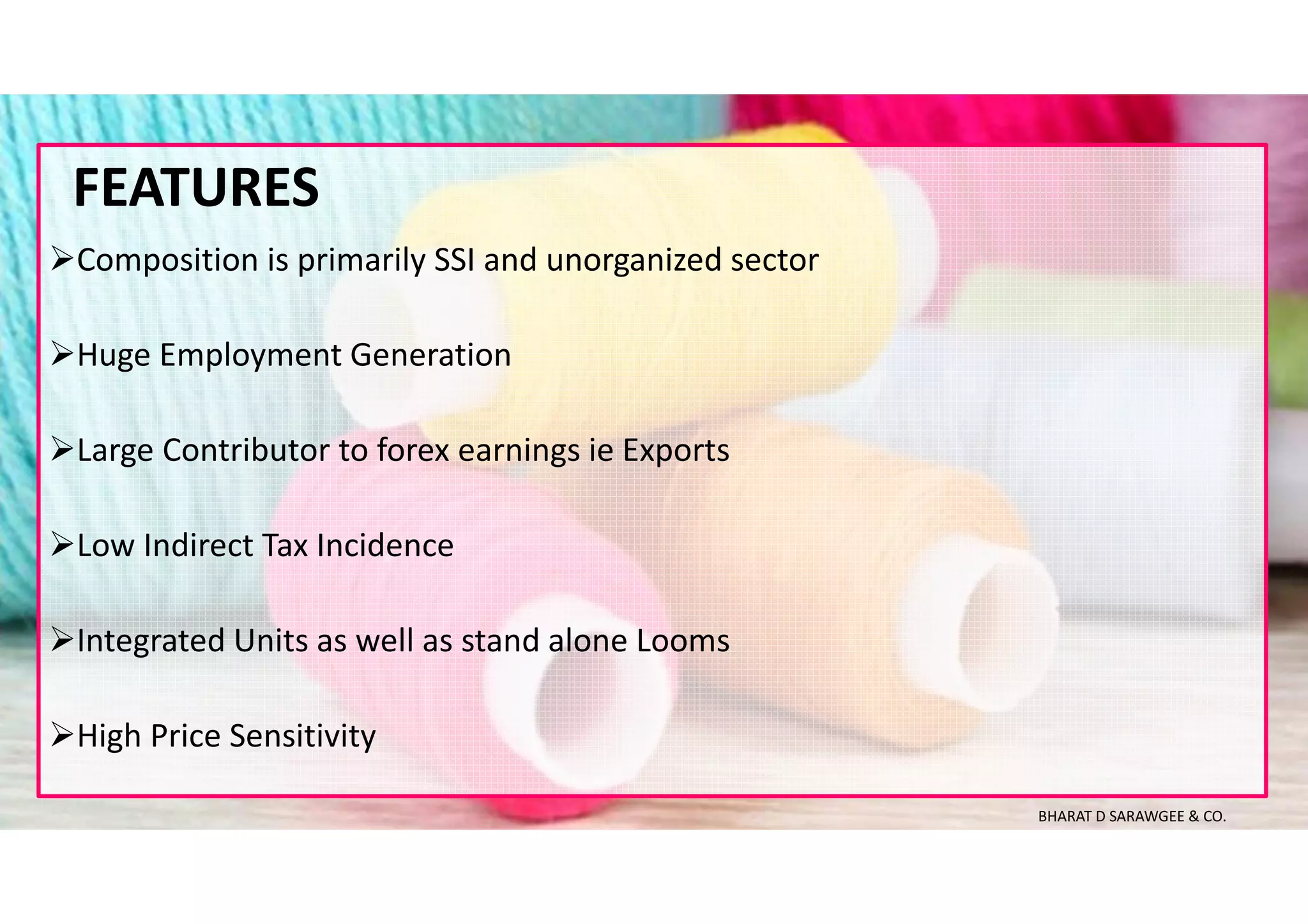

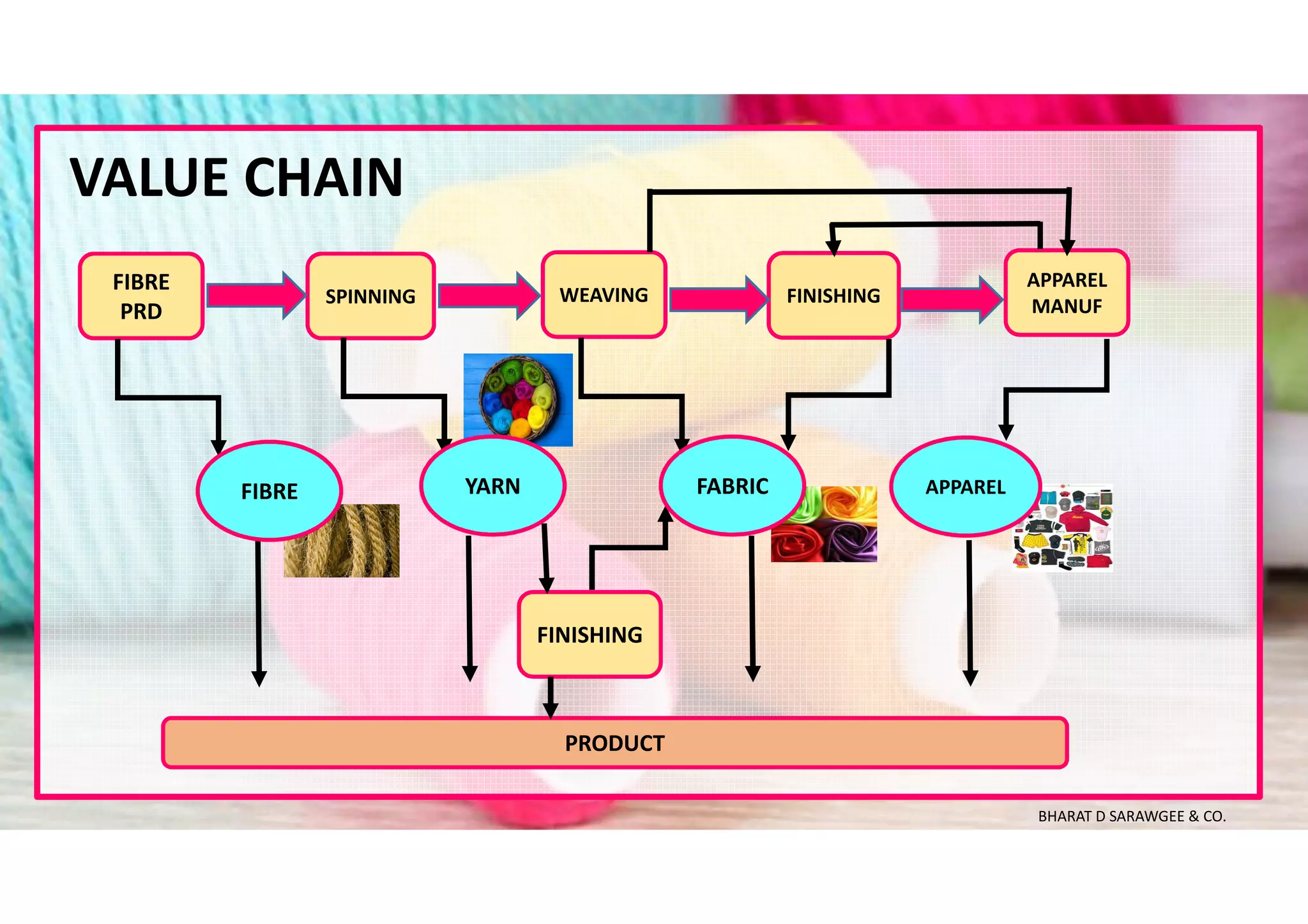

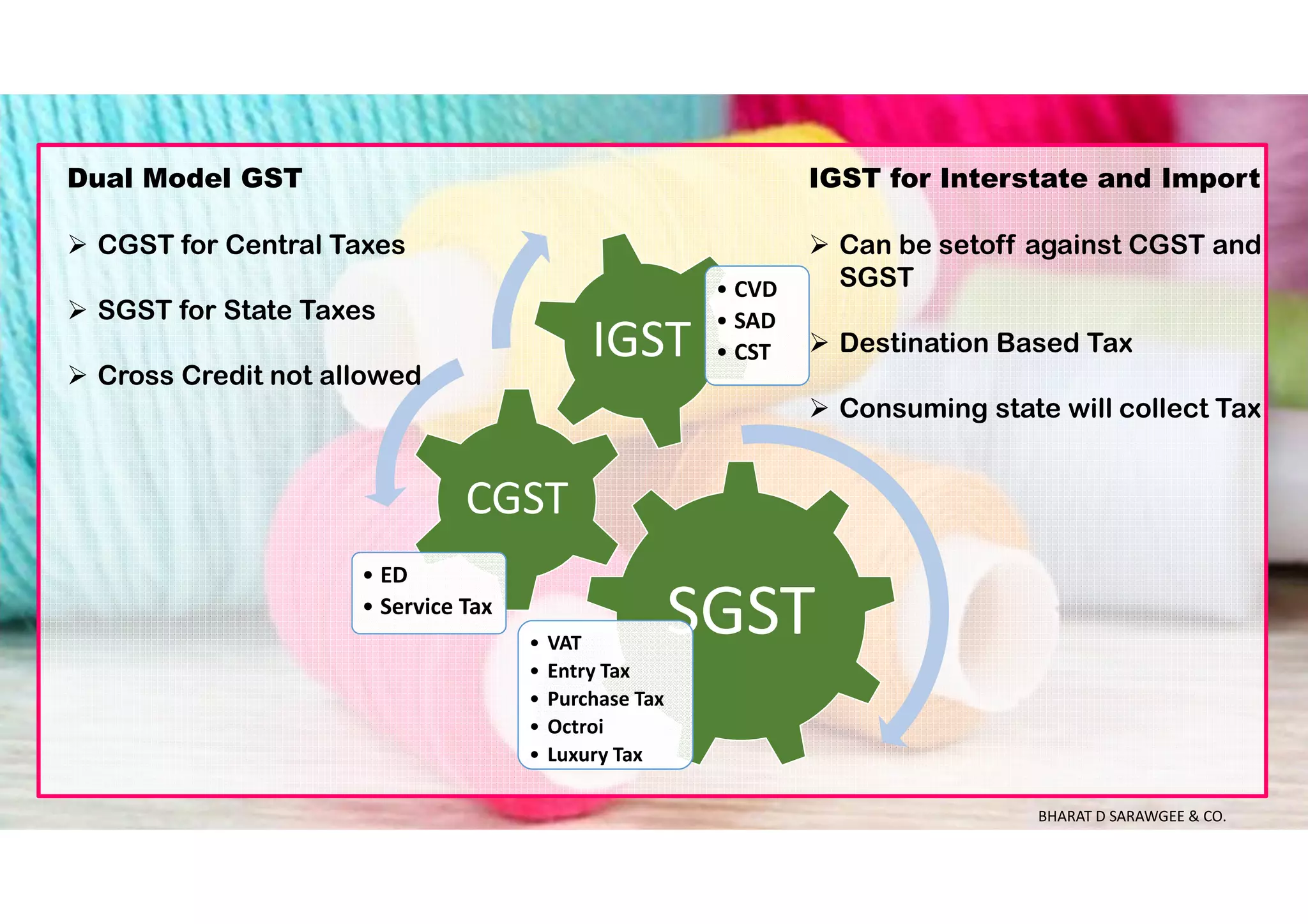

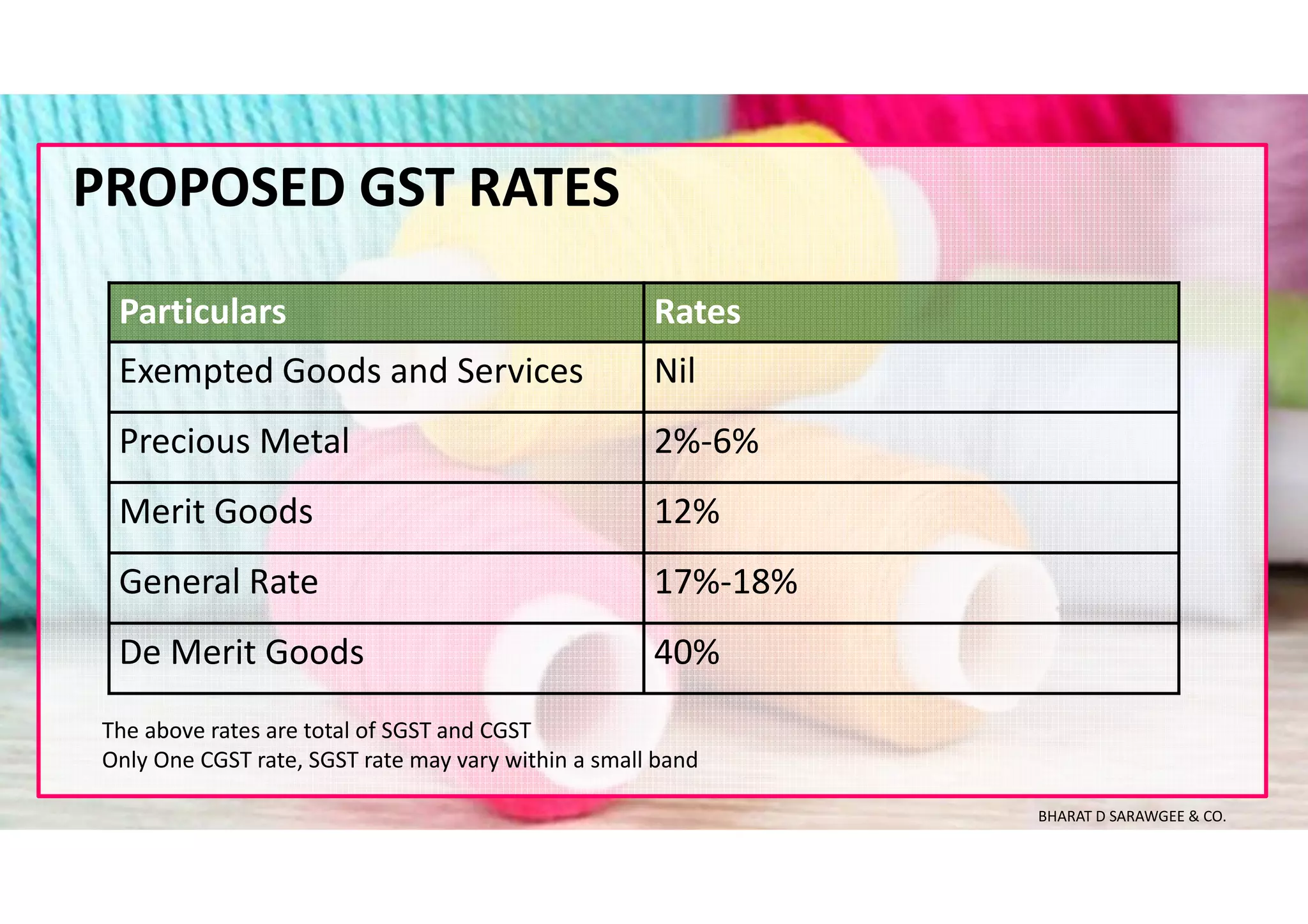

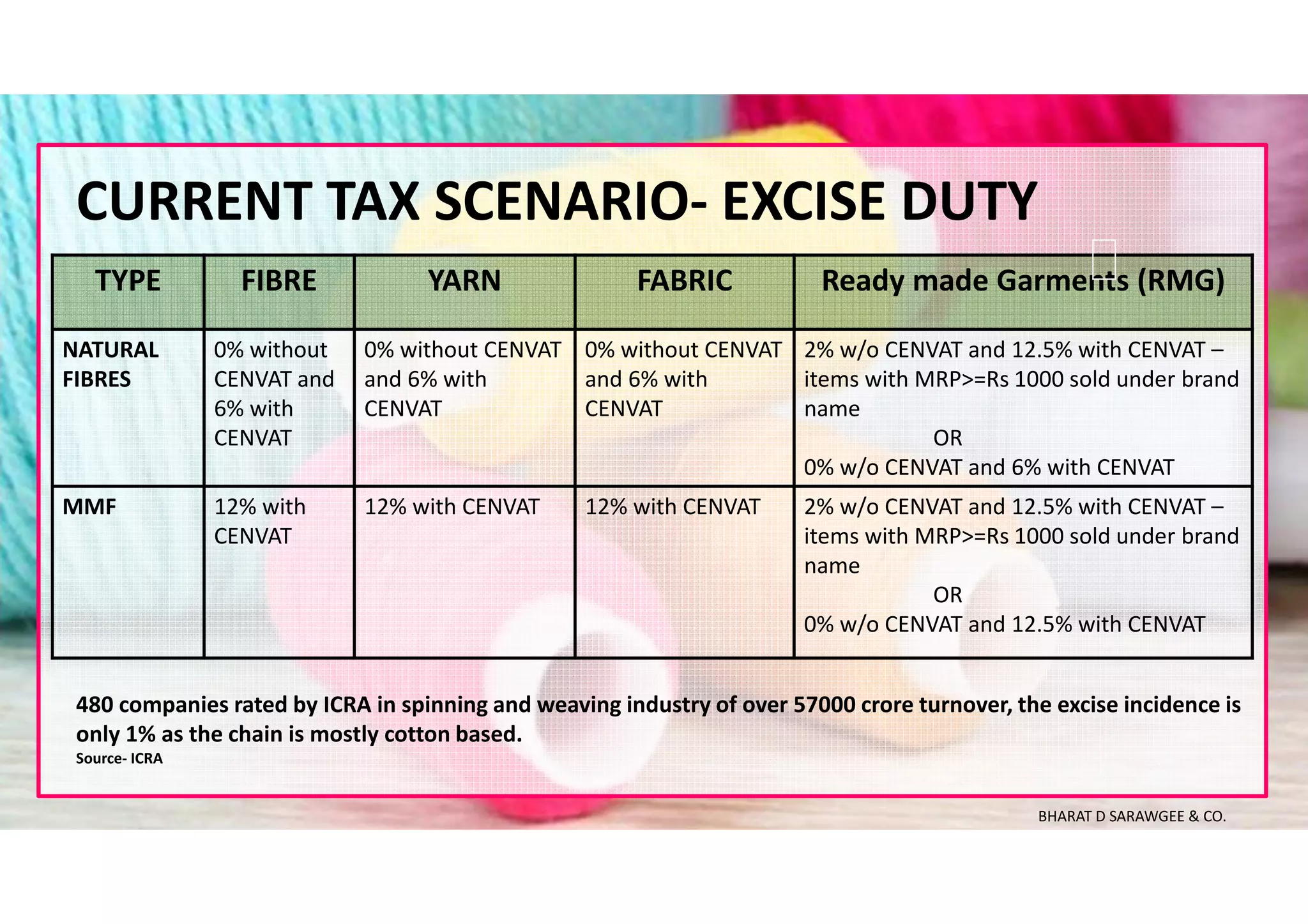

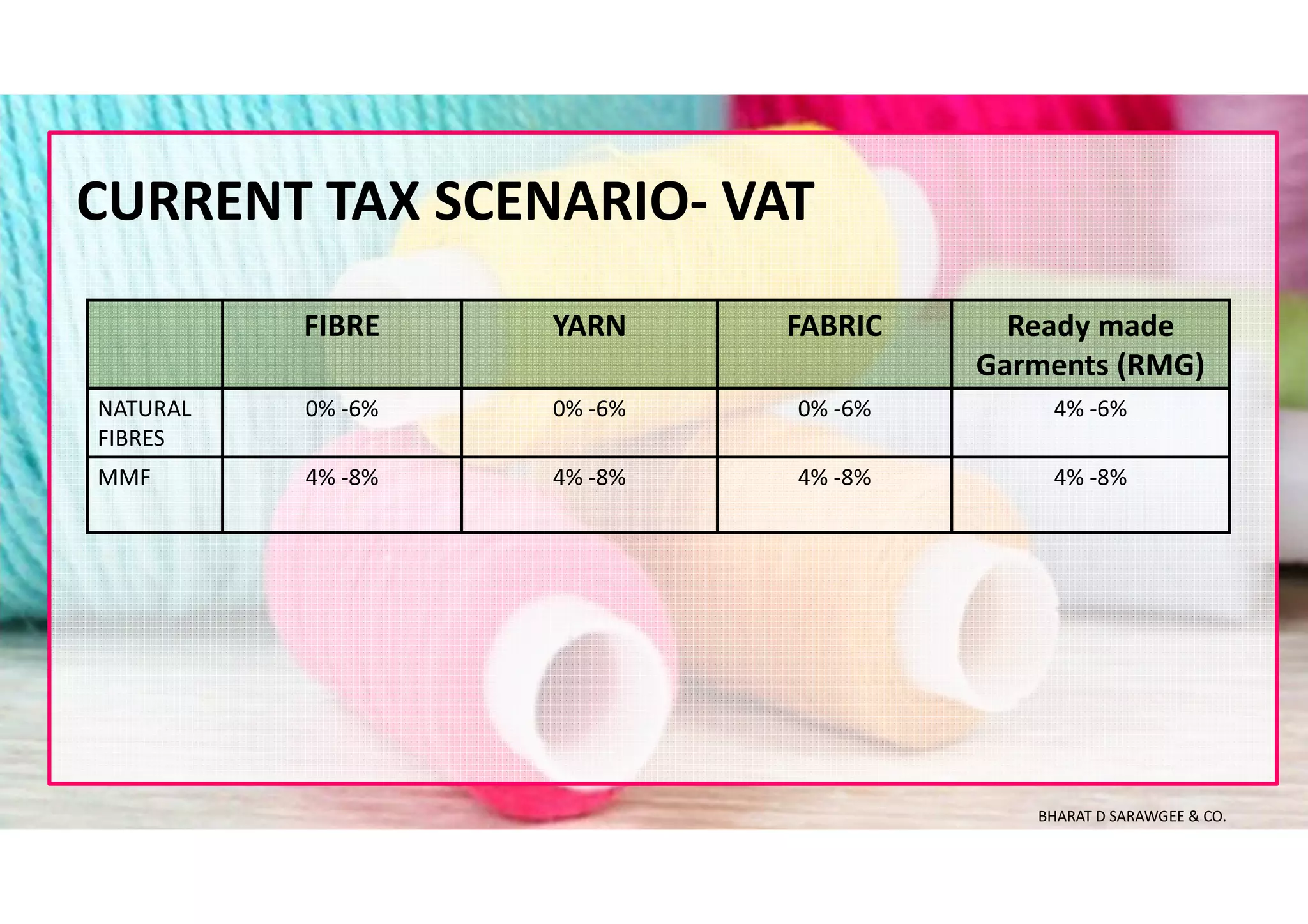

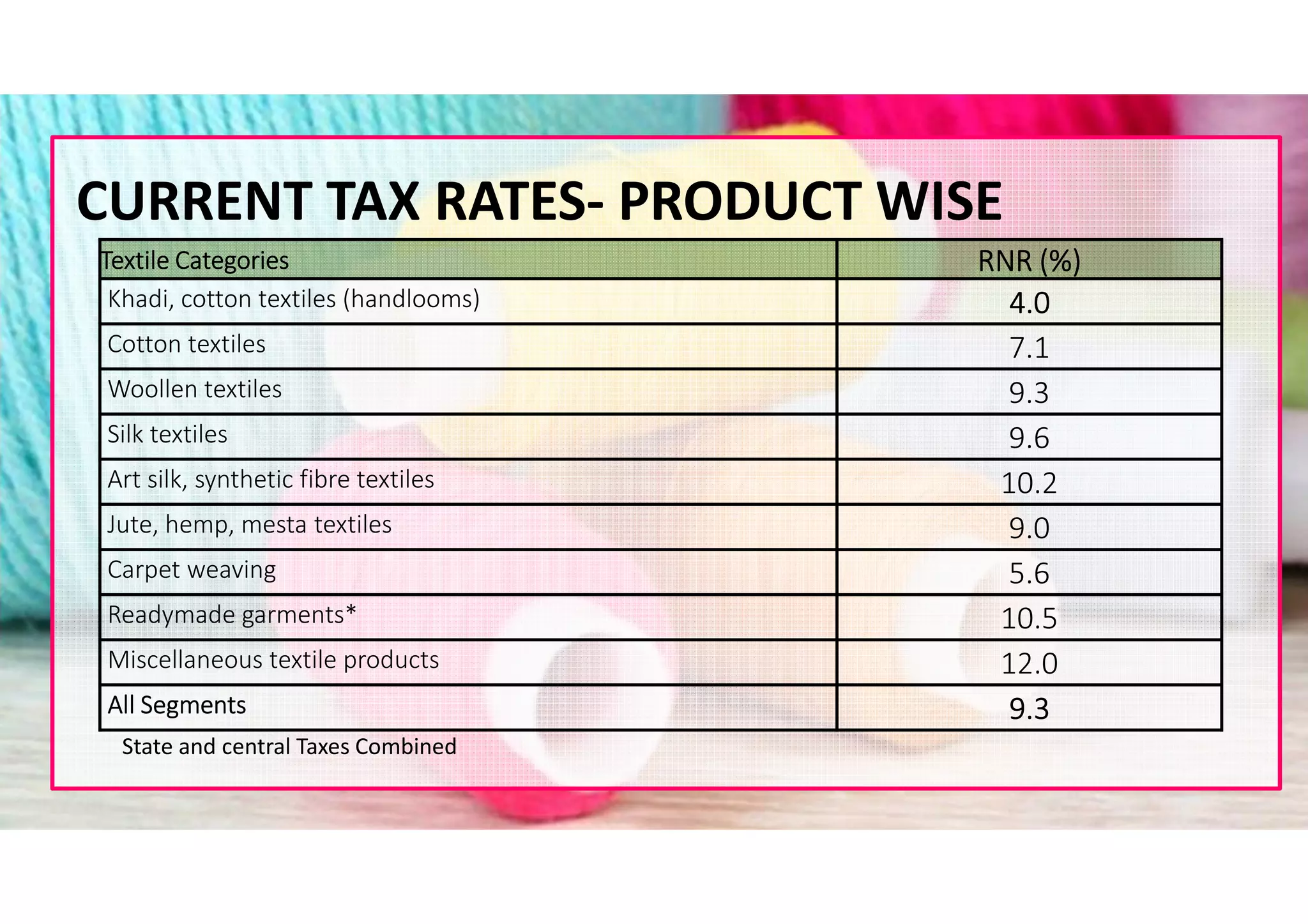

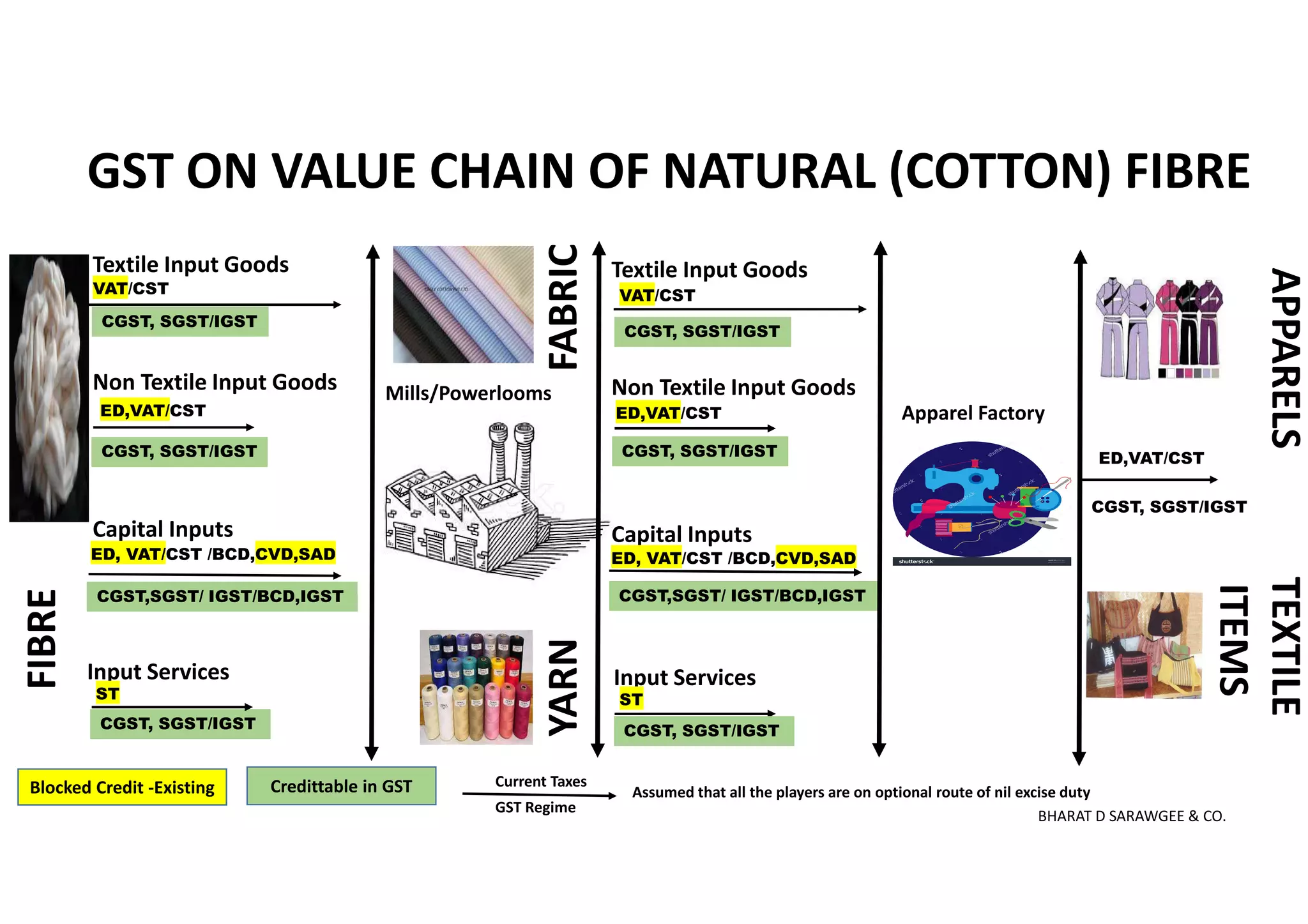

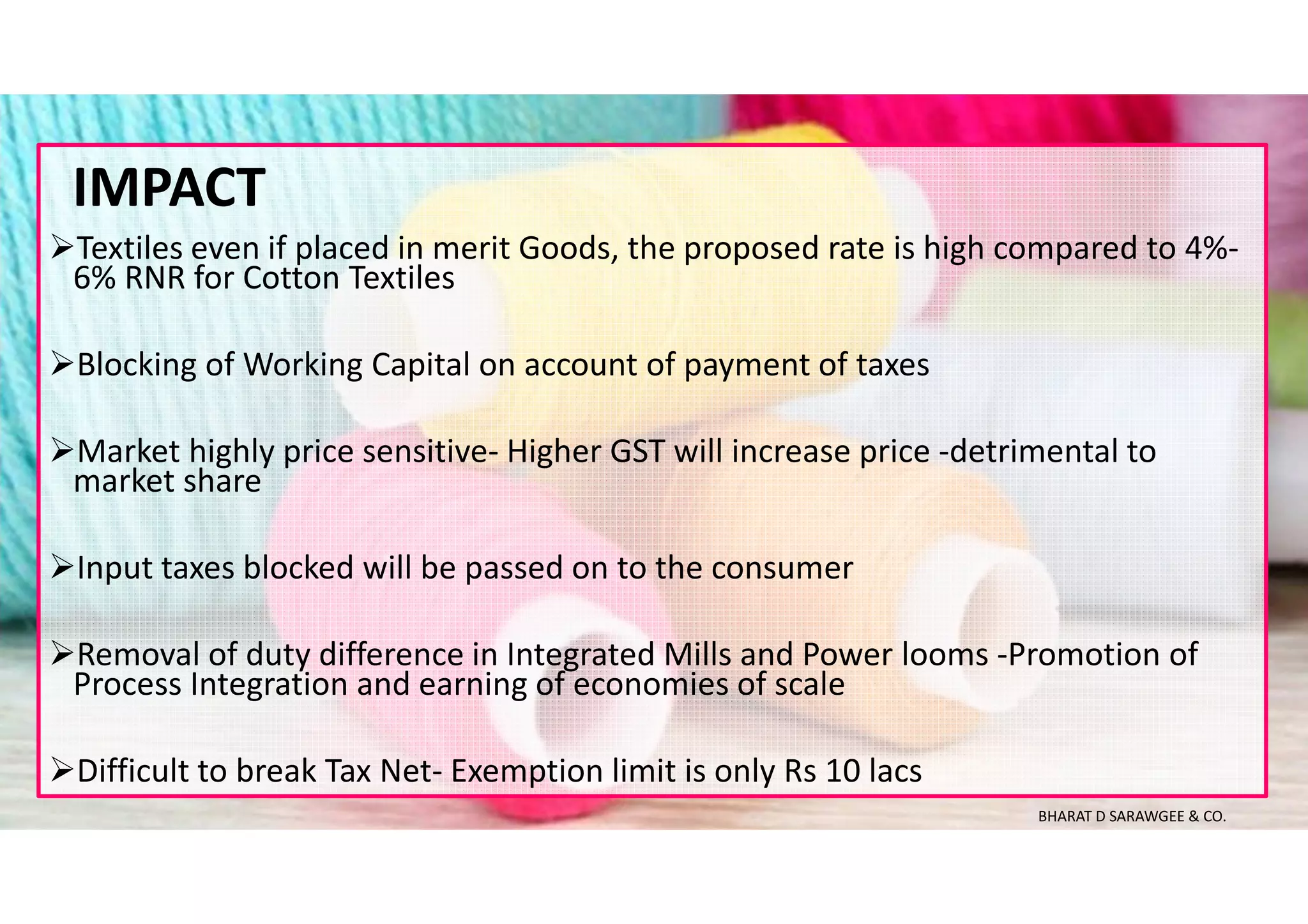

This document analyzes the impact of implementing GST on the textile and apparel industry in India. It provides an overview of the industry, describes the current tax structure, and analyzes how GST would impact different segments of the industry value chain, including natural fibers, man-made fibers, exports, and imports. It notes both potential benefits like input tax credits, a level playing field, and simplification, as well as challenges of the proposed GST rates being higher than current effective rates and difficulty bringing small units into the tax net.