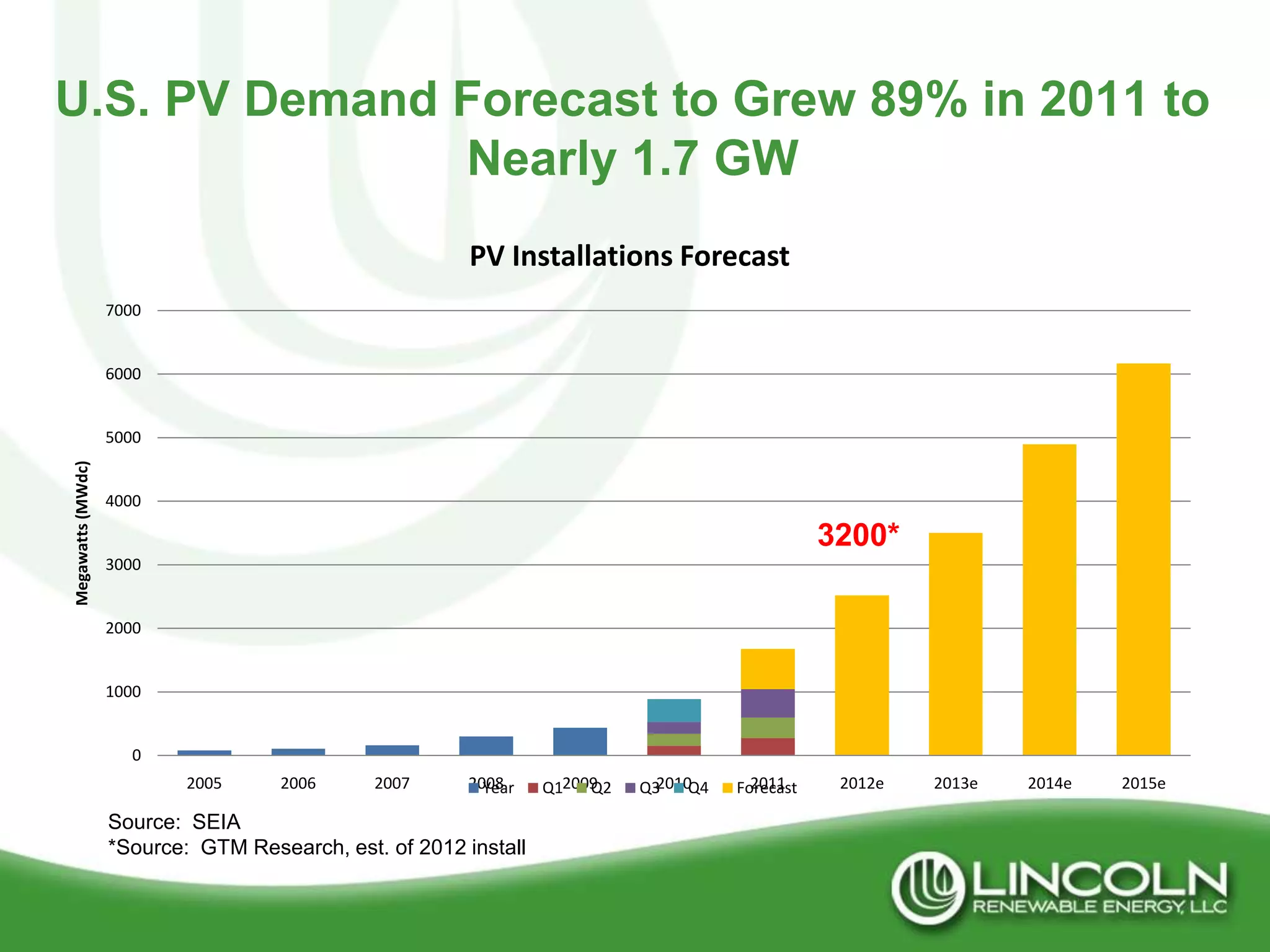

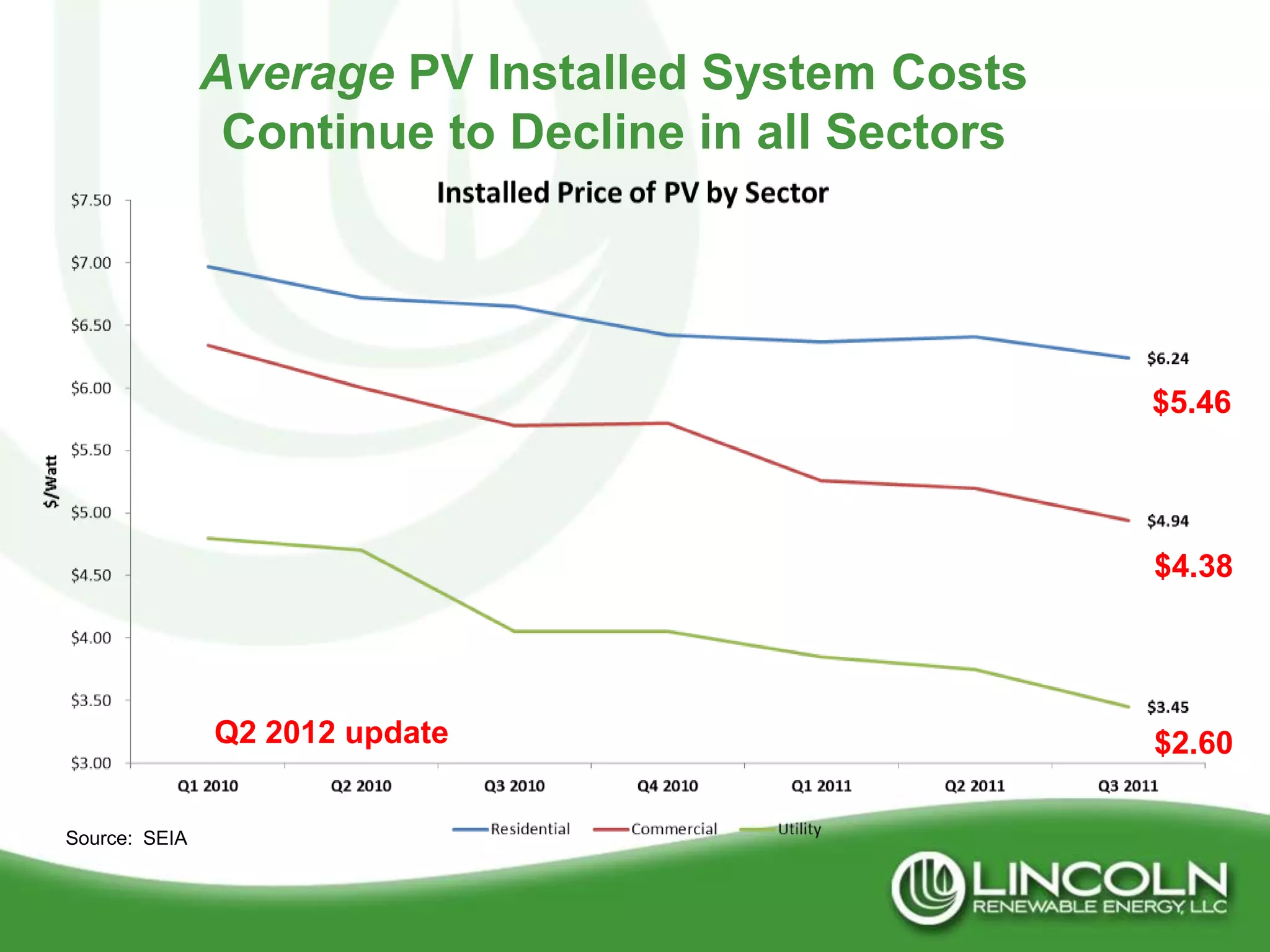

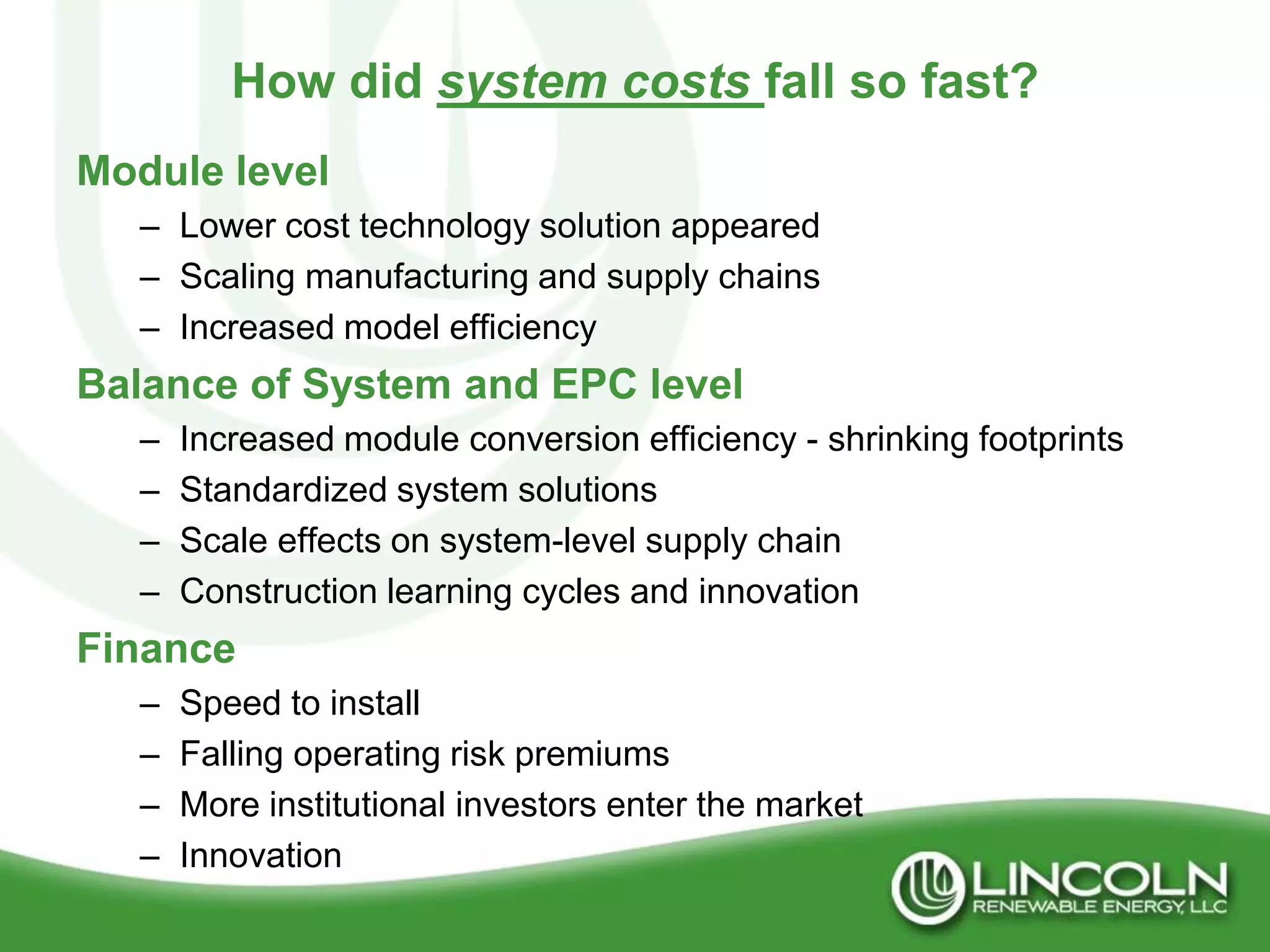

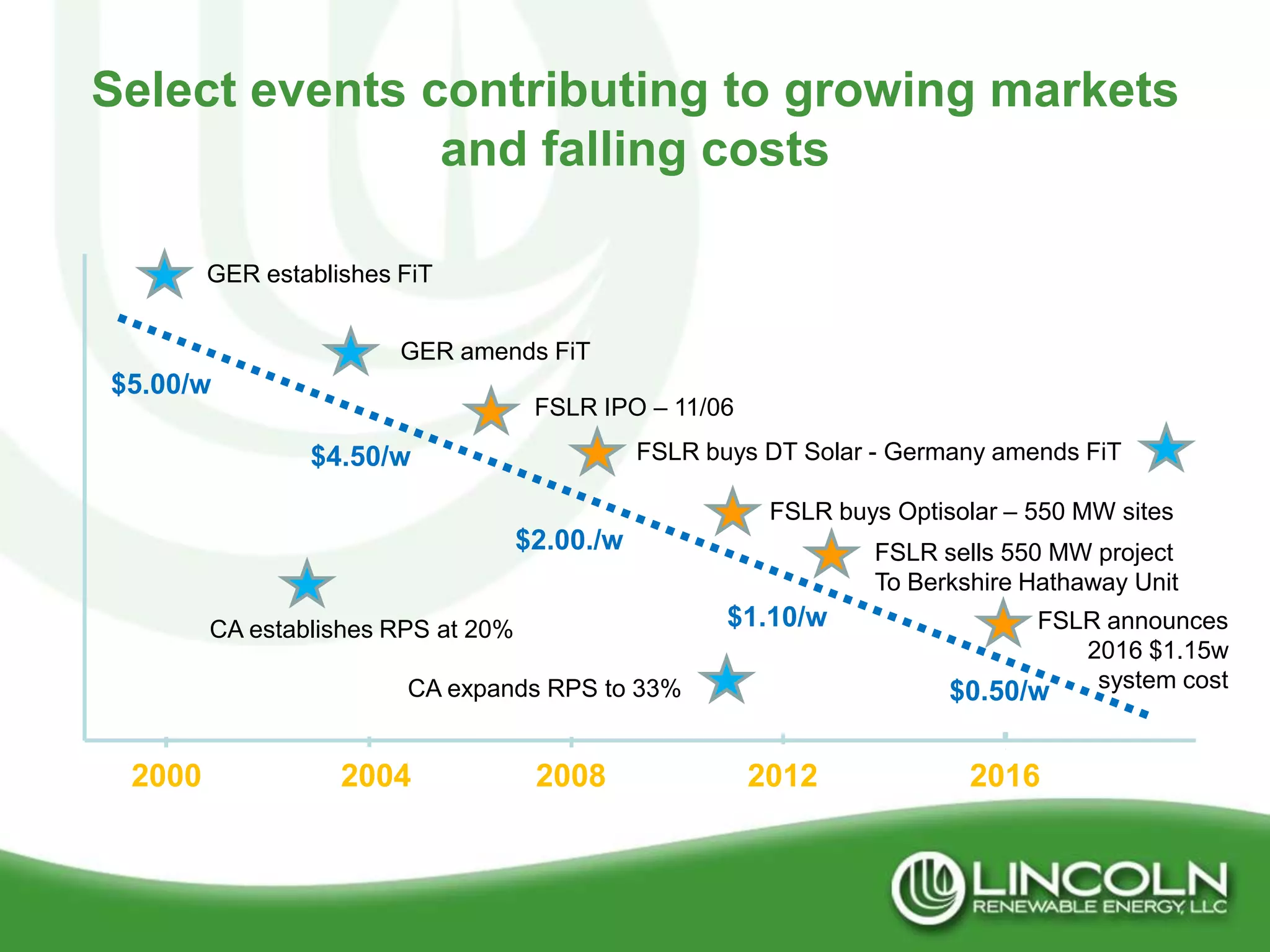

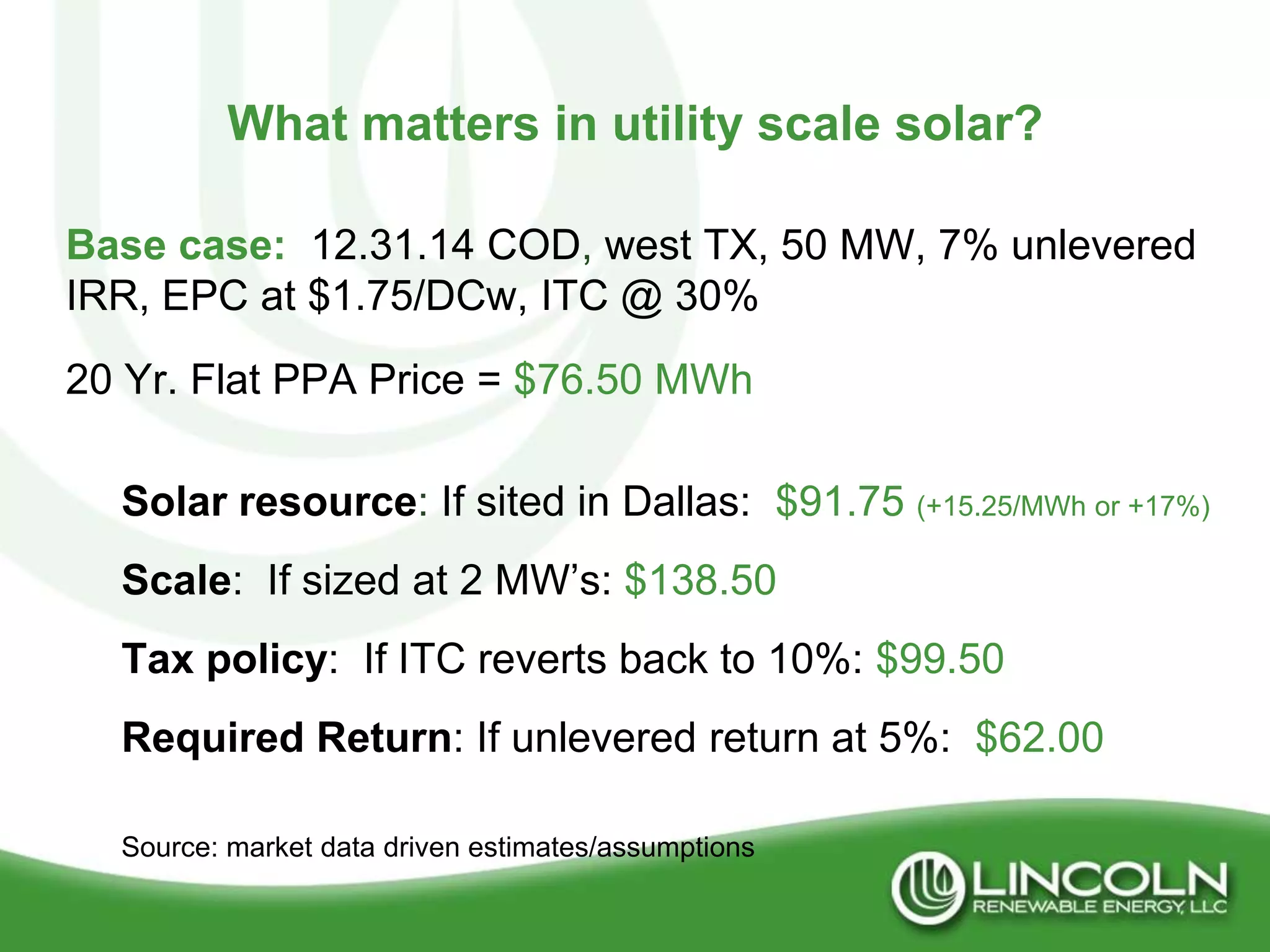

This document discusses bringing low-cost solar energy to Texas consumers through utility-scale solar projects. It provides background on Lincoln Renewable Energy and trends in falling solar costs. System costs have declined rapidly from $5.46/watt in 2008 to as low as $1.10/watt in 2012 due to technology advances, manufacturing scaling, and standardized solutions. Policy drivers like renewable portfolio standards and investment tax credits have also contributed to growing solar markets and lower costs. The document examines key factors for successful utility-scale solar projects, such as resource quality, development conditions, and providing returns sufficient to attract necessary capital investment.