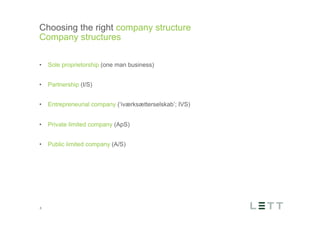

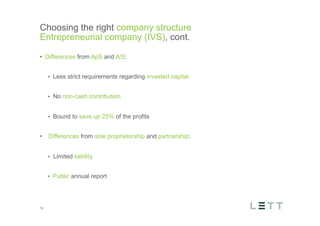

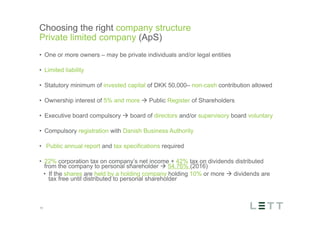

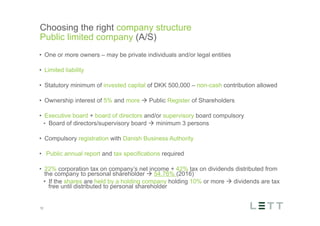

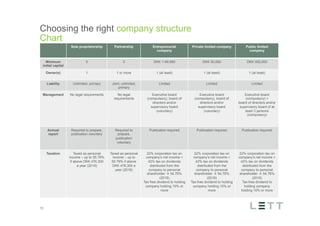

1) The document discusses various company structures for startups in Denmark including sole proprietorships, partnerships, entrepreneurial companies, private limited companies, and public limited companies.

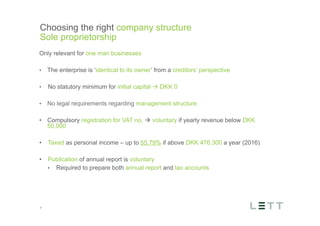

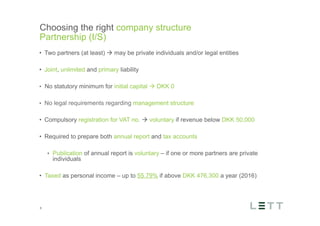

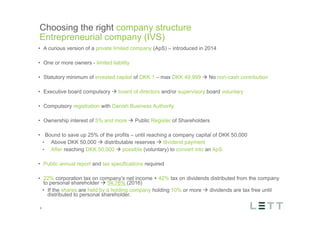

2) It outlines key details for each structure such as minimum capital requirements, liability, management and governance rules, taxation, and annual reporting requirements.

3) The presentation emphasizes that while sole proprietorships and partnerships have few legal requirements, they provide unlimited liability, while entrepreneurial companies, private limited companies and public limited companies provide liability protection but have more legal obligations.