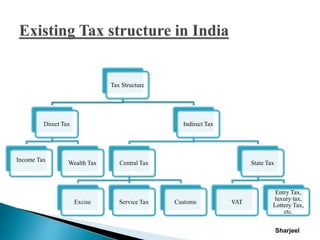

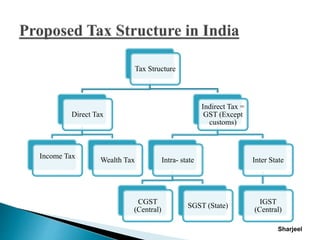

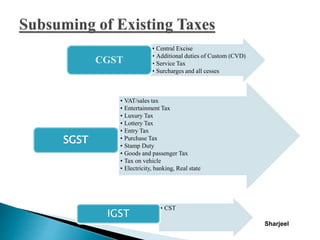

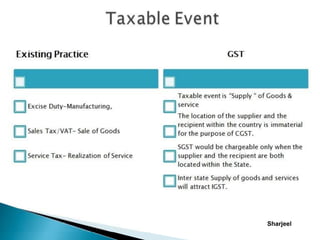

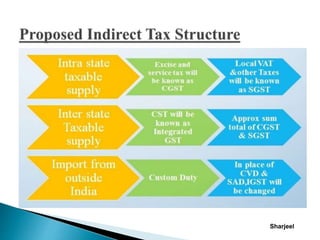

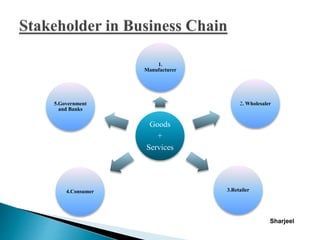

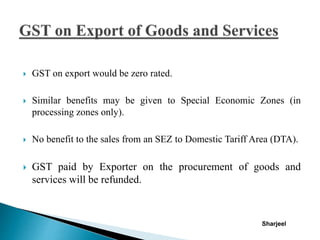

The document discusses Goods and Services Tax (GST) in India. It defines GST as a single tax on the supply of goods and services, replacing multiple taxes. GST is expected to be a major tax reform and lead to the abolition of other taxes at the central and state levels. The document also outlines the proposed tax structure under GST and its potential benefits, such as reducing hidden taxes, transaction costs, and exemptions. However, full implementation of GST depends on resolving issues around revenue sharing between states and the center.