Gst flowchart icai composition scheme

•

0 likes•419 views

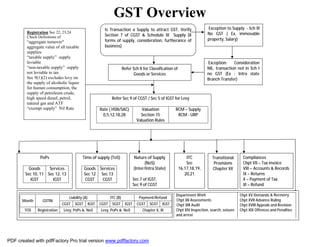

The document provides an overview of the Goods and Services Tax (GST) in India. It defines key terms like taxable supply, non-taxable supply, and exempt supply. It outlines the sections of the GST acts that cover aspects like the levy of GST, time and place of supply, input tax credit, registration, returns and payments. The document also briefly mentions the tax rates under GST and chapters dealing with assessments, appeals and penalties.

Report

Share

Report

Share

Download to read offline

Recommended

Standardised ppt on revised model gst law

This document provides a standard presentation on the revised Model GST Law from November 2016 by the Indirect Taxes Committee of the Institute of Chartered Accountants of India. It begins with basic concepts of GST such as its objectives to usher in a single rate of tax and reduce the cascading effect of taxes. It then covers key components of GST including CGST, SGST and IGST. It explains the concepts of composite supply and mixed supply. Other sections cover the meaning and scope of supply, composition levy, taxable person, and exemptions.

Levy & collection

This document discusses various aspects of CGST/SGST levy and collection under Section 9 of the CGST Act, including:

1. Rates not exceeding 20% apply to intra-state supplies except alcoholic liquor for human consumption.

2. Petrol and its by-products shall be levied with effect from the date notified by the government based on council recommendations.

3. For mixed and composite supplies, the highest tax rate among the goods or services in the combination is applied to calculate tax liability for mixed supplies, while the rate applicable to the principal supply is applied for composite supplies.

Gst presentation

The document provides an overview of the key aspects of the Goods and Services Tax (GST) implemented in India including:

1) It describes the features and fundamentals of GST including how it is a dual tax system levied by both central and state governments.

2) It outlines the registration process and requirements to register under GST.

3) It explains the various GST returns required to be filed including monthly, annual, and other periodic returns along with due dates.

4) It provides answers to common questions about GST such as who needs to register, what the tax rates are, and how GST benefits consumers.

Valuation of supply under GST

The document discusses the valuation of supplies under section 15 of the CGST/SGST Act. It states that as per section 15(1), the value of a supply shall be the transaction value which is the price actually paid or payable where the supplier and recipient are not related. The value shall also include any amount the supplier is liable to pay that was incurred by the recipient, incidental expenses charged by the supplier, interest/late fees/penalties for delayed payment, and subsidies directly linked to the price excluding central/state government subsidies. Discounts given before or at supply are excluded from transaction value but those given after supply are included. Where transaction value cannot be determined, valuation shall be as prescribed. Valuation rules

#GST Fundamentals for Export - Import# By SN Panigrahi

SN Panigrahi is an experienced professional with over 29 years of experience in various domains including project management, contract management, supply chain management, procurement, strategic sourcing, global sourcing, logistics, exports, and imports. He is certified in several areas such as Project Management Professional (PMP), Lean Six Sigma Green Belt, and GST. He has conducted over 150 workshops and published more than 500 articles. SN Panigrahi offers his expertise as an international corporate trainer, mentor, and author.

Non applicability and exemptions under gst law

The document summarizes various exemptions from GST in India, including:

1. Certain goods like live animals, meat, fish, vegetables and fruits are exempt from GST. Common items like sugar, drugs, fertilizers and national flags are also exempt.

2. Many essential services are exempt, including health care, education services up to higher secondary level, religious ceremonies, charitable activities, and pension schemes.

3. Agriculture-related services like warehousing of farm goods, fumigation, crop services and transport are exempt from GST.

4. The government has power to grant exemptions from GST if deemed necessary for public interest.

input tax credit under GST

The document discusses the key provisions related to Input Tax Credit (ITC) under the GST law in India. It begins by defining ITC and input tax. It then outlines some of the major ITC provisions under the Central GST Act and rules, including those relating to eligibility for ITC, documentation requirements, blocked credits, and time limits. Specific provisions covered in more detail include Section 16 on eligibility and conditions for ITC, Section 17 on apportionment of credit and blocked credits, and restrictions on ITC for works contracts and construction of immovable property. The document provides an overview of the major ITC concepts and sections under the GST law.

GSTR-9 (ANNUAL RETURN)

The PPT contains provision relating to GST Annual Return and form notified. (Please note the understanding is based on the law and format prevailing as on date of uploading and there are some onion and interpretation involve which may vary).

Recommended

Standardised ppt on revised model gst law

This document provides a standard presentation on the revised Model GST Law from November 2016 by the Indirect Taxes Committee of the Institute of Chartered Accountants of India. It begins with basic concepts of GST such as its objectives to usher in a single rate of tax and reduce the cascading effect of taxes. It then covers key components of GST including CGST, SGST and IGST. It explains the concepts of composite supply and mixed supply. Other sections cover the meaning and scope of supply, composition levy, taxable person, and exemptions.

Levy & collection

This document discusses various aspects of CGST/SGST levy and collection under Section 9 of the CGST Act, including:

1. Rates not exceeding 20% apply to intra-state supplies except alcoholic liquor for human consumption.

2. Petrol and its by-products shall be levied with effect from the date notified by the government based on council recommendations.

3. For mixed and composite supplies, the highest tax rate among the goods or services in the combination is applied to calculate tax liability for mixed supplies, while the rate applicable to the principal supply is applied for composite supplies.

Gst presentation

The document provides an overview of the key aspects of the Goods and Services Tax (GST) implemented in India including:

1) It describes the features and fundamentals of GST including how it is a dual tax system levied by both central and state governments.

2) It outlines the registration process and requirements to register under GST.

3) It explains the various GST returns required to be filed including monthly, annual, and other periodic returns along with due dates.

4) It provides answers to common questions about GST such as who needs to register, what the tax rates are, and how GST benefits consumers.

Valuation of supply under GST

The document discusses the valuation of supplies under section 15 of the CGST/SGST Act. It states that as per section 15(1), the value of a supply shall be the transaction value which is the price actually paid or payable where the supplier and recipient are not related. The value shall also include any amount the supplier is liable to pay that was incurred by the recipient, incidental expenses charged by the supplier, interest/late fees/penalties for delayed payment, and subsidies directly linked to the price excluding central/state government subsidies. Discounts given before or at supply are excluded from transaction value but those given after supply are included. Where transaction value cannot be determined, valuation shall be as prescribed. Valuation rules

#GST Fundamentals for Export - Import# By SN Panigrahi

SN Panigrahi is an experienced professional with over 29 years of experience in various domains including project management, contract management, supply chain management, procurement, strategic sourcing, global sourcing, logistics, exports, and imports. He is certified in several areas such as Project Management Professional (PMP), Lean Six Sigma Green Belt, and GST. He has conducted over 150 workshops and published more than 500 articles. SN Panigrahi offers his expertise as an international corporate trainer, mentor, and author.

Non applicability and exemptions under gst law

The document summarizes various exemptions from GST in India, including:

1. Certain goods like live animals, meat, fish, vegetables and fruits are exempt from GST. Common items like sugar, drugs, fertilizers and national flags are also exempt.

2. Many essential services are exempt, including health care, education services up to higher secondary level, religious ceremonies, charitable activities, and pension schemes.

3. Agriculture-related services like warehousing of farm goods, fumigation, crop services and transport are exempt from GST.

4. The government has power to grant exemptions from GST if deemed necessary for public interest.

input tax credit under GST

The document discusses the key provisions related to Input Tax Credit (ITC) under the GST law in India. It begins by defining ITC and input tax. It then outlines some of the major ITC provisions under the Central GST Act and rules, including those relating to eligibility for ITC, documentation requirements, blocked credits, and time limits. Specific provisions covered in more detail include Section 16 on eligibility and conditions for ITC, Section 17 on apportionment of credit and blocked credits, and restrictions on ITC for works contracts and construction of immovable property. The document provides an overview of the major ITC concepts and sections under the GST law.

GSTR-9 (ANNUAL RETURN)

The PPT contains provision relating to GST Annual Return and form notified. (Please note the understanding is based on the law and format prevailing as on date of uploading and there are some onion and interpretation involve which may vary).

All about Input tax credit

The following Presentation enumerates the various provisions w.r.t. ITC, how it can be used,eligibilty and conditions for claiming ITC along with various case studies and illustrations. further, it elaborates the concept of input service distributor.

GST Annual Return (GSTR-9)

UPDATED PPT ON TABLE BY TABLE POINTS ON GST ANNUAL RETURN GSTR-9. CHECK POINTS OF GSTR-9 COUPLED WITH REFERENCE TO GST AUDIT GUIDE YOU TO ANNUAL COMPLIANCE UNDER GST.

Consequences of Fake Invoices under Income Tax Act and GST

Key Takeaways:

- Rationale for Introducing Penalty Provisions

- Consequences of Fake Invoicing under Income Tax Act and GST

- Legal Proceedings and Compounding of Offences

- Judicial Precedents

Supply under GST (goods and services tax)

This document provides definitions and explanations of key terms under the Goods and Services Tax (GST) in India such as goods, services, taxable person, supplier, recipient, location of supply, and place of business. It explains concepts like input service distributor, usual place of residence, principal place of business, and fixed establishment. The document aims to outline the scope and coverage of entities, transactions, and locations that would be subject to GST in India.

Gst (2017)

This slide will give you brief idea about how GST will work and how it will benefit the society as well as government.

Input tax credit (itc) under GST

GST is nothing but a value added tax on goods & services combined. It is the provisions of Input Tax Credit that make GST a value added tax i.e collection of tax at all points after allowing credit for the inputs

Concept of Input Service Distributor (ISD) in GST-PPT

Power-point Presentation in concept of Input Service Distributor (ISD) in GST- Analysis of relevant sections and rules

PPT on gst audit

The document summarizes audit requirements under the GST law in India. It discusses the annual audit that must be conducted by chartered accountants or cost accountants for businesses with annual turnover over 2 crore rupees. It also outlines the reconciliation statements that must be filed. Additionally, the document outlines the areas of focus in the audit including reconciliation of supplies, input tax credit, taxes paid and refunds. It briefly discusses the audit that can be conducted by tax authorities with advance notice to the registered business.

Gst section 16 - Input Tax Credit – Eligibility and Conditions

Gst section 16 - Input Tax Credit – Eligibility and Conditions

Chapter V - Eligibility and conditions for taking credit

LEVY AND COLLECTION OF GST – Scope of Supply - Schedule I, II & III

Under the old tax regime in India, different taxes like excise, VAT/CST, and service tax had different taxable events. GST unified these various taxes and introduced a single taxable event of "supply". Supply includes all forms of supply of goods or services for a consideration in the course of business. Certain activities specified in Schedules I, II and III of the GST acts are treated as supply. For a transaction to qualify as supply under GST, it must be a supply of goods or services, for a consideration, in the course of business, by a taxable person, and be a taxable supply.

Input tax credit under GST

The document discusses India's Goods and Services Tax (GST) policies and regulations related to input tax credit. Key points include:

- Under GST, input tax credit is available for goods, services, and capital goods used in the course of business. This is a significant expansion of credit compared to earlier tax systems.

- Credit can be claimed by registered businesses against central GST, state GST, integrated GST, and Union territory tax paid on business purchases.

- Certain documents like tax invoices and bills of entry must be possessed, and payment must be made to the supplier within 180 days, for credit to be claimed.

- There are also time limits, apportionment and reversal

Block credit under sec 17(5) of gst

360 degree analysis of block credit in relation to vehicle , vessels and aircraft includes amendment which are effective from 01.02.2019 in their relation

GST - Input tax credit

Your guide on the most crucial pillar of GST - Input Tax Credit.

We hope this guide can help you understand the contours of Input Tax credit with regard what you are eligible for and what is explicitly denied in the law.

E way bill under GST

The document provides information about e-way bills in India. It discusses the objective and need for e-way bills, provisions under law, the e-way bill generation process which involves filling Part A and Part B, validity periods, extensions, cancellations, exceptions and verification process. E-way bills are required for inter-state movement of goods of over Rs. 50,000 in value and aim to facilitate seamless movement of goods and prevent tax evasion. Registered persons need to generate e-way bills on the common portal prior to movement of goods, listing key details of the consignment, supplier and recipient.

Input Tax Credit under GST

Find out the detailed explanation of the provisions relating to Input Tax Credit under the dual GST Law from the presentation . Give it a read and we would love to know your feedback!

GST-INPUT TAX CREDIT

The document provides information on input tax credit under GST in India. It defines key terms like input tax, input service, capital goods, output tax, inward and outward supplies. It explains the process of availing and utilizing input tax credit and conditions that must be met like having a valid tax invoice and the supplier depositing the taxes. Certain items are ineligible for input tax credit like motor vehicles, food and beverages, life and health insurance, and works contract services for construction of immovable property. The time limit to claim input tax credit is within one year from the invoice date or the due date of filing annual return, whichever is earlier.

Gst input tax credit eligibility

The document discusses input tax credit (ITC) under the Goods and Services Tax (GST) regime in India. Some key points:

1. ITC aims to ensure tax is levied only on value addition at each stage of supply chain to eliminate cascading of taxes. Only registered taxpayers can claim ITC subject to certain conditions.

2. Eligible inputs/services include those used in business. Capital goods are eligible for ITC over multiple years. ITC must be claimed within prescribed time limits and supported by valid documents.

3. ITC is allowed for taxable and zero-rated supplies but not for exempt, non-taxable or personal consumption. Credit must be apportioned

EPCG, ADV. LICE. AND EXPORT INCENTIVES

The document discusses various export promotion schemes in India including the Export Promotion Capital Goods (EPCG) Scheme, Advance Authorization Scheme, and Duty Drawback Scheme. The EPCG Scheme allows import of capital goods for production and export at zero customs duty with an export obligation. Advance Authorization allows duty-free import of raw materials for export production. Duty Drawback directly deposits a calculated amount in the exporter's account as an export incentive based on export product, quantity, and customs duty rates. The document provides details on applying for these schemes, export procedures and documentation requirements, and examples of duty drawback calculations.

Customs Duty

This document defines and explains customs duties in India. It states that customs duty is a tax imposed on imports and exports to raise government revenue and protect domestic industries. There are different types of customs duties including basic customs duty, additional duty, education and secondary education cess, and special additional duty. The document provides examples of how each duty is calculated and applied to the assessable value of imported goods.

Indirect taxes in india- pre gst era

This document provides an overview of indirect taxes in India prior to the Goods and Services Tax (GST) era. It discusses the types of indirect taxes in India including Value Added Tax (VAT) and its variants. It outlines key features of indirect taxes such as the taxable event, incidence and impact, regressive nature, and role in generating government revenue. The document also discusses provisions in the Indian Constitution related to tax authority and lists some major defects in the indirect tax structure like multiplicity of taxes, lack of cross-utilization of taxes, obstructed movement of goods, and multiple compliance requirements.

GST-FINAL sat.pptx

This document provides an overview of key aspects of the Goods and Services Tax (GST) in India, including:

- What GST is and the taxes it subsumes

- Registration requirements and thresholds

- Concepts of supply, composite/mixed supplies, and schedules

- Taxable events and the charging section

- Rates including nil and zero rated supplies

- Timelines for GST returns

The document covers the major components of the GST framework in India in a comprehensive manner across multiple pages.

GST-FINAL sat.pptx

This document provides an overview of key aspects of the Goods and Services Tax (GST) in India such as what GST is, taxes subsumed under GST, intra-state and inter-state taxes, the concept of supply, registration requirements, place of supply, the reverse charge mechanism, and return filing procedures. It discusses topics like the definition of supply, composite and mixed supplies, registration thresholds, compulsory registration scenarios, timelines for registration, and various return forms such as GSTR-1, GSTR-3B, and GSTR-4 with their periodicity and due dates.

More Related Content

What's hot

All about Input tax credit

The following Presentation enumerates the various provisions w.r.t. ITC, how it can be used,eligibilty and conditions for claiming ITC along with various case studies and illustrations. further, it elaborates the concept of input service distributor.

GST Annual Return (GSTR-9)

UPDATED PPT ON TABLE BY TABLE POINTS ON GST ANNUAL RETURN GSTR-9. CHECK POINTS OF GSTR-9 COUPLED WITH REFERENCE TO GST AUDIT GUIDE YOU TO ANNUAL COMPLIANCE UNDER GST.

Consequences of Fake Invoices under Income Tax Act and GST

Key Takeaways:

- Rationale for Introducing Penalty Provisions

- Consequences of Fake Invoicing under Income Tax Act and GST

- Legal Proceedings and Compounding of Offences

- Judicial Precedents

Supply under GST (goods and services tax)

This document provides definitions and explanations of key terms under the Goods and Services Tax (GST) in India such as goods, services, taxable person, supplier, recipient, location of supply, and place of business. It explains concepts like input service distributor, usual place of residence, principal place of business, and fixed establishment. The document aims to outline the scope and coverage of entities, transactions, and locations that would be subject to GST in India.

Gst (2017)

This slide will give you brief idea about how GST will work and how it will benefit the society as well as government.

Input tax credit (itc) under GST

GST is nothing but a value added tax on goods & services combined. It is the provisions of Input Tax Credit that make GST a value added tax i.e collection of tax at all points after allowing credit for the inputs

Concept of Input Service Distributor (ISD) in GST-PPT

Power-point Presentation in concept of Input Service Distributor (ISD) in GST- Analysis of relevant sections and rules

PPT on gst audit

The document summarizes audit requirements under the GST law in India. It discusses the annual audit that must be conducted by chartered accountants or cost accountants for businesses with annual turnover over 2 crore rupees. It also outlines the reconciliation statements that must be filed. Additionally, the document outlines the areas of focus in the audit including reconciliation of supplies, input tax credit, taxes paid and refunds. It briefly discusses the audit that can be conducted by tax authorities with advance notice to the registered business.

Gst section 16 - Input Tax Credit – Eligibility and Conditions

Gst section 16 - Input Tax Credit – Eligibility and Conditions

Chapter V - Eligibility and conditions for taking credit

LEVY AND COLLECTION OF GST – Scope of Supply - Schedule I, II & III

Under the old tax regime in India, different taxes like excise, VAT/CST, and service tax had different taxable events. GST unified these various taxes and introduced a single taxable event of "supply". Supply includes all forms of supply of goods or services for a consideration in the course of business. Certain activities specified in Schedules I, II and III of the GST acts are treated as supply. For a transaction to qualify as supply under GST, it must be a supply of goods or services, for a consideration, in the course of business, by a taxable person, and be a taxable supply.

Input tax credit under GST

The document discusses India's Goods and Services Tax (GST) policies and regulations related to input tax credit. Key points include:

- Under GST, input tax credit is available for goods, services, and capital goods used in the course of business. This is a significant expansion of credit compared to earlier tax systems.

- Credit can be claimed by registered businesses against central GST, state GST, integrated GST, and Union territory tax paid on business purchases.

- Certain documents like tax invoices and bills of entry must be possessed, and payment must be made to the supplier within 180 days, for credit to be claimed.

- There are also time limits, apportionment and reversal

Block credit under sec 17(5) of gst

360 degree analysis of block credit in relation to vehicle , vessels and aircraft includes amendment which are effective from 01.02.2019 in their relation

GST - Input tax credit

Your guide on the most crucial pillar of GST - Input Tax Credit.

We hope this guide can help you understand the contours of Input Tax credit with regard what you are eligible for and what is explicitly denied in the law.

E way bill under GST

The document provides information about e-way bills in India. It discusses the objective and need for e-way bills, provisions under law, the e-way bill generation process which involves filling Part A and Part B, validity periods, extensions, cancellations, exceptions and verification process. E-way bills are required for inter-state movement of goods of over Rs. 50,000 in value and aim to facilitate seamless movement of goods and prevent tax evasion. Registered persons need to generate e-way bills on the common portal prior to movement of goods, listing key details of the consignment, supplier and recipient.

Input Tax Credit under GST

Find out the detailed explanation of the provisions relating to Input Tax Credit under the dual GST Law from the presentation . Give it a read and we would love to know your feedback!

GST-INPUT TAX CREDIT

The document provides information on input tax credit under GST in India. It defines key terms like input tax, input service, capital goods, output tax, inward and outward supplies. It explains the process of availing and utilizing input tax credit and conditions that must be met like having a valid tax invoice and the supplier depositing the taxes. Certain items are ineligible for input tax credit like motor vehicles, food and beverages, life and health insurance, and works contract services for construction of immovable property. The time limit to claim input tax credit is within one year from the invoice date or the due date of filing annual return, whichever is earlier.

Gst input tax credit eligibility

The document discusses input tax credit (ITC) under the Goods and Services Tax (GST) regime in India. Some key points:

1. ITC aims to ensure tax is levied only on value addition at each stage of supply chain to eliminate cascading of taxes. Only registered taxpayers can claim ITC subject to certain conditions.

2. Eligible inputs/services include those used in business. Capital goods are eligible for ITC over multiple years. ITC must be claimed within prescribed time limits and supported by valid documents.

3. ITC is allowed for taxable and zero-rated supplies but not for exempt, non-taxable or personal consumption. Credit must be apportioned

EPCG, ADV. LICE. AND EXPORT INCENTIVES

The document discusses various export promotion schemes in India including the Export Promotion Capital Goods (EPCG) Scheme, Advance Authorization Scheme, and Duty Drawback Scheme. The EPCG Scheme allows import of capital goods for production and export at zero customs duty with an export obligation. Advance Authorization allows duty-free import of raw materials for export production. Duty Drawback directly deposits a calculated amount in the exporter's account as an export incentive based on export product, quantity, and customs duty rates. The document provides details on applying for these schemes, export procedures and documentation requirements, and examples of duty drawback calculations.

Customs Duty

This document defines and explains customs duties in India. It states that customs duty is a tax imposed on imports and exports to raise government revenue and protect domestic industries. There are different types of customs duties including basic customs duty, additional duty, education and secondary education cess, and special additional duty. The document provides examples of how each duty is calculated and applied to the assessable value of imported goods.

Indirect taxes in india- pre gst era

This document provides an overview of indirect taxes in India prior to the Goods and Services Tax (GST) era. It discusses the types of indirect taxes in India including Value Added Tax (VAT) and its variants. It outlines key features of indirect taxes such as the taxable event, incidence and impact, regressive nature, and role in generating government revenue. The document also discusses provisions in the Indian Constitution related to tax authority and lists some major defects in the indirect tax structure like multiplicity of taxes, lack of cross-utilization of taxes, obstructed movement of goods, and multiple compliance requirements.

What's hot (20)

Consequences of Fake Invoices under Income Tax Act and GST

Consequences of Fake Invoices under Income Tax Act and GST

Concept of Input Service Distributor (ISD) in GST-PPT

Concept of Input Service Distributor (ISD) in GST-PPT

Gst section 16 - Input Tax Credit – Eligibility and Conditions

Gst section 16 - Input Tax Credit – Eligibility and Conditions

LEVY AND COLLECTION OF GST – Scope of Supply - Schedule I, II & III

LEVY AND COLLECTION OF GST – Scope of Supply - Schedule I, II & III

Similar to Gst flowchart icai composition scheme

GST-FINAL sat.pptx

This document provides an overview of key aspects of the Goods and Services Tax (GST) in India, including:

- What GST is and the taxes it subsumes

- Registration requirements and thresholds

- Concepts of supply, composite/mixed supplies, and schedules

- Taxable events and the charging section

- Rates including nil and zero rated supplies

- Timelines for GST returns

The document covers the major components of the GST framework in India in a comprehensive manner across multiple pages.

GST-FINAL sat.pptx

This document provides an overview of key aspects of the Goods and Services Tax (GST) in India such as what GST is, taxes subsumed under GST, intra-state and inter-state taxes, the concept of supply, registration requirements, place of supply, the reverse charge mechanism, and return filing procedures. It discusses topics like the definition of supply, composite and mixed supplies, registration thresholds, compulsory registration scenarios, timelines for registration, and various return forms such as GSTR-1, GSTR-3B, and GSTR-4 with their periodicity and due dates.

Goods and Service Tax - Relevant Definitions

These slides provide an overview of Goods And Service Tax. I have covered some of the Definitions related to GST here.

Ms. Suchitra Kumari has assisted in editing these slides.

A GOOD TUTORIAL TO UNDERSTAND GOODS AND SEERVICE

This document provides information about GST registration requirements in India. It defines key terms related to registration such as aggregate turnover, casual taxable person, etc. It explains that registration is required if aggregate turnover exceeds Rs. 20 lakhs. It also discusses the process of applying for registration online, details required, registration number format, display of registration certificate, amendment and cancellation procedures.

AN OVERVIEW OF IGST ACT

The document provides an overview of key aspects of the Integrated Goods and Services Tax (IGST) Act in India. It notes that IGST is levied on all inter-state supplies of goods and services at a rate not exceeding 40%. Zero-rated supplies that allow for input tax credit include exports and supplies to special economic zones. Advance rulings under the IGST Act provide binding guidance on issues like classification and taxability. Refund provisions exist for taxes wrongly paid and for goods purchased in India by international tourists.

GST LAW_12_09_2016

The document provides information about Goods and Service Tax (GST) in India. Some key points:

1. GST Network (GSTN) was incorporated in 2013 as a private company to function as a common IT infrastructure for GST-related filings and tax payments.

2. The proposed dual GST model in India includes CGST, SGST, and IGST which will be levied on intra-state and inter-state supplies respectively.

3. The Model GST law includes provisions related to registration of taxable persons, filing of returns, payment and collection of tax, and defines key terms like person, supply, goods, services etc.

Mr. Rohan Shah.ppt

This document discusses the introduction of a negative list for service tax in India through amendments made in the Finance Act of 2012. It provides background on the existing complex tax structure for goods and services in India. The key changes introduced include switching from a selective approach to taxing services to a negative list approach, where all services are taxable unless specifically exempted. A negative list of 17 services now exempted from tax is provided. The document discusses the rationale for introducing a negative list to simplify compliance and widen the tax base. It is estimated to potentially increase tax revenues substantially.

Issues in Export & Import of Goods & Services vis-a-vis Foreign Trade Policy

The following presentation enumerates various issues related to import and export of goods under GST like modes of exports, zero-rated supply, supplies to SEZ and others, how to claim refund of ITC and IGST by using different forms. Further, it deals with methods to rectify mistakes in the respective refund forms under GST.

Input tax credit in GST

The document discusses concepts related to input tax credit under GST including definitions of key terms, eligibility criteria for availing input tax credit, utilization of input tax credits across states, and restrictions on availing input tax credit for certain goods and services. It provides illustrations of availment and utilization of input tax credit for intra-state and inter-state transactions. It also discusses special provisions related to capital goods and transition provisions for availment of credits.

Presentation on igst model

This document provides an overview of the proposed Goods and Services Tax (GST) model in India. It discusses the perceived benefits of GST, the existing indirect tax structure, key features of the Constitution Amendment Bill, the proposed GST model including features of the draft GST law, the role of the GST Network and Central Board of Excise and Customs, and the next steps toward implementation. The key aspects covered are the dual GST structure of CGST and SGST/IGST, the proposed tax rates and compliance requirements, and the transition process.

Vikram cgst updated budget 2018

The document provides an overview of key changes and definitions in the CGST Act related to Budget 2018. Some important points include:

- Chapter 1 covers introductory provisions including important definitions like casual taxable person, non-resident taxable person, composite supply, mixed supply, exempt supply, non-taxable supply, and goods and services.

- Chapter 2 deals with tax officers and their powers. Important officers include those appointed by the central and state governments.

- Chapter 3 covers levy and collection of tax including the scope and time of supply, tax liability on composite/mixed supplies, the charging section, reverse charge, and the composition scheme.

- Chapter 4 defines the time and value

EXPORT OF GOODS IN GST REGIME

The document discusses key provisions related to exports of goods in the GST regime, including definitions, rules and procedures for claiming refunds on zero-rated supplies. It provides details on sections and rules governing zero-rated supplies, input tax credit, blocked credits, and the options and processes for claiming refunds on exports - either without payment of tax by furnishing a letter of undertaking or bond, or by paying tax upfront and then claiming refund. It also summarizes the relevant circulars issued with respect to furnishing letters of undertaking or bonds for exports.

Perusal of Reverse Charge Mechanism in GST

This document provides information on Goods and Service Tax (GST) laws regarding reverse charge mechanism (RCM) in India. Some key points:

1. Under GST law, the government can notify categories of goods or services where tax is to be paid by the recipient of such goods/services under RCM instead of the supplier.

2. Tax is to be paid under RCM by registered recipients on inward supplies of goods or services exceeding Rs. 5000 per day from unregistered suppliers.

3. Notified services and goods where tax is to be paid by the recipient under RCM are provided in the document along with detailed analysis and explanations.

4. The process of discharging reverse charge

Budget Presentation 2023_GST_CLAUSE_04022023.pdf

Presentation on Indirect Proposal of Budget 2023.

Our Partner Ramandeep Singh Bhatia presented the same before the august gathering of members from trade and profession.

#GST #tax #gstupdates #gstindia #gstind

#budget2023 #budget

Normal Service tax rate with effect from 1st June 2015 is 14

This document provides information on service tax rates for various taxable services in India effective June 1, 2015. Key services mentioned include transport, accommodation, food and beverages, tour packages, construction, and works contracts. Tax rates range from 1.4% to 9.8% depending on the specific service and whether input tax credits have been claimed. The document also outlines revised service tax rates for activities like booking air tickets, life insurance, money changing, and lottery distribution.

Framework of GST Laws

The document provides an overview of the framework of GST laws in India. It discusses key concepts such as the types of GST (CGST, SGST, IGST), taxes subsumed under GST, exclusions from GST, laws governing GST, and the GST council. It also explains important aspects like the administration of GST, levy and collection of tax, the concept of supply which is the taxable event, and import of services under GST.

GST TRAINING ON VARIOUS CONCEPTS OF GST

This presentation enumerates the constitutional aspect of GST with amendments, GST levy on goods and services in inter-state and intra-state supply, what is supply, types of supply, the supply of goods or services, persons liable to pay tax under GST, taxable and distinct persons under GST and reverse charge mechanism under GST.

GCC VAT Agreement (with Index)

Pleased to share a curated version of Gulf Co-operation Council (GCC) Value Added Tax (VAT) Agreement with an index for ease of reading and reference. An index is a basic yet important element to give an overview of all the provisions of the law.

This document is intended for CFOs, finance controllers, finance managers, lawyers and tax professionals involved in the VAT implementation in the UAE, KSA, Kuwait, Oman, Bahrain and Qatar.

We are a team of tax and accounting professionals, advising & assisting companies/businesses on VAT implementation in the UAE and Saudi Arabia. Please feel free to contact us on info@AskPankaj.com

GST - E-Invoicing and New GST Returns.pdf

The document provides information on e-invoicing, new GST returns, and integrated GST solutions in India. It discusses the proposed e-invoicing infrastructure and process, highlighting key aspects like mandatory fields. New GST returns being introduced include Normal, Sahaj, and Sugam returns filed monthly or quarterly depending on taxpayer turnover. The document outlines differences between the existing and new return filing processes.

28-05-2017_Nagpur_GST_Conclave3.pptx

This document provides an overview of the Goods and Services Tax (GST) in India. It discusses the problems with the current indirect tax structure, the key features of GST, and how GST aims to be a "game changer" by replacing multiple taxes with a single tax and reducing economic distortions. The document outlines the proposed GST model and rates, input tax credit provisions, registration requirements, and transition provisions. It also summarizes the statutory scheme for levying GST on intra-state and inter-state supplies.

Similar to Gst flowchart icai composition scheme (20)

Issues in Export & Import of Goods & Services vis-a-vis Foreign Trade Policy

Issues in Export & Import of Goods & Services vis-a-vis Foreign Trade Policy

Normal Service tax rate with effect from 1st June 2015 is 14

Normal Service tax rate with effect from 1st June 2015 is 14

More from Rajula Gurva Reddy

Gst flowchart icai supply

The document provides an overview of the Goods and Services Tax (GST) in India. It defines key terms like taxable supply, non-taxable supply, and exempt supply. It outlines the sections of the GST acts that cover aspects like the levy of GST, time and place of supply, input tax credit, registration, returns and payments. The document also briefly mentions the rate of GST, valuation rules, reverse charge mechanism, and transitional provisions.

Gst flowchart icai location of suplier receiver

The document provides an overview of the Goods and Services Tax (GST) in India. It defines key terms like taxable supply, non-taxable supply, and exempt supply. It outlines the sections of the GST acts that cover aspects like the levy of GST, time and place of supply, input tax credit, registrations, returns and payments. The document also briefly mentions the tax rates under GST and the exceptions to the levy.

Executive supplement gst

This document provides an overview of the Goods and Services Tax (GST) implemented in India, including:

1. It outlines the history and challenges of India's previous indirect tax structure that led to the implementation of GST. This includes issues like cascading taxes and lack of uniformity across states.

2. It summarizes international models of GST and how it has been implemented in over 140 countries globally with common principles like being destination-based and allowing input tax credits.

3. It describes the objectives and key aspects of GST in India like subsuming multiple taxes into a single tax, creating a unified market, and being a consumption-based tax levied at each stage of supply.

Simplified approach to export of services rules dear friends

This document analyzes whether certain services provided in India would qualify as export of services under service tax rules. It provides explanations for each condition required to classify a service as an export of service, including that the service provider and recipient must be located in different countries, the payment must be received in foreign currency, and the place of provision must be outside India based on the Place of Provision of Services Rules. The document concludes that if all conditions specified in the Export of Services Rules are met, including those analyzed in the questions and answers, then a service can be classified as an export of service and would not be taxable.

Cbec notification-40-2017-cgst-rate-dt-23-oct-2017-nominal-gst-rate-for-suppl...

This notification provides an exemption from central tax for intra-state supply of goods by a registered supplier to a registered recipient for export, with the tax levied reduced to 0.05% from the standard rate. Several conditions are outlined for the supplier and recipient to qualify for the exemption, including the supplier issuing an invoice, the recipient exporting goods within 90 days and providing shipping documentation to the supplier. The supplier is not eligible for exemption if the recipient fails to export within 90 days of invoicing.

Types of returns under gst

The document discusses the various types of returns that must be filed under the Goods and Services Tax (GST) in India. It explains returns that normal taxpayers, composition taxpayers, foreign non-residents, input service distributors, tax deductors, and e-commerce operators must file, including GSTR-1, GSTR-2, GSTR-3, GSTR-4, and others. These returns must be filed monthly or quarterly and include details of outward and inward supplies, tax payments, input tax credits, and reconciliations to ensure all transactions are recorded properly.

Gst flowchart icai gst returns

The document provides an overview of the Goods and Services Tax (GST) in India. It defines key terms like taxable supply, non-taxable supply, and exempt supply. It outlines the sections of the GST acts that cover levy, place of supply, time of supply, nature of supply, input tax credit, registration, returns, payments, and refunds. The document also briefly mentions the chapters that cover assessments, audits, inspections, demands and recovery, appeals and revisions, offences and penalties.

Gst flowchart icai assessment

The document provides an overview of the Goods and Services Tax (GST) in India. It defines key terms like taxable supply, non-taxable supply, and exempt supply. It outlines the sections of the GST acts that cover levy, place of supply, time of supply, nature of supply, input tax credit, registration, returns, payments, and refunds. The document also briefly mentions the chapters that cover assessments, audits, inspections, demands and recovery, appeals and revisions, offences and penalties.

Gst flowchart icai valuation

The document provides an overview of the Goods and Services Tax (GST) in India. It defines key terms like taxable supply, non-taxable supply, and exempt supply. It outlines the sections of the GST acts that cover aspects like the levy of GST, time and place of supply, input tax credit, registration, returns and payments. The document also briefly mentions the tax rates under GST and chapters dealing with assessments, appeals and penalties.

Gst flowchart icai time of supply

The document provides an overview of the Goods and Services Tax (GST) in India. It defines key terms like taxable supply, non-taxable supply, and exempt supply. It outlines the sections of the GST acts that cover aspects like the levy of GST, time and place of supply, input tax credit, registration, returns and payments. The document also briefly mentions the tax rates under GST and chapters dealing with assessments, appeals and penalties.

Gst flowchart icai audit

The document provides an overview of the Goods and Services Tax (GST) in India. It defines key terms like taxable supply, non-taxable supply, and exempt supply. It outlines the sections of the GST acts that cover levy, place of supply, time of supply, nature of supply, input tax credit, registration, returns, payments, and refunds. The document also briefly mentions the chapters that cover assessments, audits, inspections, demands and recovery, appeals and revisions, offences and penalties.

Gst flowchart icai registration

The document provides an overview of the Goods and Services Tax (GST) in India. It defines key terms like taxable supply, non-taxable supply, and exempt supply. It outlines the sections of the GST acts that cover aspects like the levy of GST, time and place of supply, input tax credit, registration, returns and payments. The document also briefly mentions the tax rates under GST and chapters dealing with assessments, appeals and penalties.

Gst flowchart icai assessment

The document provides an overview of key concepts related to the Goods and Services Tax (GST) in India. It defines important terms like taxable supply, non-taxable supply, and exempt supply. It also outlines the sections of the GST law that cover levy and rates, valuation, registration, time and place of supply, input tax credit, and compliance requirements.

Gst flowchart icai offences

The document provides an overview of the Goods and Services Tax (GST) in India. It defines key terms like taxable supply, non-taxable supply, and exempt supply. It outlines the sections of the GST acts that cover aspects like the levy of GST, time and place of supply, input tax credit, registration, returns and payments. The document also briefly mentions the rate of GST, valuation rules, reverse charge mechanism, and transitional provisions.

Gst concept, impact analysis

The document provides information about Goods and Services Tax (GST) in India, including:

1) It defines GST and explains that it is a single tax rate for goods and services unlike the previous system which had different tax rates for goods and services.

2) GST has two components - Central GST and State GST which are levied on intra-state supplies, and Integrated GST which is levied on inter-state supplies.

3) The document discusses the key aspects of GST such as its structure, rates, time and place of supply, input tax credit, returns, and the impact and changes for businesses. It aims to simplify complex GST concepts with examples and

Types of returns under gst

The document discusses the various types of returns that must be filed under the Goods and Services Tax (GST) in India. It explains returns that normal taxpayers, composition taxpayers, foreign non-residents, input service distributors, tax deductors, and e-commerce operators must file, including GSTR-1, GSTR-2, GSTR-3, GSTR-4, and others. These returns must be filed monthly or quarterly and include details of outward and inward supplies, tax payments, input tax credit, and reconciliations to ensure all transactions are recorded properly.

Gst presentation

The document provides information on India's proposed Goods and Services Tax (GST) regime, including:

1) It outlines the current indirect tax regime and taxes that will be subsumed or not subsumed under GST. Major taxes to be subsumed include service tax, central excise duty, VAT/sales tax, while some taxes like electricity duty and property tax will not be.

2) GST will include CGST, SGST, UGST, and IGST which will be levied on the supply of goods or services. IGST will apply to inter-state supplies while CGST+SGST will apply intra-state.

3) Input tax credit will be

Ethics

This document discusses professional ethics for lawyers in India. It covers the origin and development of the legal profession in India from ancient times through British rule to the present. Key highlights include:

1) The Advocates Act of 1961 established the Bar Council of India and State Bar Councils to regulate the legal profession and enroll advocates.

2) To enroll as an advocate one must be an Indian citizen over 21, have a recognized law degree, and pay the enrollment fee. Convictions for moral turpitude or untouchability offenses can disqualify enrollment.

3) The Bar Councils frame rules on professional ethics, take disciplinary action for misconduct, and protect advocates' rights. Senior Advocate status

Issues in pops final

The document summarizes key changes to the rules for determining the place of provision of services under the service tax regime in India post 2012. Some key points:

1. A new charging section was introduced requiring determination of place of provision of service.

2. The Place of Provision of Services Rules, 2012 (POPS Rules) were introduced to determine whether a service was provided in the "taxable territory".

3. Under the main Rule 3, the location of the service receiver determines the place of provision. Exceptions are provided in Rules 4-6 and 9-12.

Simplified approach to export of services rules dear friends

This document analyzes whether certain services provided in India would qualify as export of services under service tax rules. It provides explanations for each condition required to qualify as an export of service, including that the service provider must be located in India, the recipient located outside India, the service cannot be in the negative list, the place of provision must be outside India, and payment must be received in convertible foreign currency. The document concludes that if all conditions under Rule 6A of the Service Tax Rules are met, the service will be considered an export of service.

More from Rajula Gurva Reddy (20)

Simplified approach to export of services rules dear friends

Simplified approach to export of services rules dear friends

Cbec notification-40-2017-cgst-rate-dt-23-oct-2017-nominal-gst-rate-for-suppl...

Cbec notification-40-2017-cgst-rate-dt-23-oct-2017-nominal-gst-rate-for-suppl...

Simplified approach to export of services rules dear friends

Simplified approach to export of services rules dear friends

Recently uploaded

Sangyun Lee, 'Why Korea's Merger Control Occasionally Fails: A Public Choice ...

Presentation slides for a session held on June 4, 2024, at Kyoto University. This presentation is based on the presenter’s recent paper, coauthored with Hwang Lee, Professor, Korea University, with the same title, published in the Journal of Business Administration & Law, Volume 34, No. 2 (April 2024). The paper, written in Korean, is available at <https://shorturl.at/GCWcI>.

What are the common challenges faced by women lawyers working in the legal pr...

The legal profession, which has historically been male-dominated, has experienced a significant increase in the number of women entering the field over the past few decades. Despite this progress, women lawyers continue to encounter various challenges as they strive for top positions.

Guide on the use of Artificial Intelligence-based tools by lawyers and law fi...

This guide aims to provide information on how lawyers will be able to use the opportunities provided by AI tools and how such tools could help the business processes of small firms. Its objective is to provide lawyers with some background to understand what they can and cannot realistically expect from these products. This guide aims to give a reference point for small law practices in the EU

against which they can evaluate those classes of AI applications that are probably the most relevant for them.

Incometax Compliance_PF_ ESI- June 2024

This document briefly explains the June compliance calendar 2024 with income tax returns, PF, ESI, and important due dates, forms to be filled out, periods, and who should file them?.

Lifting the Corporate Veil. Power Point Presentation

"Lifting the Corporate Veil" is a legal concept that refers to the judicial act of disregarding the separate legal personality of a corporation or limited liability company (LLC). Normally, a corporation is considered a legal entity separate from its shareholders or members, meaning that the personal assets of shareholders or members are protected from the liabilities of the corporation. However, there are certain situations where courts may decide to "pierce" or "lift" the corporate veil, holding shareholders or members personally liable for the debts or actions of the corporation.

Here are some common scenarios in which courts might lift the corporate veil:

Fraud or Illegality: If shareholders or members use the corporate structure to perpetrate fraud, evade legal obligations, or engage in illegal activities, courts may disregard the corporate entity and hold those individuals personally liable.

Undercapitalization: If a corporation is formed with insufficient capital to conduct its intended business and meet its foreseeable liabilities, and this lack of capitalization results in harm to creditors or other parties, courts may lift the corporate veil to hold shareholders or members liable.

Failure to Observe Corporate Formalities: Corporations and LLCs are required to observe certain formalities, such as holding regular meetings, maintaining separate financial records, and avoiding commingling of personal and corporate assets. If these formalities are not observed and the corporate structure is used as a mere façade, courts may disregard the corporate entity.

Alter Ego: If there is such a unity of interest and ownership between the corporation and its shareholders or members that the separate personalities of the corporation and the individuals no longer exist, courts may treat the corporation as the alter ego of its owners and hold them personally liable.

Group Enterprises: In some cases, where multiple corporations are closely related or form part of a single economic unit, courts may pierce the corporate veil to achieve equity, particularly if one corporation's actions harm creditors or other stakeholders and the corporate structure is being used to shield culpable parties from liability.

原版制作(PSU毕业证书)宾州州立大学公园分校毕业证学历证书一模一样

学校原件一模一样【微信:741003700 】《(PSU毕业证书)宾州州立大学公园分校毕业证学历证书》【微信:741003700 】学位证,留信认证(真实可查,永久存档)原件一模一样纸张工艺/offer、雅思、外壳等材料/诚信可靠,可直接看成品样本,帮您解决无法毕业带来的各种难题!外壳,原版制作,诚信可靠,可直接看成品样本。行业标杆!精益求精,诚心合作,真诚制作!多年品质 ,按需精细制作,24小时接单,全套进口原装设备。十五年致力于帮助留学生解决难题,包您满意。

本公司拥有海外各大学样板无数,能完美还原。

1:1完美还原海外各大学毕业材料上的工艺:水印,阴影底纹,钢印LOGO烫金烫银,LOGO烫金烫银复合重叠。文字图案浮雕、激光镭射、紫外荧光、温感、复印防伪等防伪工艺。材料咨询办理、认证咨询办理请加学历顾问Q/微741003700

【主营项目】

一.毕业证【q微741003700】成绩单、使馆认证、教育部认证、雅思托福成绩单、学生卡等!

二.真实使馆公证(即留学回国人员证明,不成功不收费)

三.真实教育部学历学位认证(教育部存档!教育部留服网站永久可查)

四.办理各国各大学文凭(一对一专业服务,可全程监控跟踪进度)

如果您处于以下几种情况:

◇在校期间,因各种原因未能顺利毕业……拿不到官方毕业证【q/微741003700】

◇面对父母的压力,希望尽快拿到;

◇不清楚认证流程以及材料该如何准备;

◇回国时间很长,忘记办理;

◇回国马上就要找工作,办给用人单位看;

◇企事业单位必须要求办理的

◇需要报考公务员、购买免税车、落转户口

◇申请留学生创业基金

留信网认证的作用:

1:该专业认证可证明留学生真实身份

2:同时对留学生所学专业登记给予评定

3:国家专业人才认证中心颁发入库证书

4:这个认证书并且可以归档倒地方

5:凡事获得留信网入网的信息将会逐步更新到个人身份内,将在公安局网内查询个人身份证信息后,同步读取人才网入库信息

6:个人职称评审加20分

7:个人信誉贷款加10分

8:在国家人才网主办的国家网络招聘大会中纳入资料,供国家高端企业选择人才

Genocide in International Criminal Law.pptx

Excited to share insights from my recent presentation on genocide! 💡 In light of ongoing debates, it's crucial to delve into the nuances of this grave crime.

XYZ-v.-state-of-Maharashtra-Bombay-HC-Writ-Petition-6340-2023.pdf

असंगत न्यायालयी फैसलों के कारण भारत में महिलाओं को सुरक्षित गर्भपात के लिए एक भ्रामक और अनुचित कानूनी लड़ाई का सामना करना पड़ रहा है।

Search Warrants for NH Law Enforcement Officers

Training aid for law enforcement officers related to search warrants, the requirements needed, drafting, and execution of the search warrant.

Patenting_Innovations_in_3D_Printing_Prosthetics.pptx

slide deck : Patenting innovations in 3D printing

Defending Weapons Offence Charges: Role of Mississauga Criminal Defence Lawyers

Discover how Mississauga criminal defence lawyers defend clients facing weapon offence charges with expert legal guidance and courtroom representation.

To know more visit: https://www.saini-law.com/

The Work Permit for Self-Employed Persons in Italy

Learn more on how to obtain the work permit for self-employed persons in Italy at https://immigration-italy.com/selfemployment-work-permit-in-italy/.

在线办理(SU毕业证书)美国雪城大学毕业证成绩单一模一样

学校原件一模一样【微信:741003700 】《(SU毕业证书)美国雪城大学毕业证成绩单》【微信:741003700 】学位证,留信认证(真实可查,永久存档)原件一模一样纸张工艺/offer、雅思、外壳等材料/诚信可靠,可直接看成品样本,帮您解决无法毕业带来的各种难题!外壳,原版制作,诚信可靠,可直接看成品样本。行业标杆!精益求精,诚心合作,真诚制作!多年品质 ,按需精细制作,24小时接单,全套进口原装设备。十五年致力于帮助留学生解决难题,包您满意。

本公司拥有海外各大学样板无数,能完美还原。

1:1完美还原海外各大学毕业材料上的工艺:水印,阴影底纹,钢印LOGO烫金烫银,LOGO烫金烫银复合重叠。文字图案浮雕、激光镭射、紫外荧光、温感、复印防伪等防伪工艺。材料咨询办理、认证咨询办理请加学历顾问Q/微741003700

【主营项目】

一.毕业证【q微741003700】成绩单、使馆认证、教育部认证、雅思托福成绩单、学生卡等!

二.真实使馆公证(即留学回国人员证明,不成功不收费)

三.真实教育部学历学位认证(教育部存档!教育部留服网站永久可查)

四.办理各国各大学文凭(一对一专业服务,可全程监控跟踪进度)

如果您处于以下几种情况:

◇在校期间,因各种原因未能顺利毕业……拿不到官方毕业证【q/微741003700】

◇面对父母的压力,希望尽快拿到;

◇不清楚认证流程以及材料该如何准备;

◇回国时间很长,忘记办理;

◇回国马上就要找工作,办给用人单位看;

◇企事业单位必须要求办理的

◇需要报考公务员、购买免税车、落转户口

◇申请留学生创业基金

留信网认证的作用:

1:该专业认证可证明留学生真实身份

2:同时对留学生所学专业登记给予评定

3:国家专业人才认证中心颁发入库证书

4:这个认证书并且可以归档倒地方

5:凡事获得留信网入网的信息将会逐步更新到个人身份内,将在公安局网内查询个人身份证信息后,同步读取人才网入库信息

6:个人职称评审加20分

7:个人信誉贷款加10分

8:在国家人才网主办的国家网络招聘大会中纳入资料,供国家高端企业选择人才

V.-SENTHIL-BALAJI-SLP-C-8939-8940-2023-SC-Judgment-07-August-2023.pdf

सुप्रीम कोर्ट ने यह भी माना था कि मजिस्ट्रेट का यह कर्तव्य है कि वह सुनिश्चित करे कि अधिकारी पीएमएलए के तहत निर्धारित प्रक्रिया के साथ-साथ संवैधानिक सुरक्षा उपायों का भी उचित रूप से पालन करें।

Matthew Professional CV experienced Government Liaison

As an experienced Government Liaison, I have demonstrated expertise in Corporate Governance. My skill set includes senior-level management in Contract Management, Legal Support, and Diplomatic Relations. I have also gained proficiency as a Corporate Liaison, utilizing my strong background in accounting, finance, and legal, with a Bachelor's degree (B.A.) from California State University. My Administrative Skills further strengthen my ability to contribute to the growth and success of any organization.

Synopsis On Annual General Meeting/Extra Ordinary General Meeting With Ordina...

Synopsis On Annual General Meeting/Extra Ordinary General Meeting With Ordina...Syed Muhammad Humza Hussain

Synopsis On Annual General Meeting/Extra Ordinary General Meeting With Ordinary And Special Businesses And Ordinary And Special Resolutions with Companies (Postal Ballot) Regulations, 2018Recently uploaded (20)

Sangyun Lee, 'Why Korea's Merger Control Occasionally Fails: A Public Choice ...

Sangyun Lee, 'Why Korea's Merger Control Occasionally Fails: A Public Choice ...

What are the common challenges faced by women lawyers working in the legal pr...

What are the common challenges faced by women lawyers working in the legal pr...

fnaf lore.pptx ...................................

fnaf lore.pptx ...................................

Guide on the use of Artificial Intelligence-based tools by lawyers and law fi...

Guide on the use of Artificial Intelligence-based tools by lawyers and law fi...

Lifting the Corporate Veil. Power Point Presentation

Lifting the Corporate Veil. Power Point Presentation

XYZ-v.-state-of-Maharashtra-Bombay-HC-Writ-Petition-6340-2023.pdf

XYZ-v.-state-of-Maharashtra-Bombay-HC-Writ-Petition-6340-2023.pdf

Patenting_Innovations_in_3D_Printing_Prosthetics.pptx

Patenting_Innovations_in_3D_Printing_Prosthetics.pptx

Defending Weapons Offence Charges: Role of Mississauga Criminal Defence Lawyers

Defending Weapons Offence Charges: Role of Mississauga Criminal Defence Lawyers

The Work Permit for Self-Employed Persons in Italy

The Work Permit for Self-Employed Persons in Italy

V.-SENTHIL-BALAJI-SLP-C-8939-8940-2023-SC-Judgment-07-August-2023.pdf

V.-SENTHIL-BALAJI-SLP-C-8939-8940-2023-SC-Judgment-07-August-2023.pdf

Matthew Professional CV experienced Government Liaison

Matthew Professional CV experienced Government Liaison

Tax Law Notes on taxation law tax law for 10th sem

Tax Law Notes on taxation law tax law for 10th sem

Synopsis On Annual General Meeting/Extra Ordinary General Meeting With Ordina...

Synopsis On Annual General Meeting/Extra Ordinary General Meeting With Ordina...

Gst flowchart icai composition scheme

- 1. GST Overview Is Transaction a Supply to attract GST, Verify Section 7 of CGST & Schedule III Supply (8 forms of supply, consideration, furtherance of business) Exception to Supply - Sch III No GST ( Ex, immovable property, Salary) Refer Sch II for Classification of Goods or Services Exception: Consideration NIL, transaction not in Sch I no GST (Ex : Intra state Branch Transfer) Refer Sec 9 of CGST / Sec 5 of IGST for Levy Rate ( HSN/SAC) 0,5,12,18,28 Valuation Section 15 Valuation Rules RCM – Supply RCM - URP Registration Sec 22, 23,24 Check Definitions of “aggregate turnover" aggregate value of all taxable supplies “taxable supply” supply leviable “non-taxable supply” supply not leviable to tax Sec 9(1)(2) excludes levy on the supply of alcoholic liquor for human consumption, the supply of petroleum crude, high speed diesel, petrol, natural gas and ATF “exempt supply” Nil Rate PoPs Goods Sec 10, 11 IGST Services Sec 12, 13 IGST Time of supply (ToS) Goods Sec 12 CGST Services Sec 13 CGST Nature of Supply (NoS) (Inter/Intra State) Sec 7 of IGST, Sec 9 of CGST ITC Sec 16,17,18,19, 20,21 Transitional Provisions Chapter XX Compliances Chpt VII – Tax invoice VIII – Accounts & Records IX – Returns X – Payment of Tax XI – Refund Department Work Chpt XII Assessments Chpt XIII Audit Chpt XIV Inspection, search, seizure and arrest Chpt XV Demands & Recovery Chpt XVII Advance Ruling Chpt XVIII Appeals and Revision Chpt XIX Offences and Penalties Month GSTIN Liability (A) ITC (B) Payment/Refund CGST SGST IGST CGST SGST IGST CGST SGST IGST TOS Registration Levy, PoPs & NoS Levy, PoPs & NoS Chapter X, XI PDF created with pdfFactory Pro trial version www.pdffactory.com

- 2. PDF created with pdfFactory Pro trial version www.pdffactory.com

- 3. “aggregate turnover" means the aggregate value of all taxable supplies (excluding the value of inward supplies on which tax is payable by a person on reverse charge basis, “taxable supply” means a supply of goods or services or both which is leviable to tax under this Act; “non-taxable supply” means a supply of goods or services or both which is not leviable to tax under this Act or under the Integrated Goods and Services Tax Act; Sec 9(1)(2) excludes levy on the supply of alcoholic liquor for human consumption, the supply of petroleum crude, high speed diesel, petrol, natural gas and ATF “exempt supply” means supply of any goods or services or both which attracts nil rate of tax or which may be wholly exempt from tax under section 11, or under section 6 of the Integrated Goods and Services Tax Act, and includes non-taxable supply; PDF created with pdfFactory Pro trial version www.pdffactory.com

- 4. PDF created with pdfFactory Pro trial version www.pdffactory.com

- 5. PDF created with pdfFactory Pro trial version www.pdffactory.com

- 6. PDF created with pdfFactory Pro trial version www.pdffactory.com

- 7. PDF created with pdfFactory Pro trial version www.pdffactory.com

- 8. PDF created with pdfFactory Pro trial version www.pdffactory.com

- 9. PDF created with pdfFactory Pro trial version www.pdffactory.com

- 10. PDF created with pdfFactory Pro trial version www.pdffactory.com

- 11. PDF created with pdfFactory Pro trial version www.pdffactory.com

- 12. PDF created with pdfFactory Pro trial version www.pdffactory.com

- 13. PDF created with pdfFactory Pro trial version www.pdffactory.com

- 14. PDF created with pdfFactory Pro trial version www.pdffactory.com

- 15. PDF created with pdfFactory Pro trial version www.pdffactory.com

- 16. PDF created with pdfFactory Pro trial version www.pdffactory.com

- 17. PDF created with pdfFactory Pro trial version www.pdffactory.com