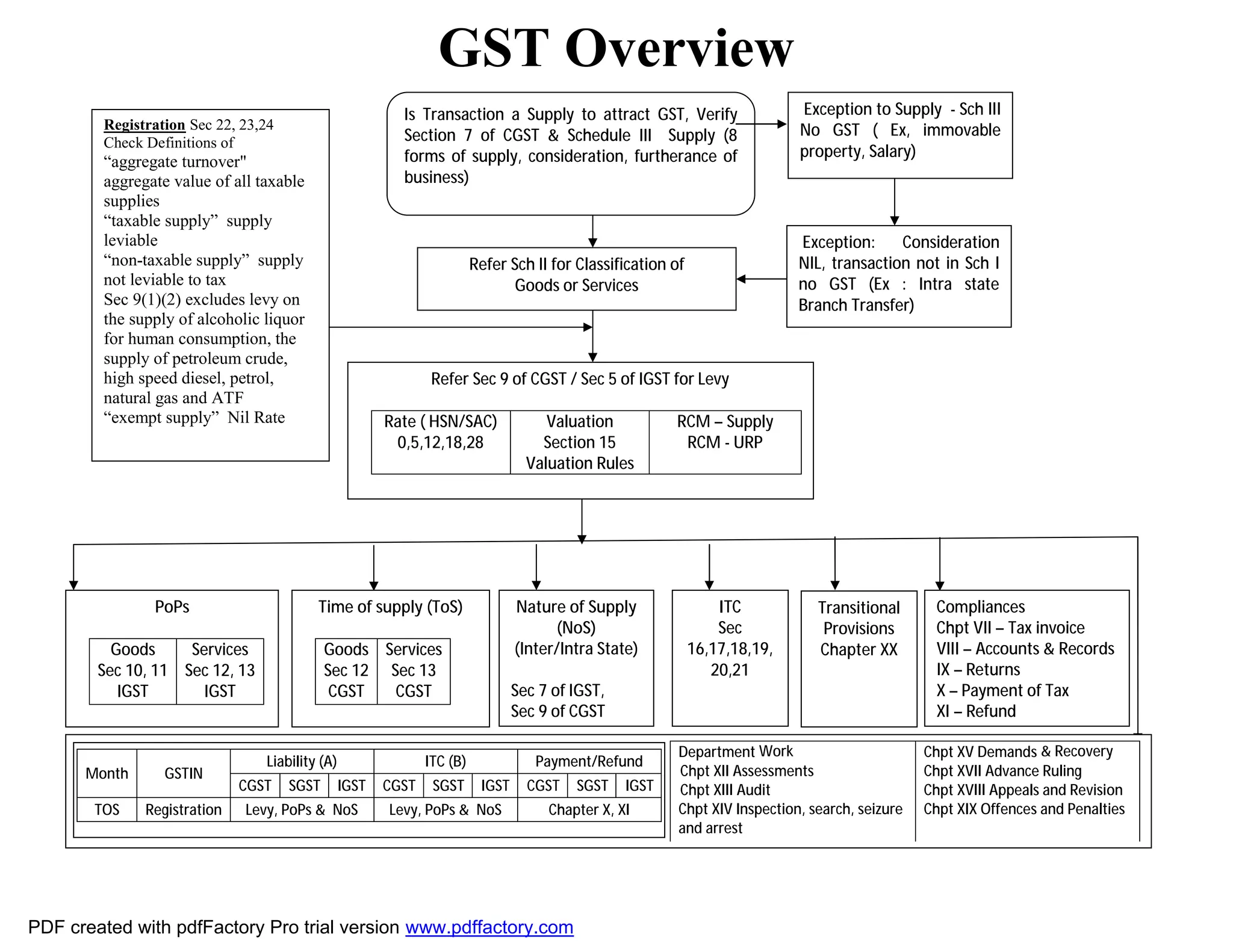

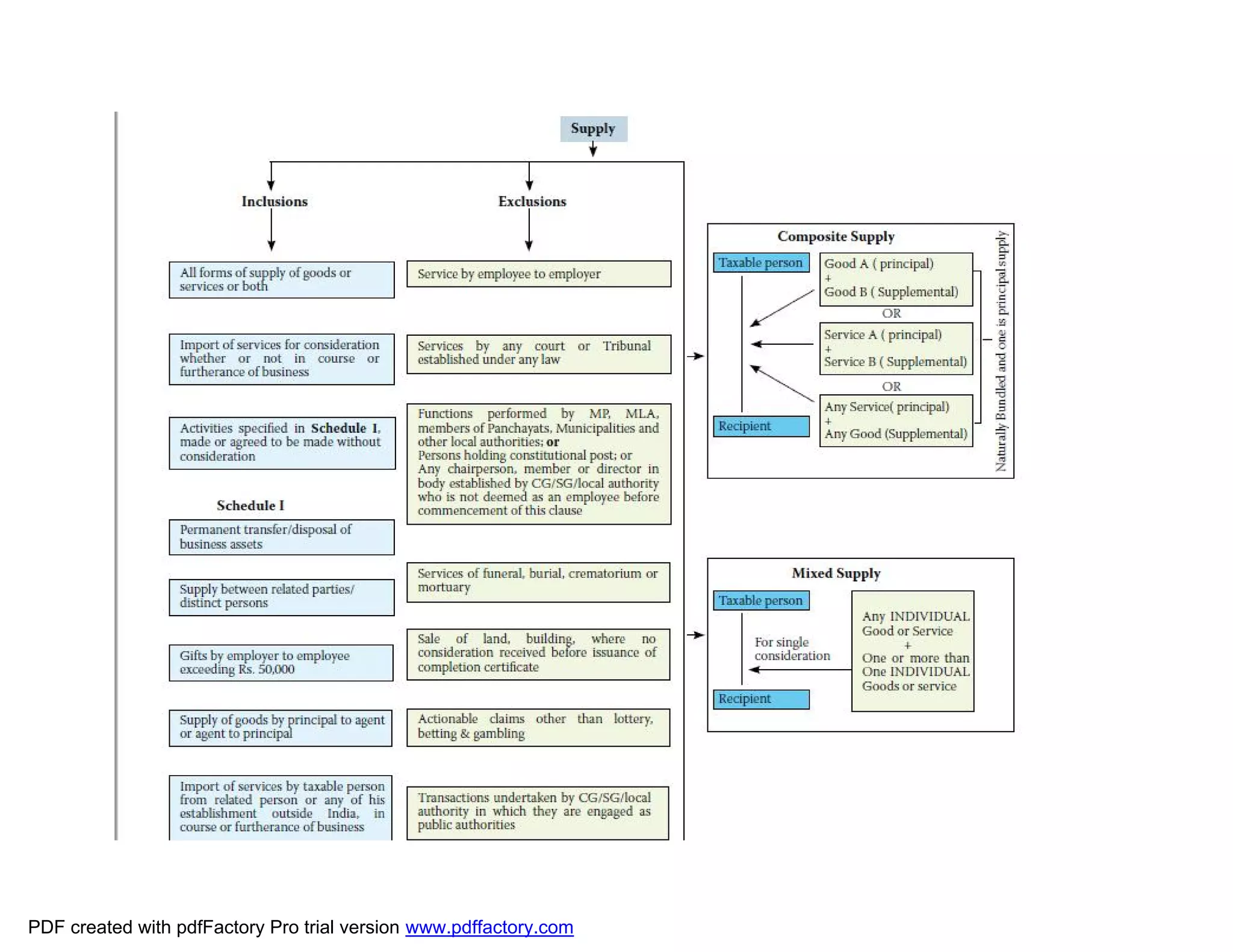

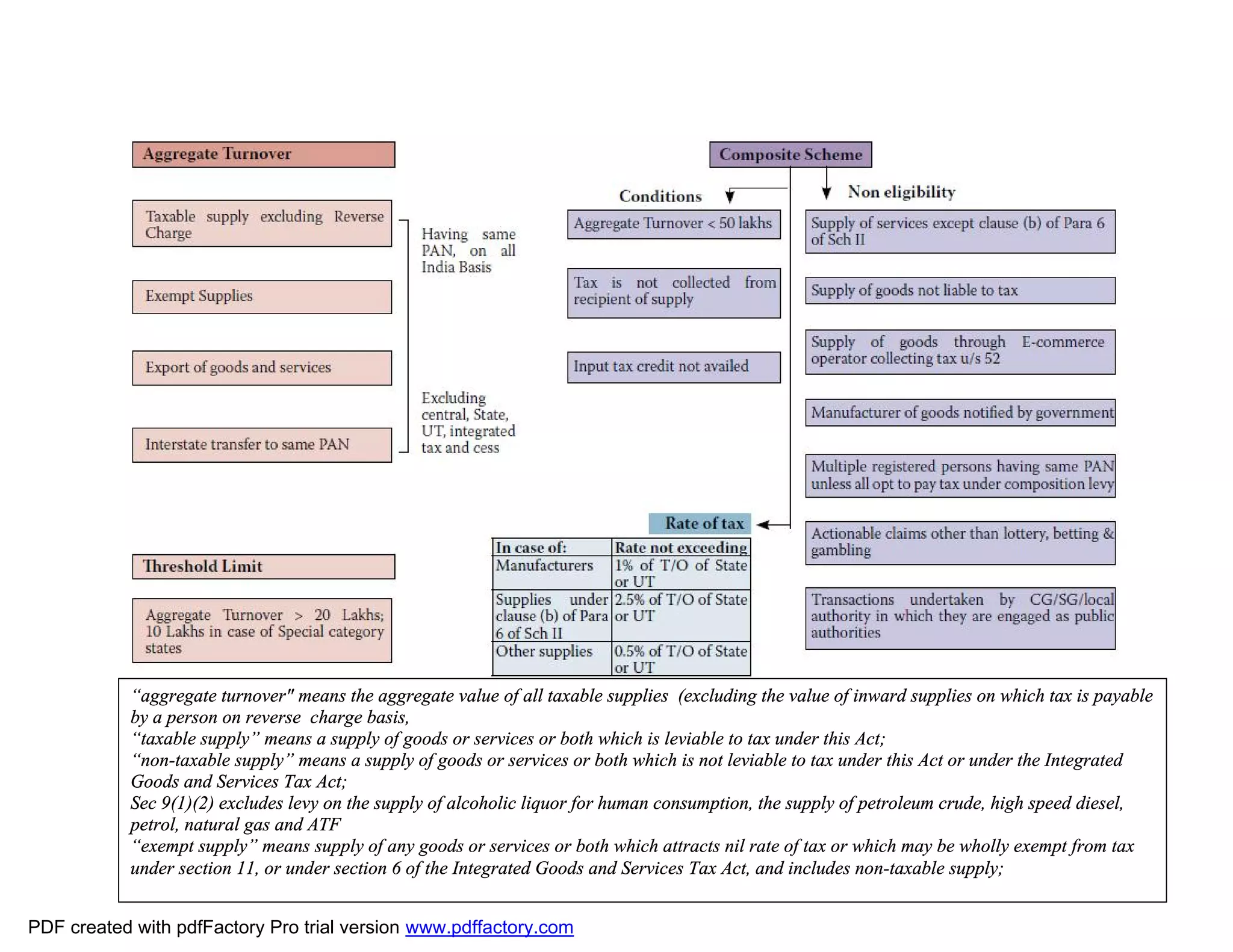

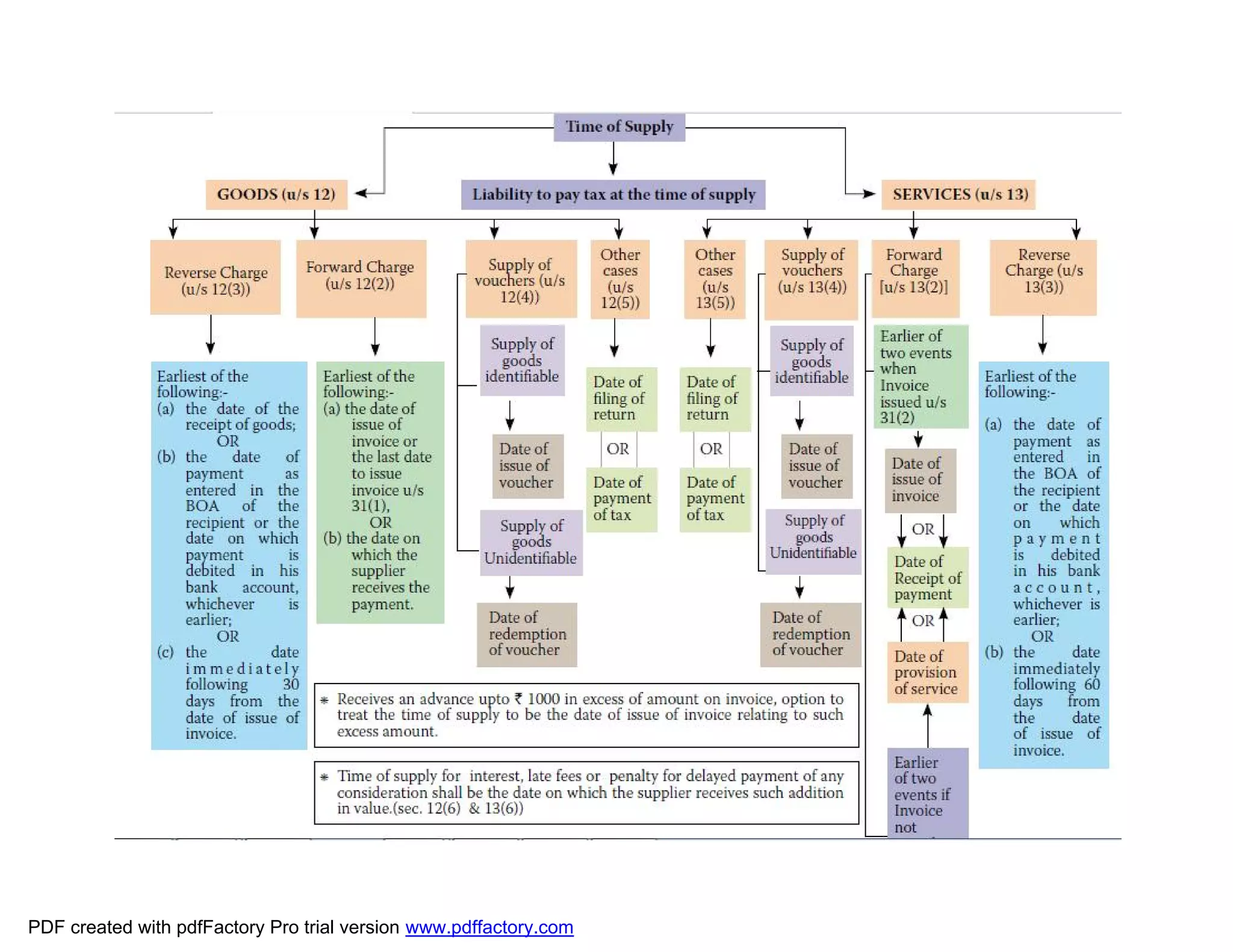

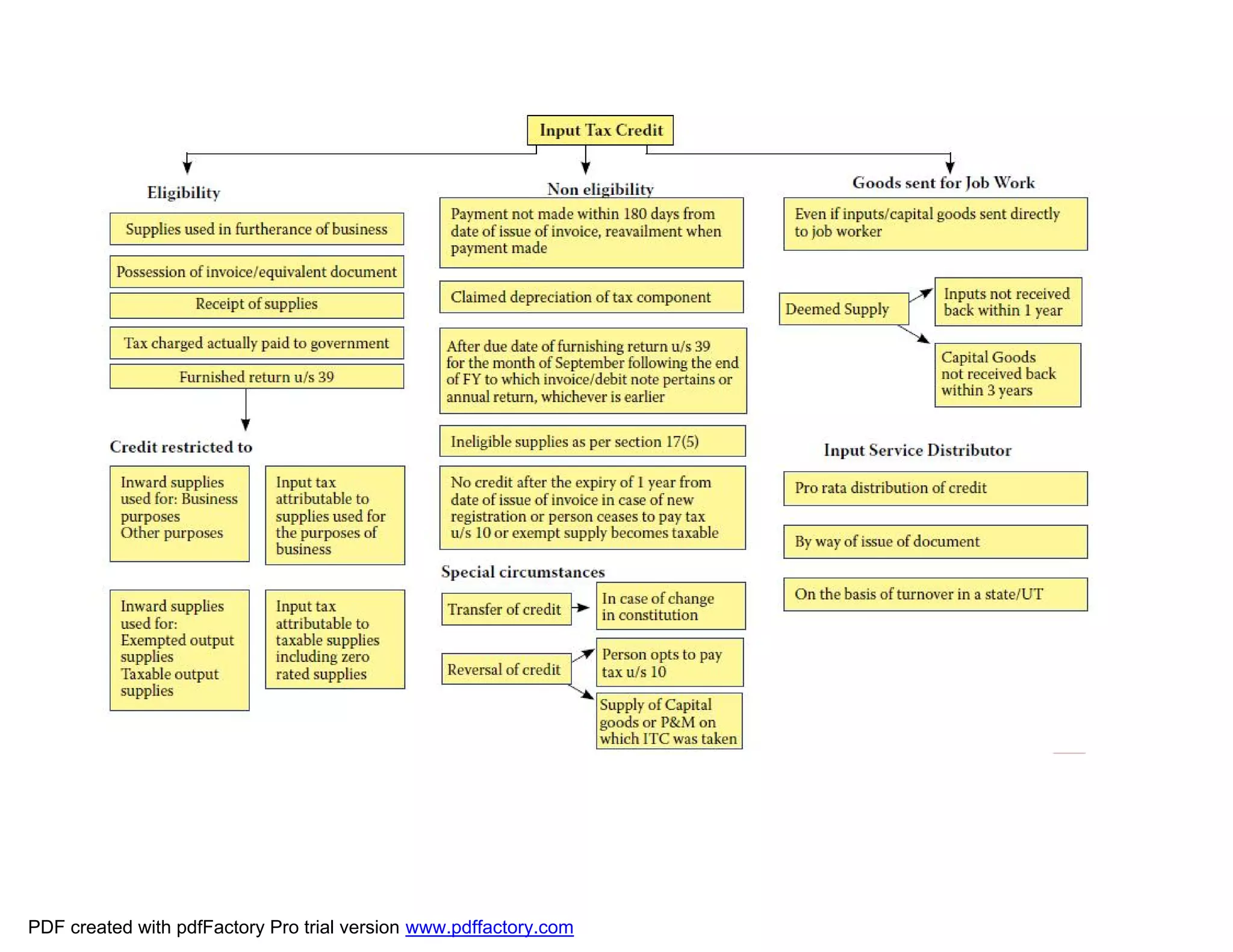

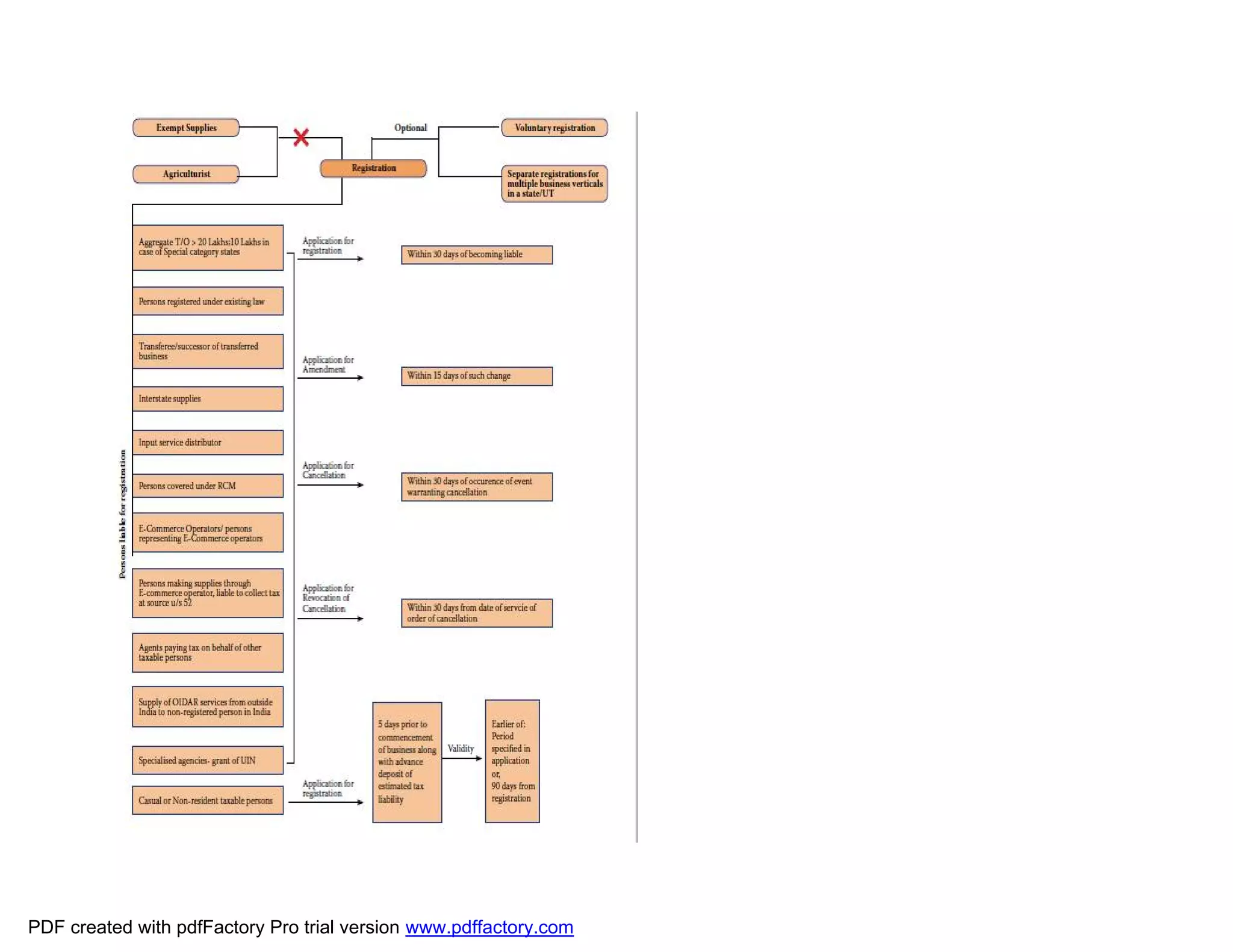

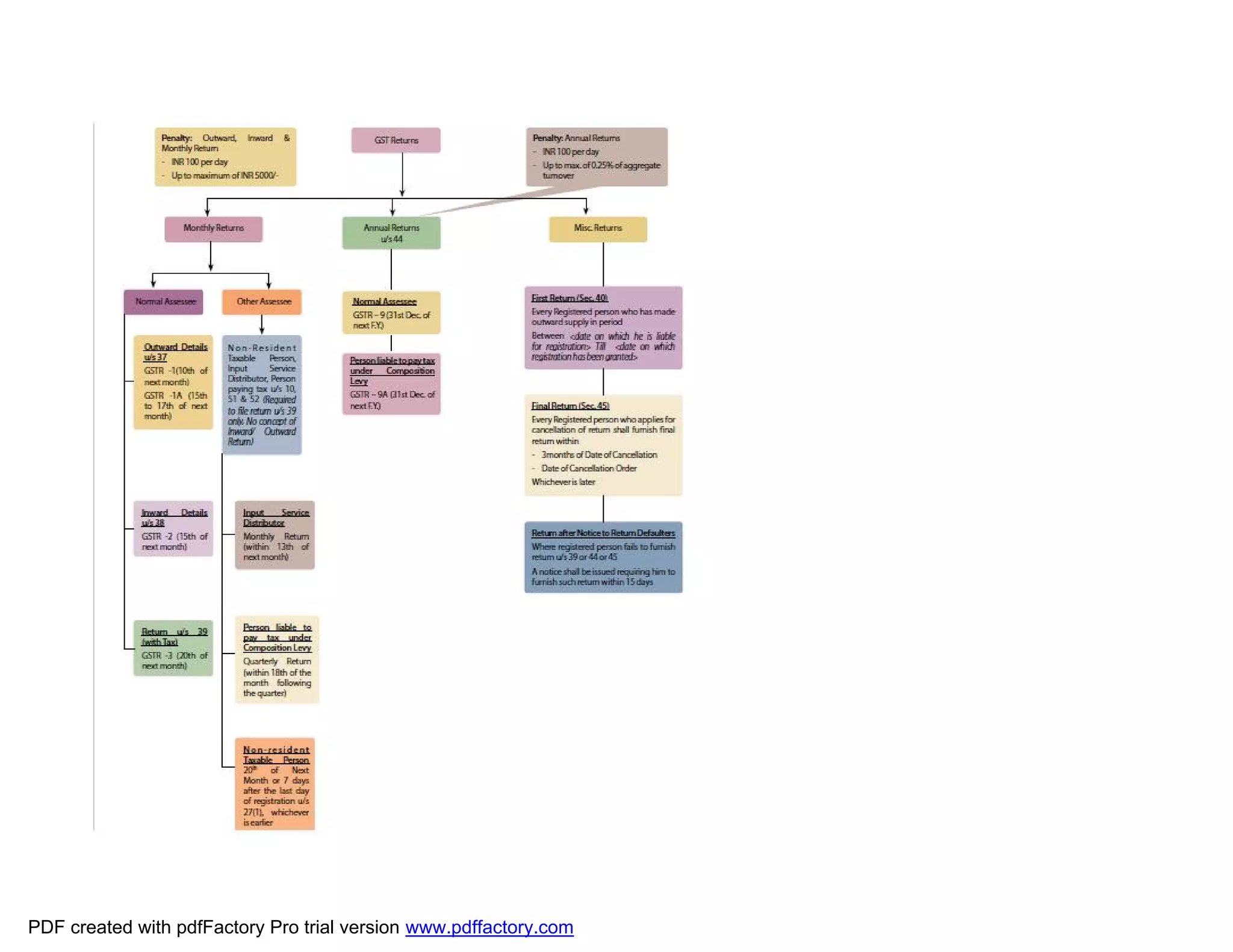

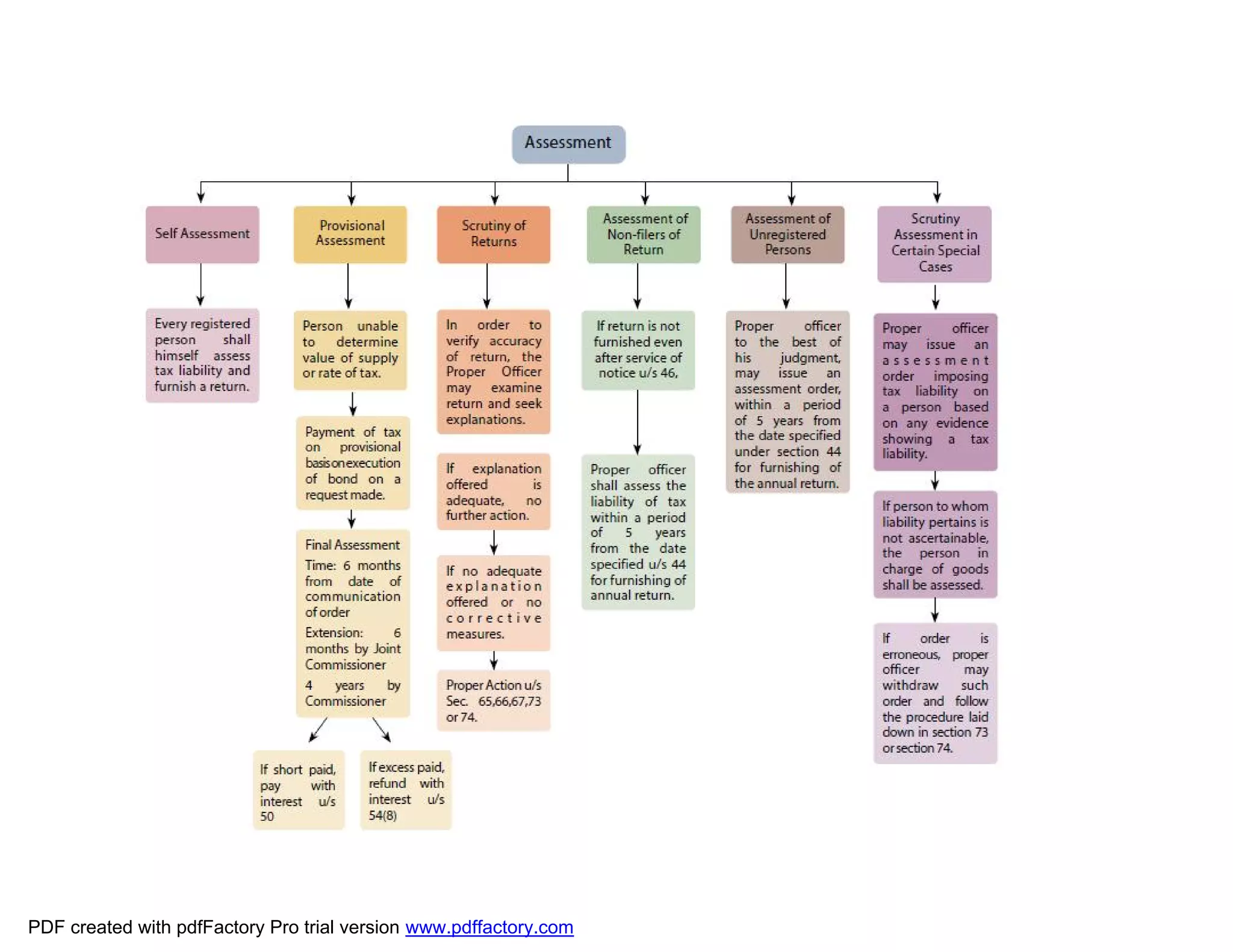

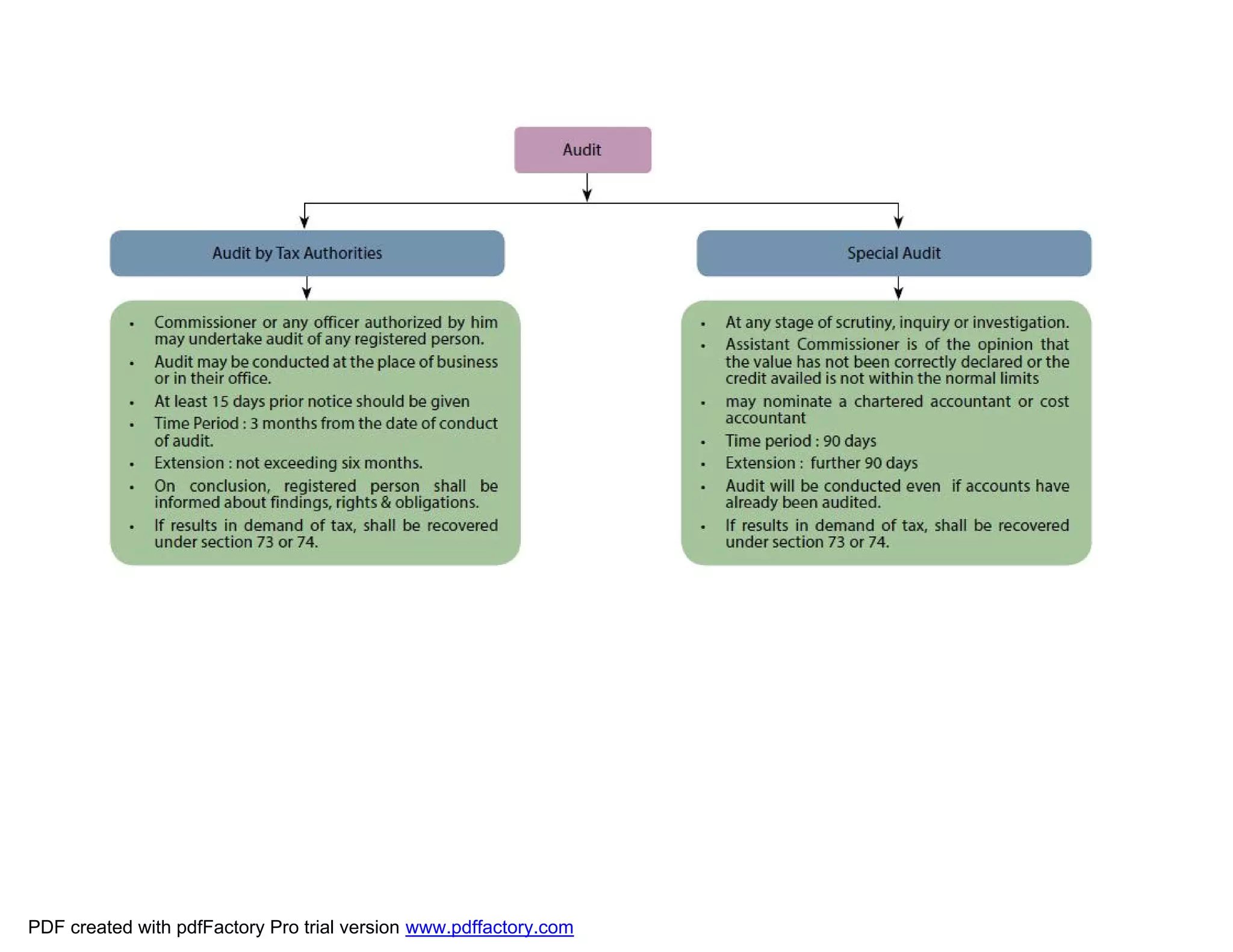

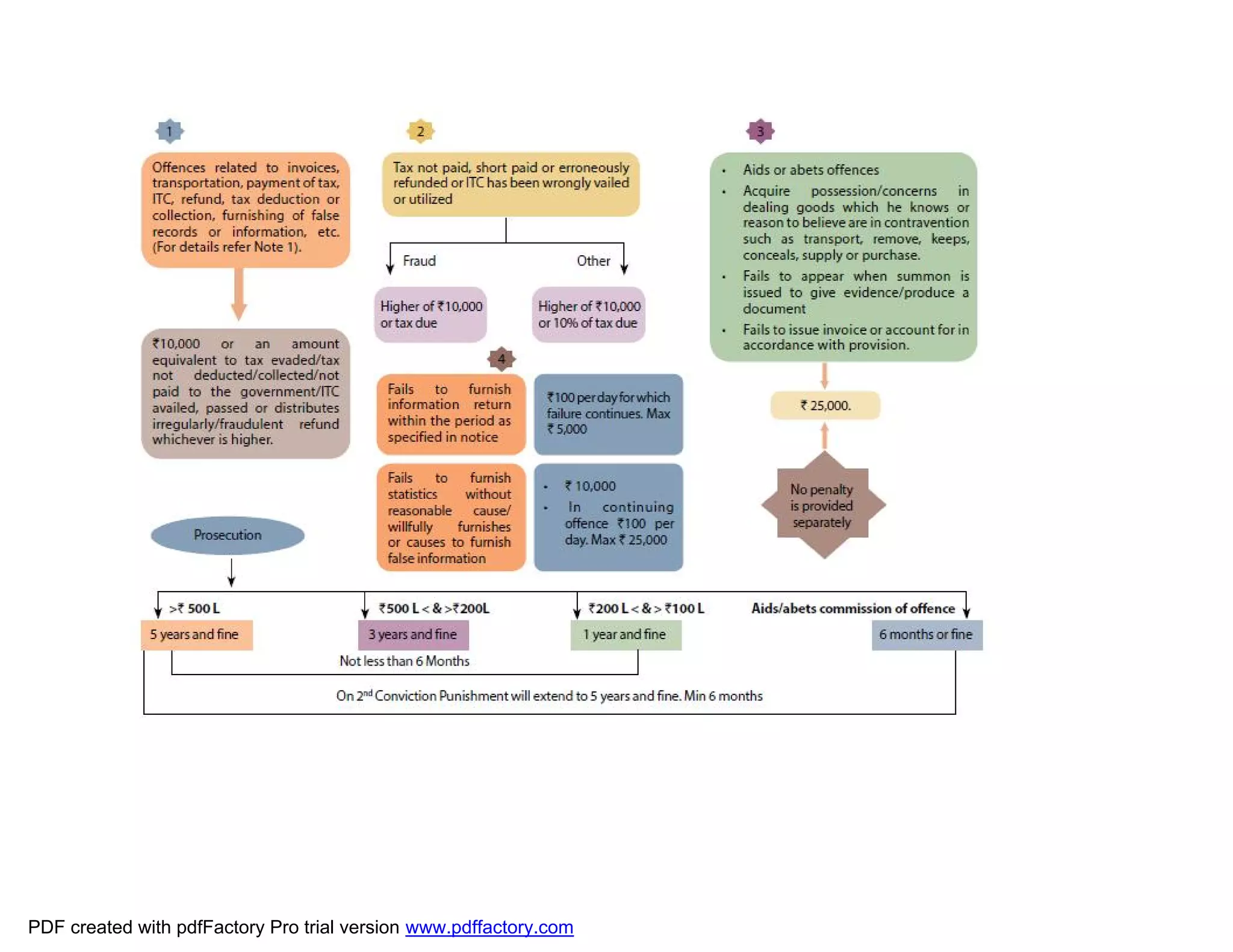

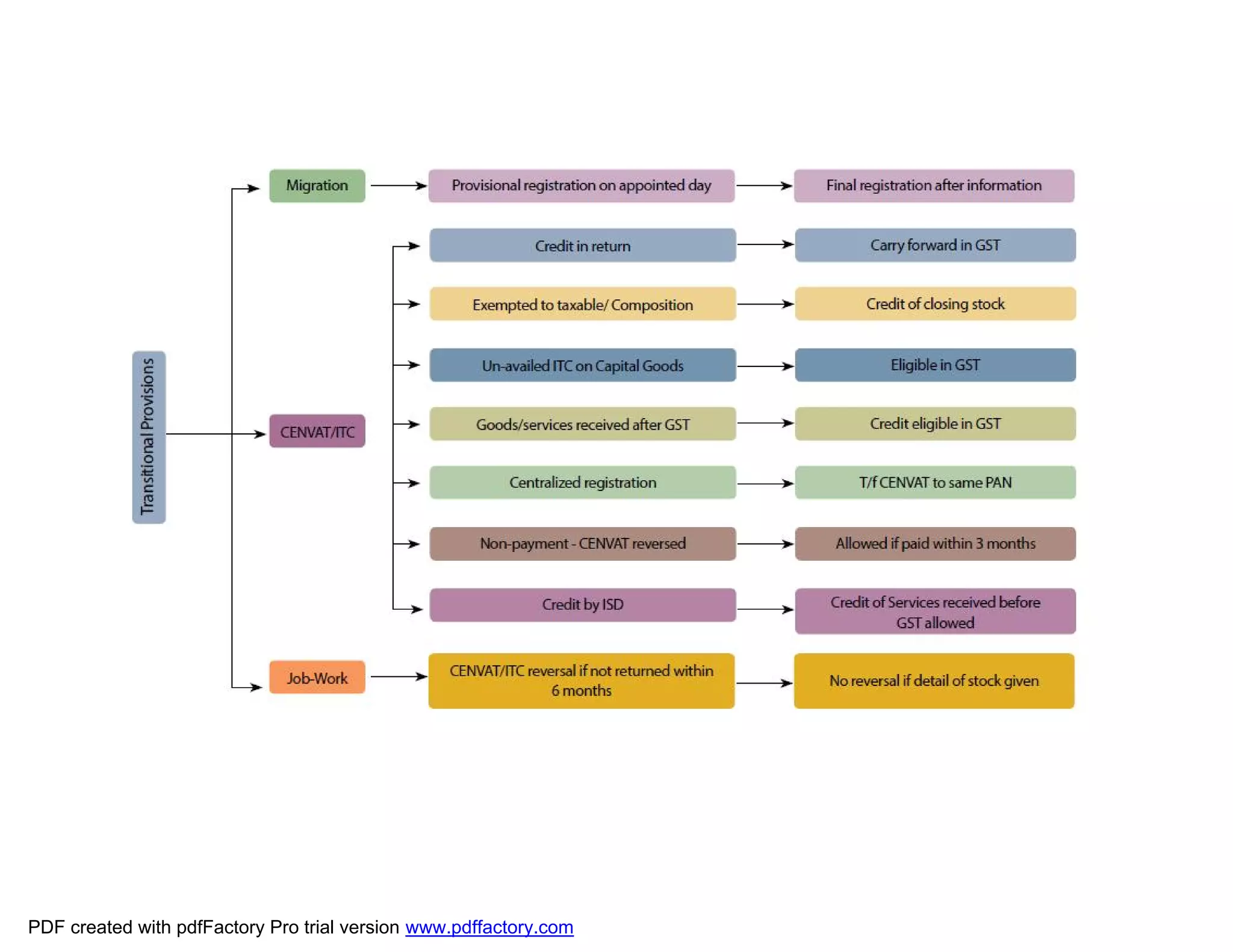

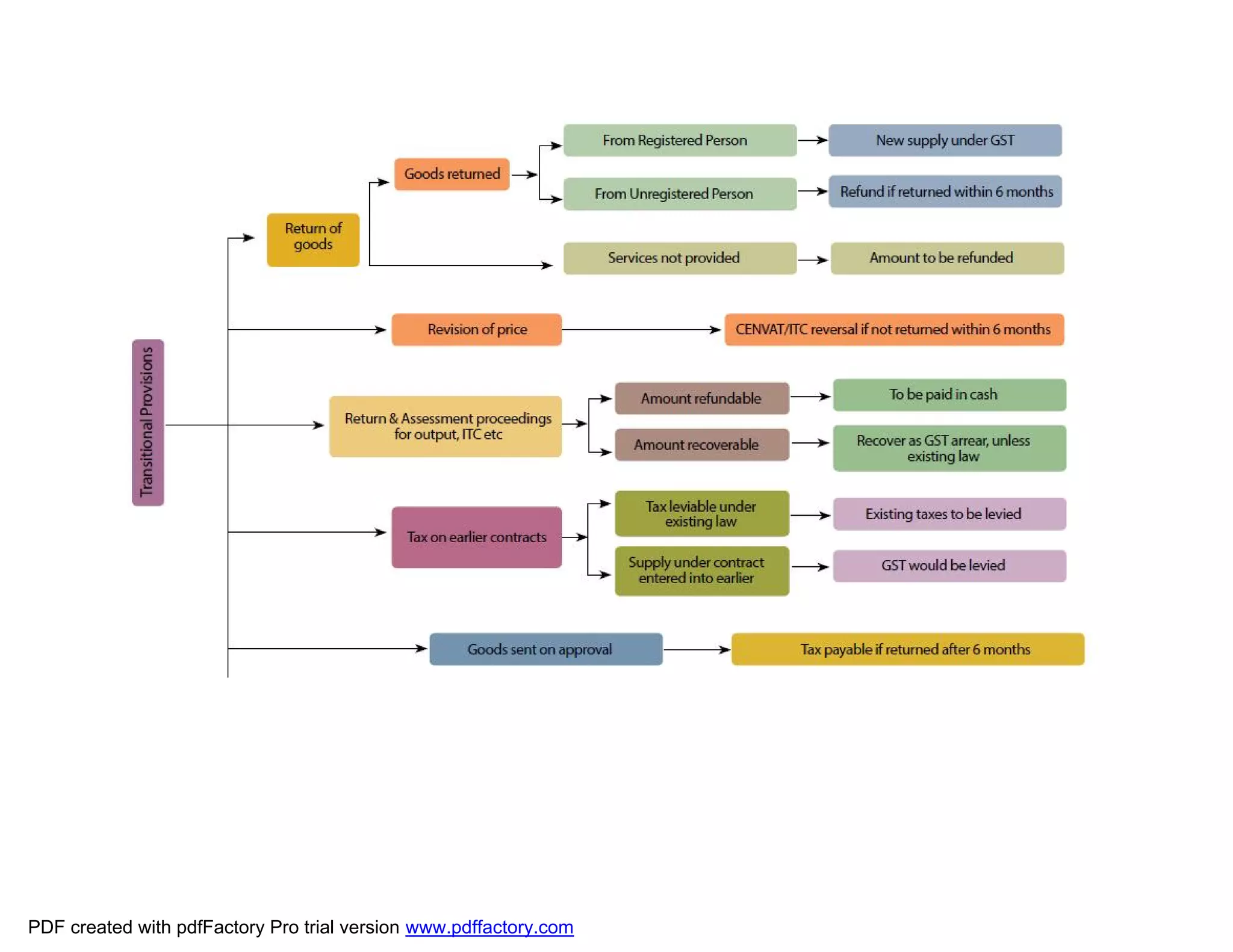

The document provides an overview of the Goods and Services Tax (GST) in India. It defines key terms like taxable supply, non-taxable supply, and exempt supply. It outlines the sections of the GST acts that cover levy, place of supply, time of supply, nature of supply, input tax credit, registration, returns, payments, and refunds. The document also briefly mentions the chapters that cover assessments, audits, inspections, demands and recovery, appeals and revisions, offences and penalties.