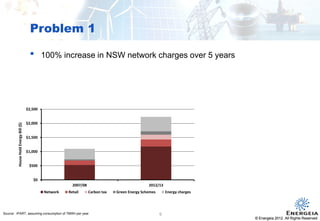

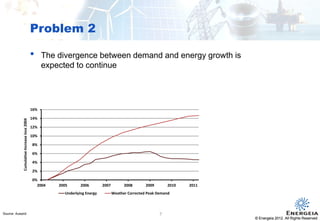

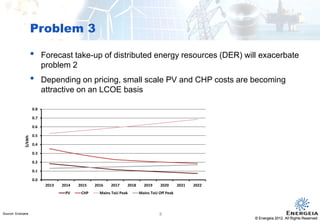

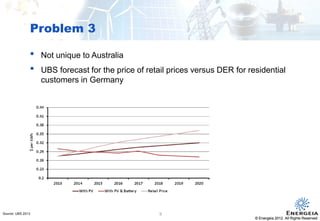

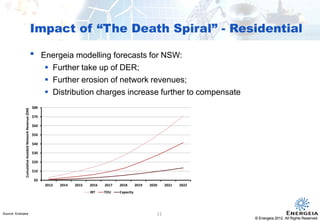

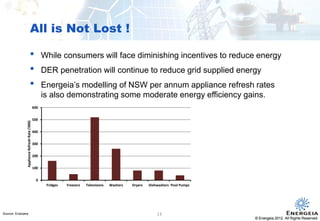

This document discusses four problems facing the electricity market: rising energy prices, divergence between demand and energy growth, increasing adoption of distributed energy resources, and declining network load factors. To address these issues, capacity-based pricing is proposed to maintain network revenues and incentivize demand management over energy consumption. While this may reduce incentives for energy efficiency, natural appliance replacement cycles and distributed energy adoption will continue to lower grid usage to some degree.